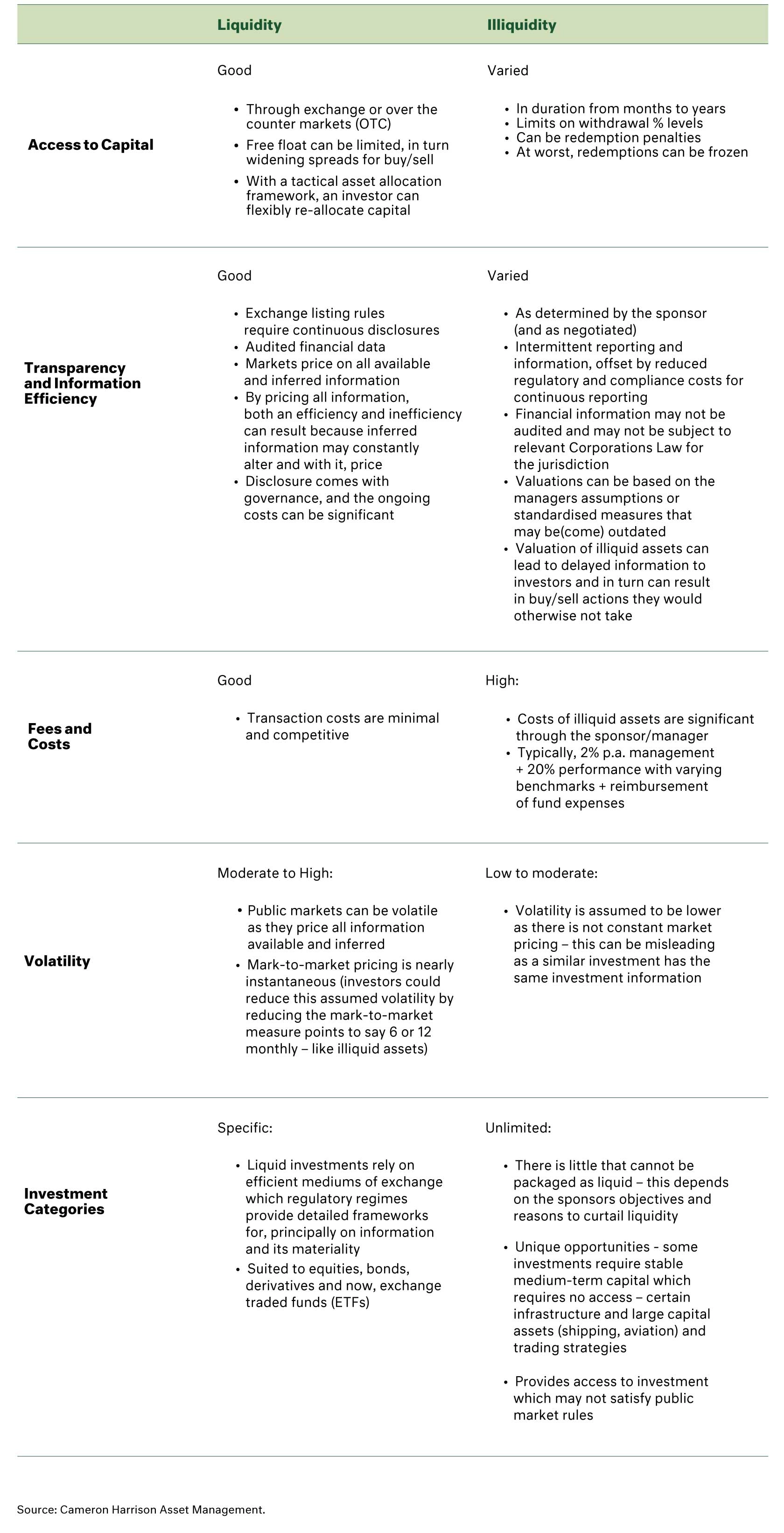

For investors, the consideration of liquidity when investing in asset classes can be quite vexed. It is a conversation normally couched around the (presented) benefits of a particular investment. Typically, illiquid investments are presented and packaged in vehicles or fund structures covering investments in private equity, venture capital, esoteric trading strategies, infrastructure, property and certain credit. They also typically have sponsors who seek to make illiquidity accessible. Alternatively, public markets provide the access to investment, covering publicly listed equities, bonds, cash and derivatives (options, futures). There are merits to both liquid and illiquid assets, and more importantly, dependent on the investment fundamentals itself and the investor’s own needs and requirements. In short, there is no one correct approach or policy, but there is a need to understand the trade-offs.

In Australia, illiquid investments can be in the form of direct investment (wholesale managed funds, property syndicates, direct property) or more opaque, indirect investment types (Industry Superannuation Funds via private equity, property development, infrastructure).

At Cameron Harrison, our prism of review and analysis is focussed on optimal risk-adjusted returns post fees. We principally achieve this with high quality liquid investments which provide the benefit of tactical asset allocation management, significant diversification and lower management and transaction costs. There is of course a client’s specific utility preference which also needs to be taken account of. Whilst there is portfolio structuring merit in investing in certain illiquid assets, in over 40 years of managing client wealth, typically the benefits to the sponsor through fees and lock-up outweigh the benefits.