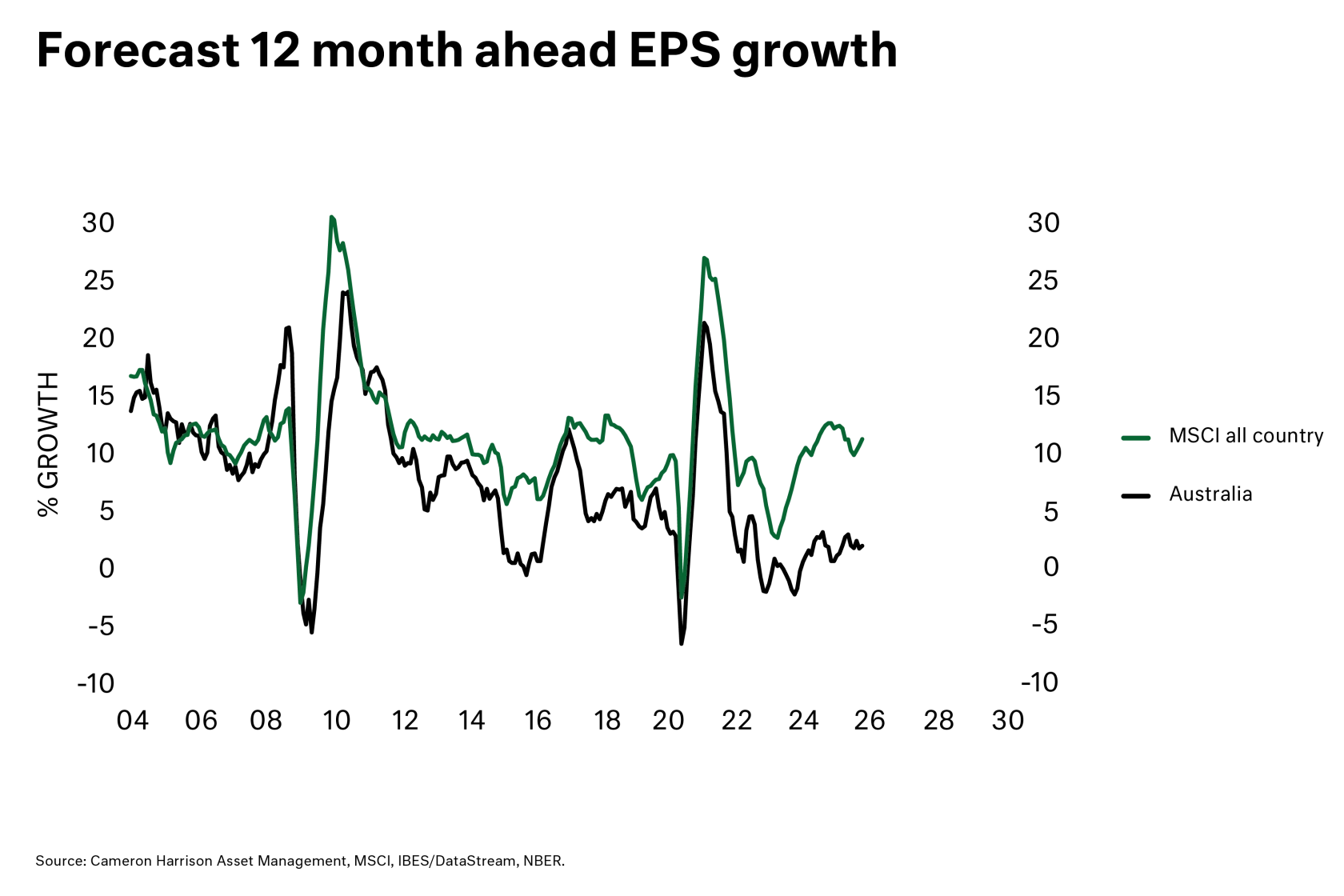

Australia appears to be slipping back into the post-GFC, pre-COVID growth model – one marked by flat real wages, declining productivity, and reliance on population growth to drive headline GDP. Australian real wages are 4.8% lower than before the pandemic, compared with most developed peers that have managed gains, and real household disposable income per capita has fallen by 8% over the past two years, the worst outcome across the OECD.

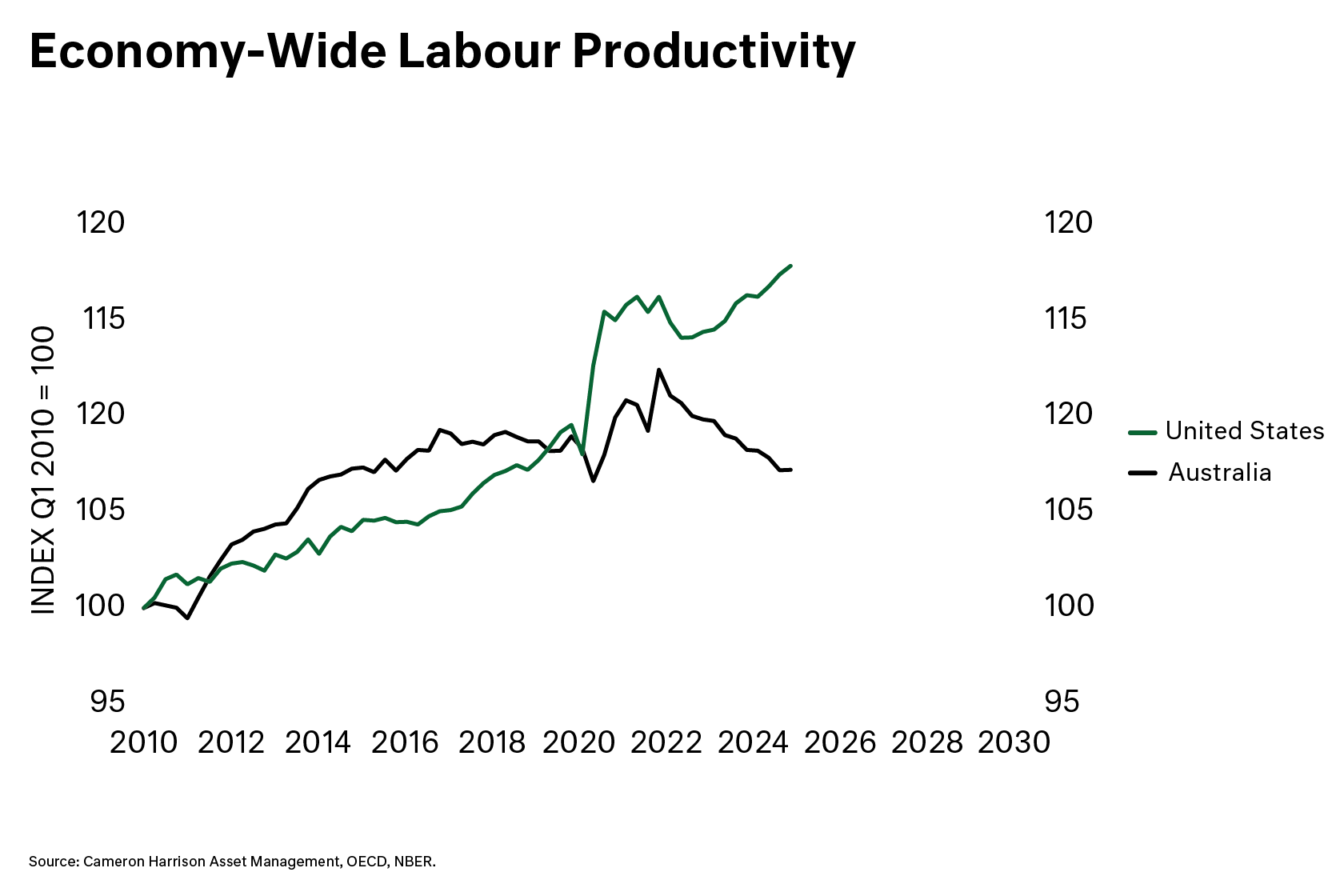

At the same time, productivity growth has slowed structurally, according to the Reserve Bank of Australia, leaving little scope for wages to rise without inflationary pressure. With per-capita GDP falling for seven consecutive quarters through 2024, Australians have lost over a decade of progress in living standards.

Added to this is the increasing role of government, not just as regulator but as an active player in the private economy. The outcome looks uncomfortably similar to the current UK experience – a tepid growth environment where households feel little genuine progress and fiscal levers do the heavy lifting.