As we emerge from our Covid-19 gloom to relish our freedoms, there remains much uncertainty over what ‘normal’ will mean in the post-Covid world. Nowhere is this apparent than in the property sector, which touches on where we live, how we shop, the environment in which we work and how we do business.

Our 2022 Property Investment Guide distinguishes between impermanent effects and permanent, longer-term structural changes that result from new behaviours. Identifying several trends that will support a further compression in yields and strong rental incomes in the year ahead, including:

• The reopening of the Australian economy and cessation of work from home orders.

• Low unemployment and the arrival of ~490,000 migrants by 2024, driving space requirements in office buildings.

• Onshoring of inventory storage to improve delivery times and protect against supply chain disruptions.

• High industrial land and construction costs crimping supply in a 2-5 year window.

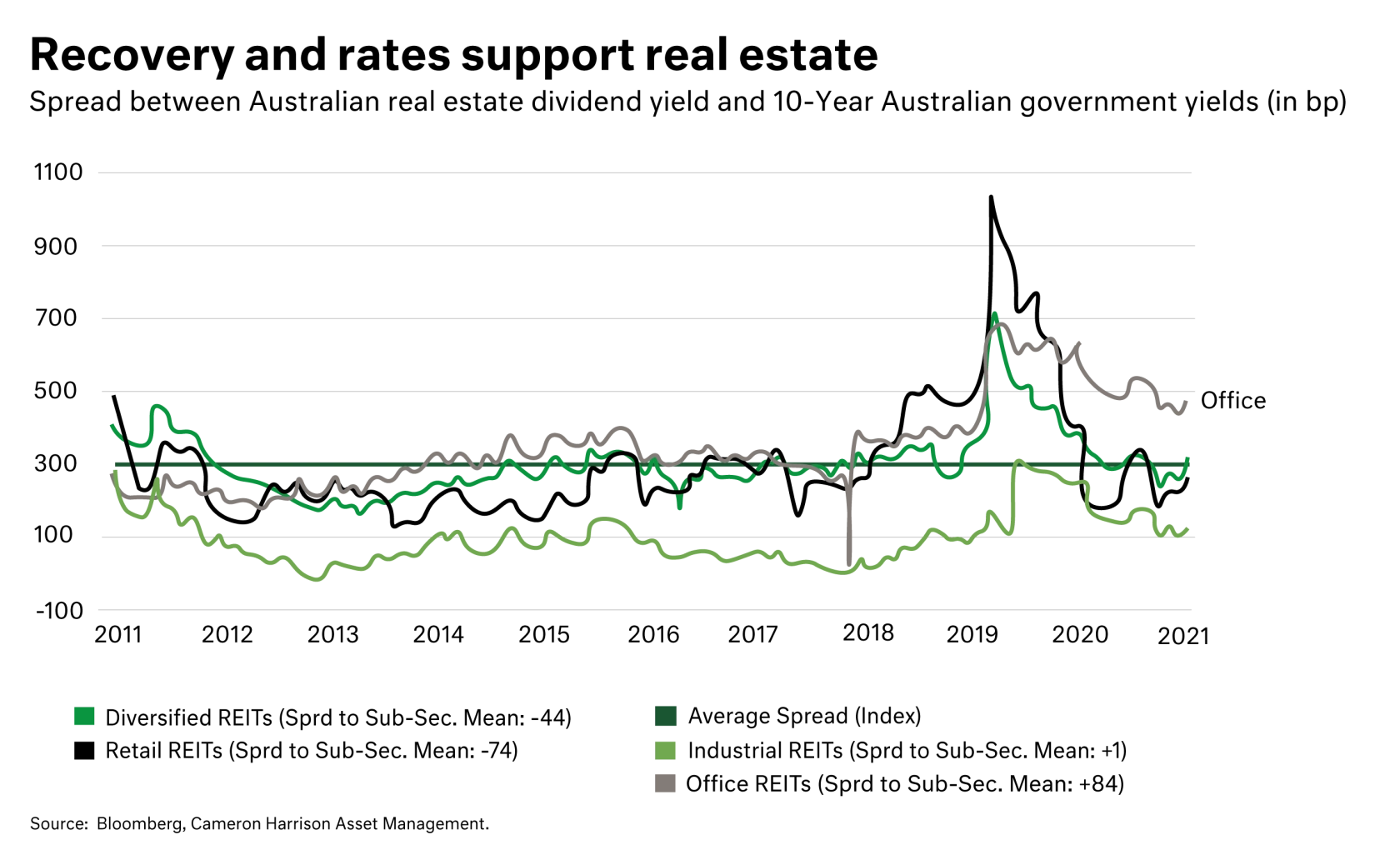

We believe that Commercial property remains an attractive source of income in an ultra-low yield environment, that is underpinned by high-quality real assets. Annual rent reviews are a combination of fixed and inflation-adjusted, providing a natural hedge against inflation risks over the next 2-5 years. Our Listed Property strategy is focused on investments in Industrial property (distribution assets and associated office) and fringe CBD office sectors, areas which we believe offer relative value.