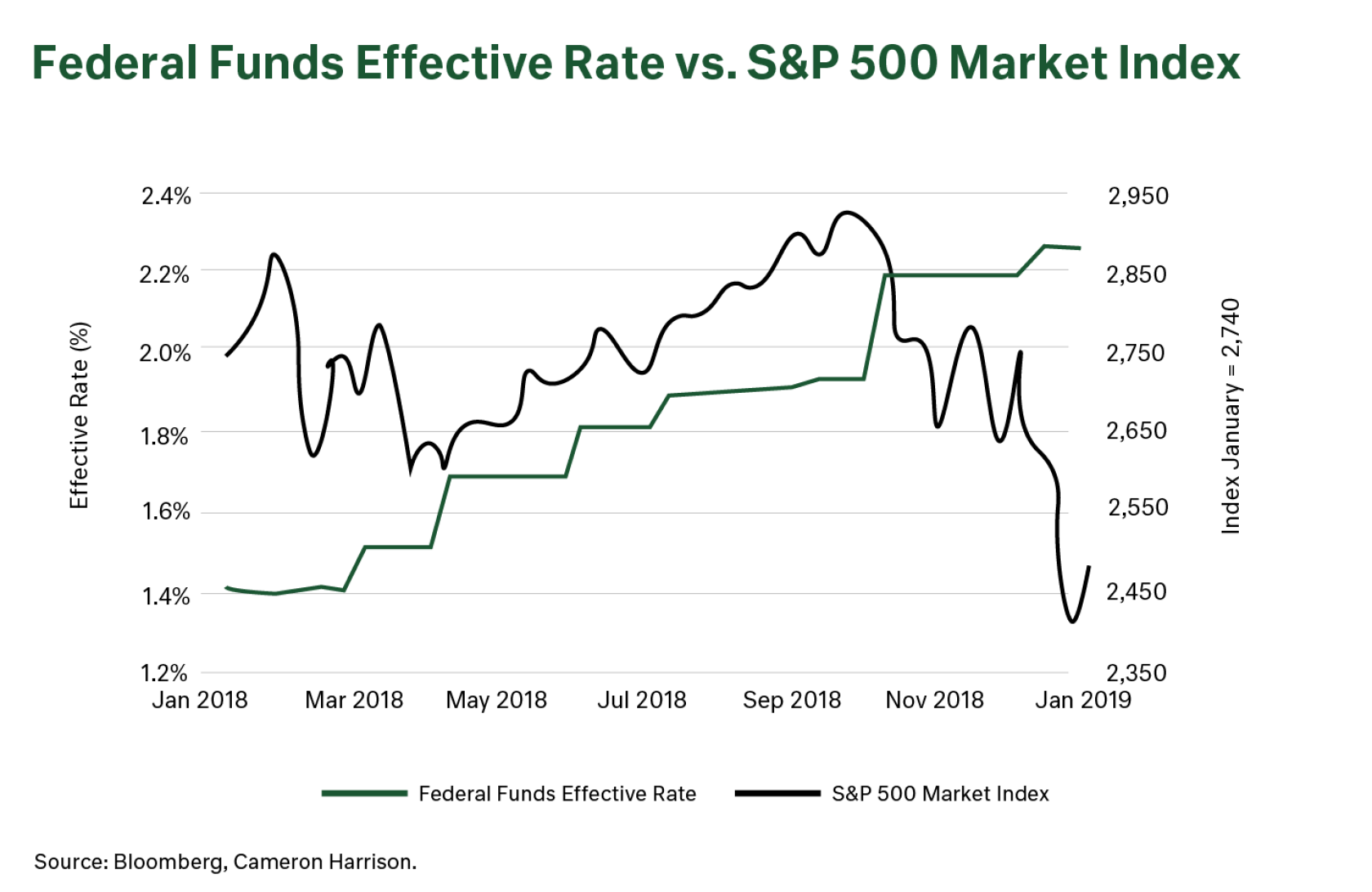

The last time that the US Federal Reserve decided to tighten monetary policy by simultaneously reducing its balance sheet (quantitative tightening) and rising interest rates, it led to the only year of negative returns for the S&P500 index in the last decade. Will the post-pandemic experience be a repeat of 2018 or has the paradigm shifted?

The key difference between now and the last tightening cycle, is the underlying strength of economic growth. In 2018, we were nearing the end of a long, slow bull market and the economy was not able to withstand higher interest rates. In contrast, we anticipate a second year of reasonable economic growth, supported by fiscal spending, a continued focus on wages growth and full employment by central banks and the healthy balance sheets of households. This stronger growth potential, and a shift in attitudes to fiscal stimulus as a means to control growth rates, means that the US economy can tolerate a return to normal(ish) interest rate settings.

That said, over the past 2 years, share markets around the globe have “raced” ahead of underlying economic growth. The year ahead will see markets unwind some of the gains in speculative assets and a change in equity market leadership from secular growth to cyclical companies.

Our key investment takeaways for the year ahead as summarised below:

Economic growth will continue to be reasonable in 2022, supported by household savings, wage growth and fiscal stimulus; with an economic recession unlikely.

A return to normal monetary policy is a positive sign for long-term investors as it reflects a stable economic footing to invest and a return to fundamental valuations.

Cheap debt and government income support has driven speculative investment and the risk of price bubbles in a narrow grouping of assets – cryptocurrency, technology, SPACS, a certain car manufacturer, etc.

Companies with valuations ‘built on sand’ – loss-making tech stocks – are at greatest risk of a correction.

In the absence of a recession, which we view as unlikely, we anticipate that the narrow build-up in valuations will mean that any correction will be equally narrowly focussed (see points 3 & 4).

Higher interest rates driven by economic growth is a good environment for cyclical (high beta & value stocks) as they can grow earnings to offset the impact of valuation declines.

Defensive assets offer limited portfolio protection in a rising rate environment, we prefer an allocation to quality equities and real assets to offset the impacts of inflation.

Cameron Harrison have been advising business owners and their families on asset allocation and intergenerational wealth management for over 50 years. We have demonstrated over a long period our ability to manage investments through both the good times and bad by keeping the client at the centre of our business.

For more information on our approach to investment strategy or any other inquiries, please contact us on +613 9655 5000.

Sourced from: