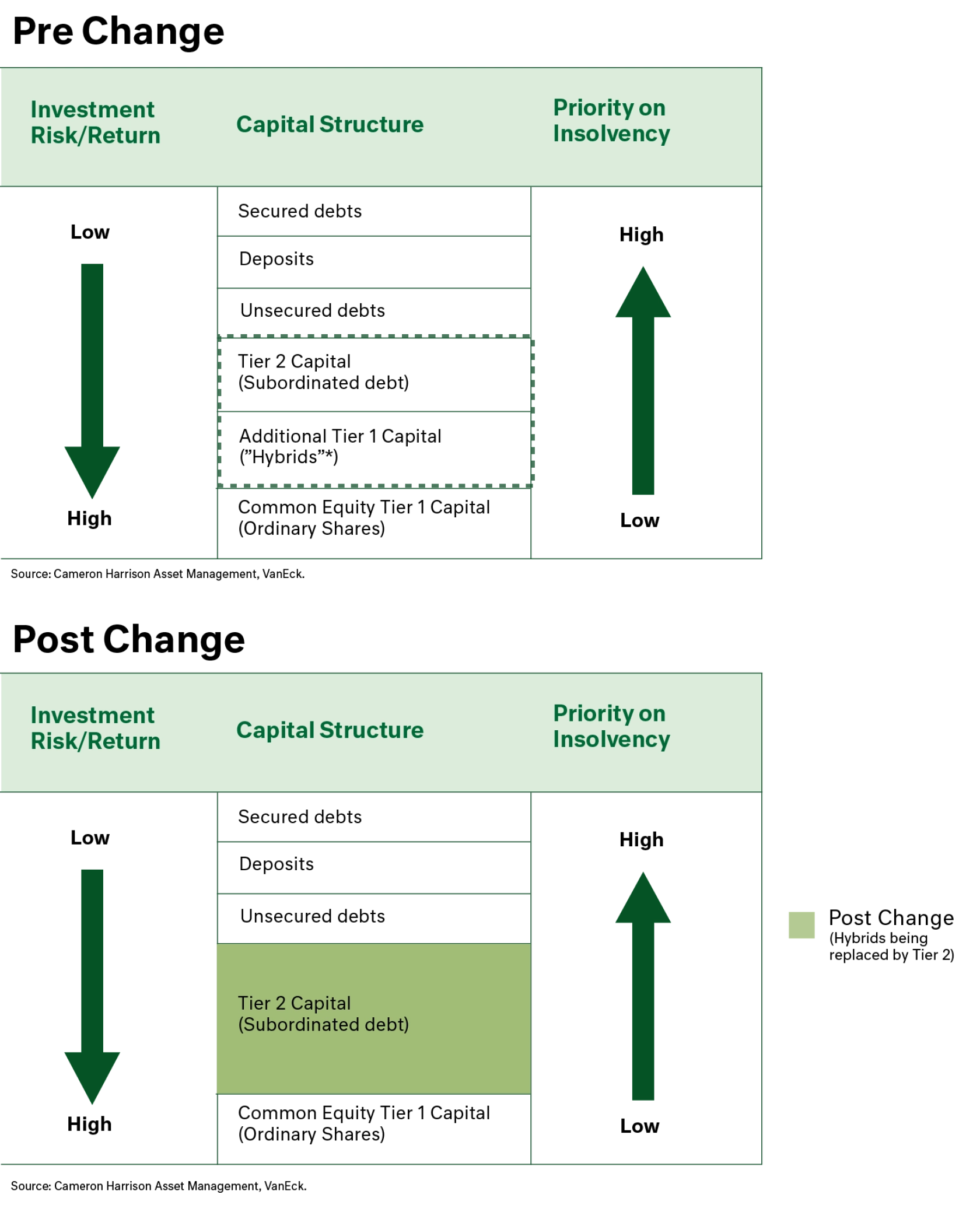

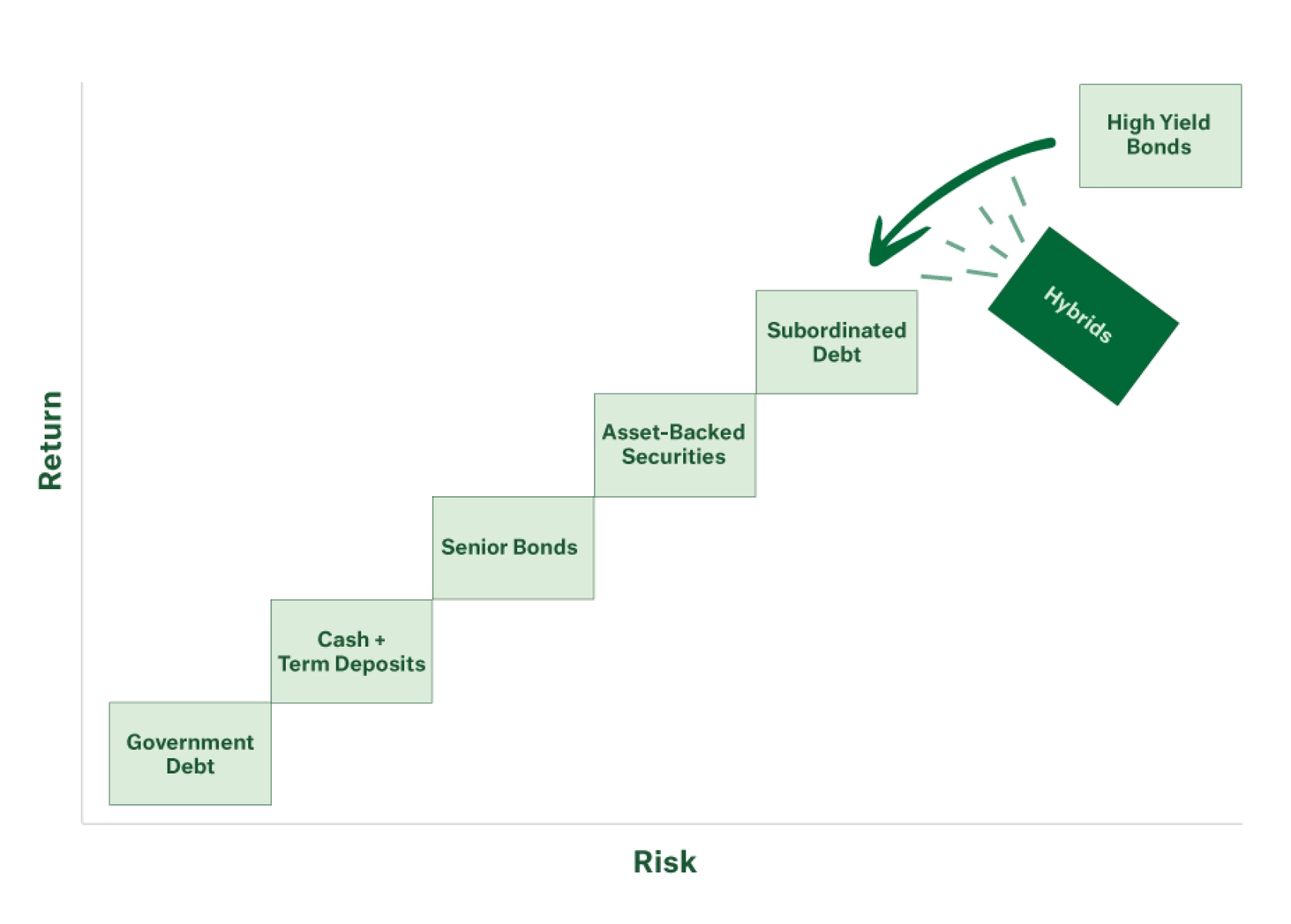

In September, APRA made a significant announcement to the Australian banking sector and the fixed income market with its proposal to remove Additional Tier 1 Capital (known as AT1 or Hybrids) from the capital structure of banks. Currently 1.5% of bank capital is required to be held as AT1, but from 2027 (over a transition period until 2032) this will be phased out. The Australia hybrid market is relatively small at $43 billion, especially when compared with Government issued bonds at are over $1.5 trillion and financial institution bonds near $600 billion. The particular ‘sweet spot’ of hybrids has been twofold – firstly, they have been ASX listed and available to retail and institutional investors, and secondly, they have carried a tax effective gross up yield through imputation credits (again, attractive to retail or private investors)

Hybrids (AT1 capital) are designed to enhance the stability and resilience of banks. It acts as a buffer to absorb losses when a bank’s equity capital falls below a certain threshold. The name ‘Hybrid’ stems from the ability for this capital to convert into equity in times of stress when the equity of a bank falls below a threshold (5.125% for Australian banks). This ‘tops up’ a bank’s equity to protect deposit holders. Below is a simple look at a bank’s capital structure.