Over recent months, currency markets have been quietly recalibrating. The US dollar (‘USD’), after nearly two years of dominance, has begun to soften as investors anticipate a gentler phase of the Federal Reserve’s (‘Fed’) policy cycle. The shift hasn’t been dramatic, but it marks an inflection point from an environment driven by rate-hiking urgency to one focused on managing a controlled slowdown.

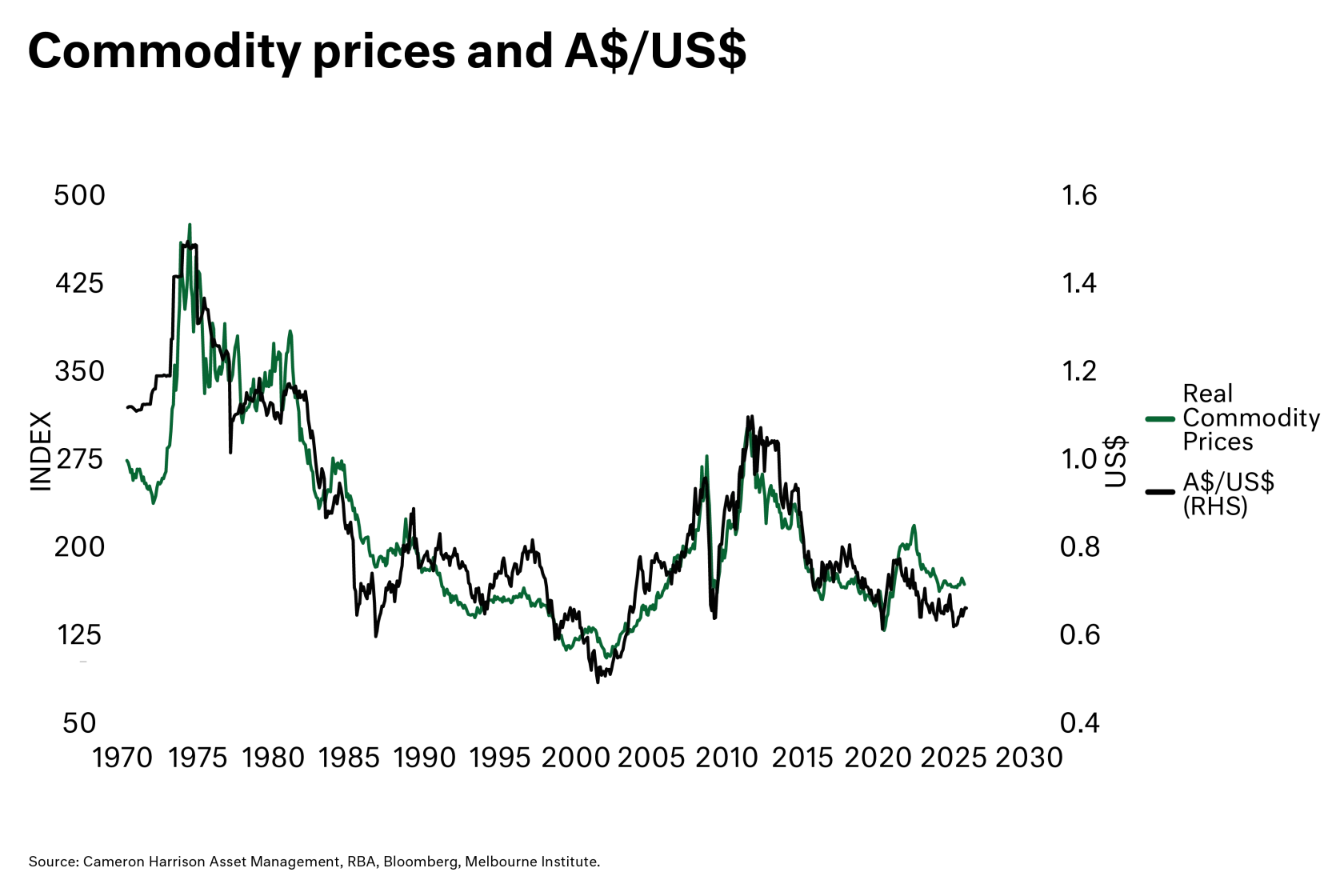

Closer to home, the AUD has been testing the upper end of its recent range, hovering between US 65-67 cents. Its movements have mirrored the ebb and flow of global risk appetite. Firmer commodity prices and a modest pickup in Chinese stimulus headlines have provided support, while softer export data and lingering doubts about China’s property sector have kept enthusiasm in check.

This relationship between commodity prices and the AUD remains clear (see chart below). When real commodity prices strengthen, the AUD typically follows, and vice versa. That link is evident again in recent months as both have stabilised after a period of weakness, hinting at renewed confidence in global demand, but also underscoring the AUD’s sensitivity to shifting growth expectations.