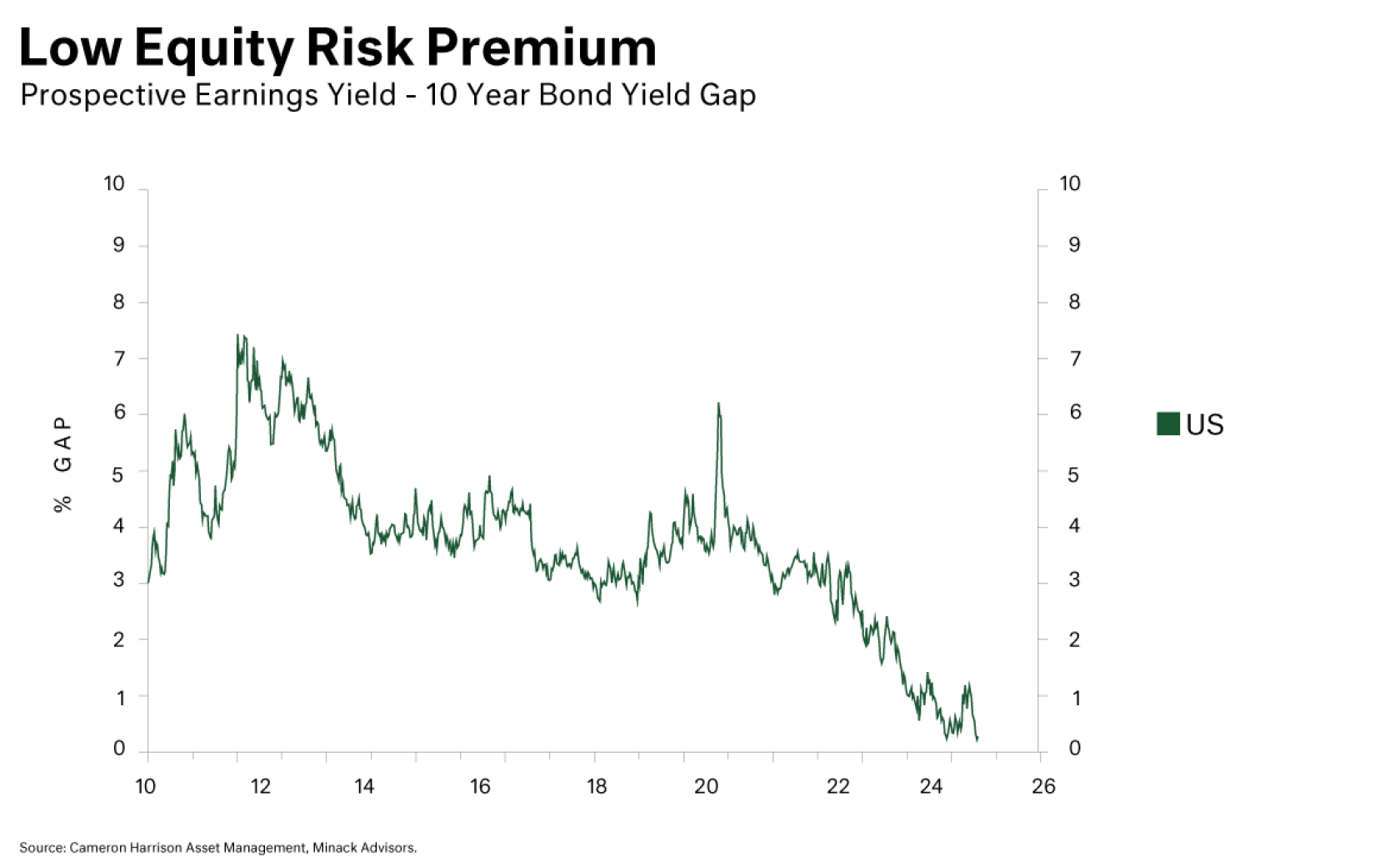

One of the industry’s metrics to determine valuation is the earnings yield. This figure, expressed as a percentage, reflects the return on investment based on current earnings and provides a comparison to other assets, such as bonds.

There is an extension to this valuation metric known as the earnings yield ‘gap’. Equities are inherently a riskier investment in comparison to bonds, therefore rational investors would expect to be paid a ‘risk premium’ to compensate for the additional risk taken on through equity ownership. This can often be measured as the ‘spread’ between earnings yield and risk-free rate of 10-year US Treasury Bonds: