Our role as advisers is to assist clients through this process, which is always specific and appropriate to their individual position – whether a family, a significant wealth owner or not-for-profit organisation. The setting of asset allocation is a core element of wealth strategy, and flows from a clear, well considered and detailed framework of objectives, factor considerations and inputs. Most importantly, it must be evaluated against risk settings at every stage.

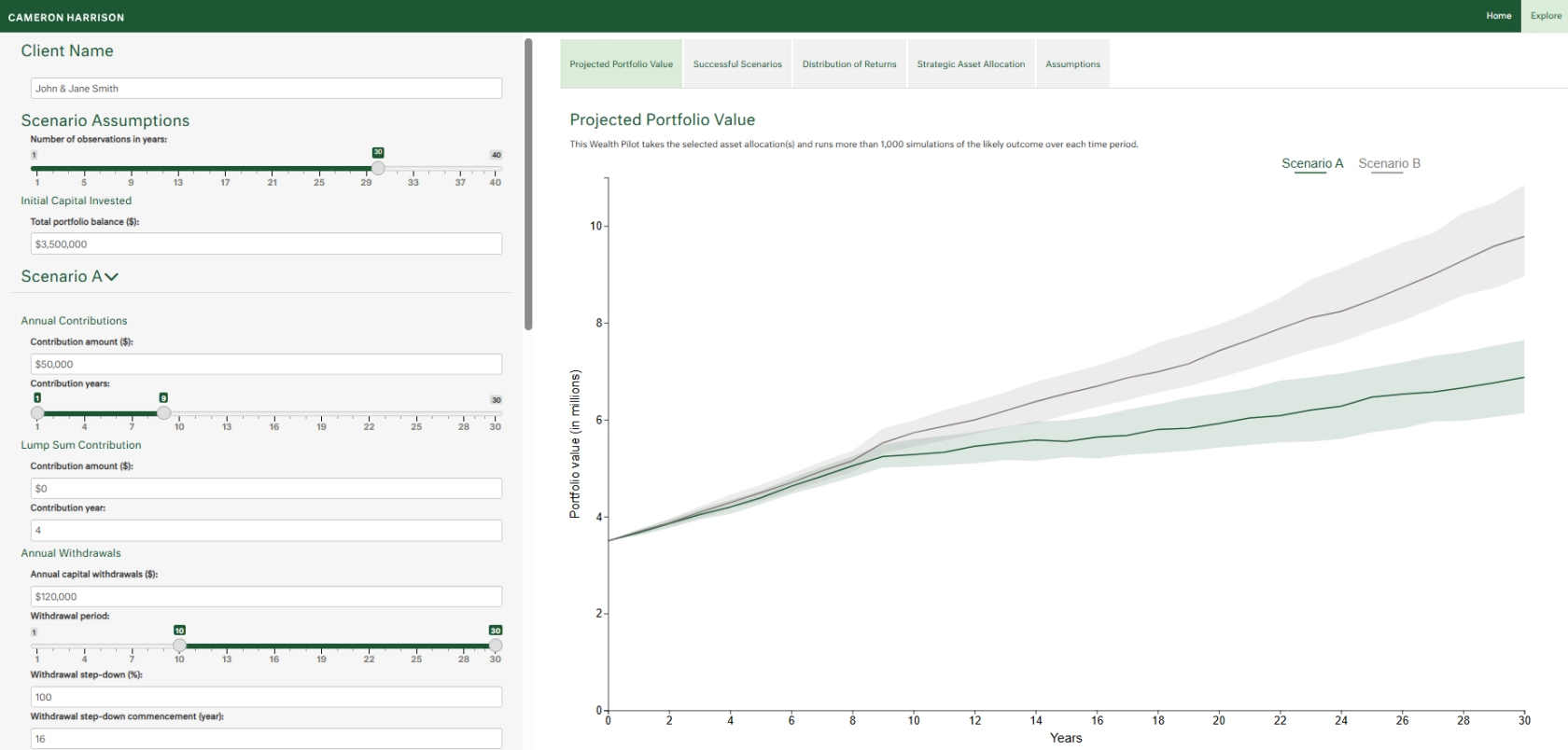

Constructing a strategy that seeks to achieve specific future wealth outcomes but limits the variability in those outcomes can be a delicate balance to strike. When clients are asked how much risk they are willing to tolerate, many would respond that they do not want to take risk for risk’s sake but are prepared to accept some risk to achieve their goals. The challenge is defining what can be a rather intangible factor – until you experience the variability and potential loss, you may underestimate your aversion to it.