This is occasioned by the forward assumption of sharply lower inflation. We agree that inflation is at its tipping point and will moderate somewhat through 2023, but equally, our view is that markets in search of the early bottom, are perhaps maybe being premature.

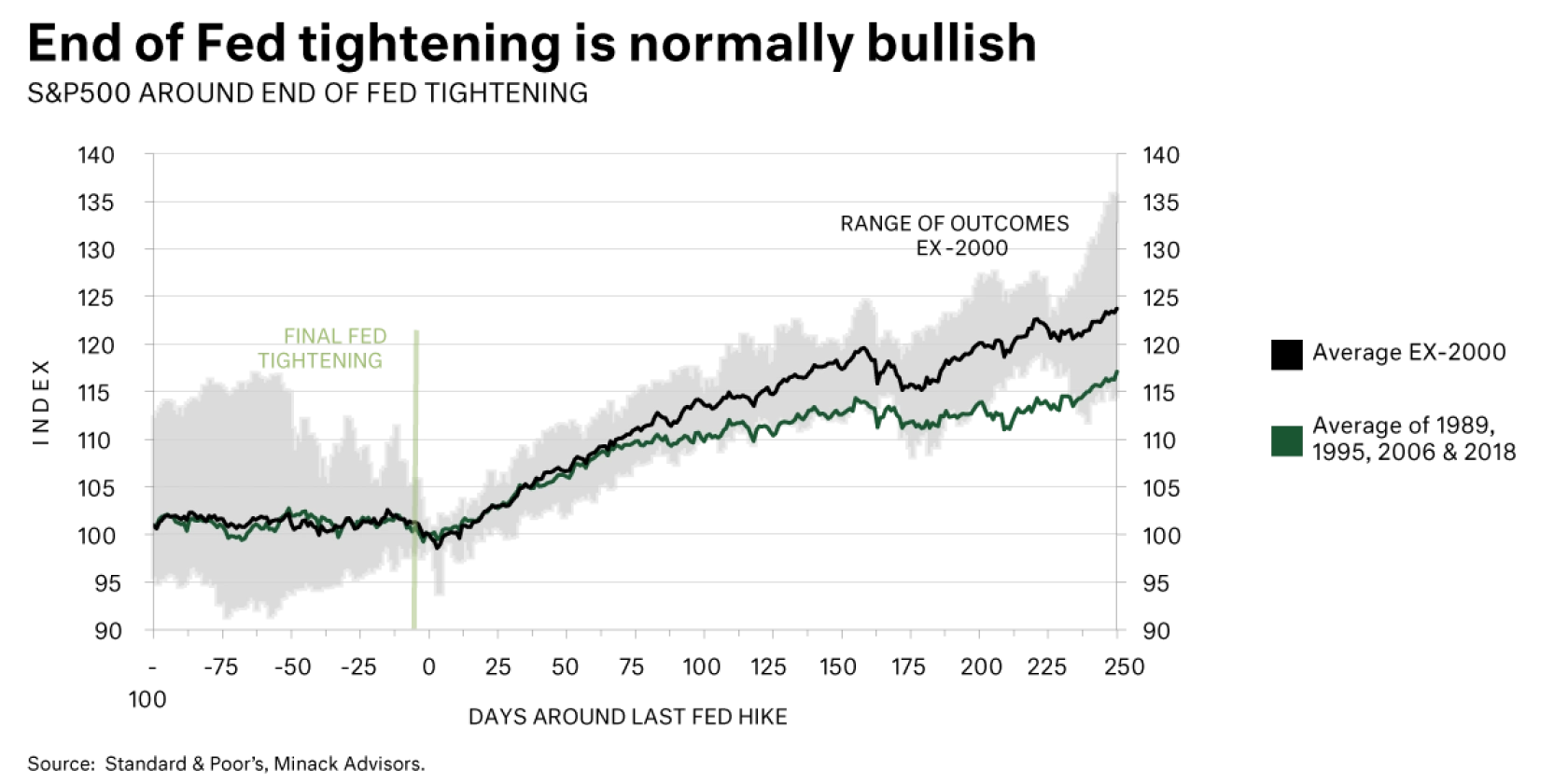

The below graph is fairly unambiguous. Irrespective of economic growth and corporate earnings, the bottom of the rate increase cycle for the Federal Reserve Funds Rate (represented by the green line), shows a clear and solid rebound in equity performance, almost without exception. Judging the inflexion point is of course what equity markets are doing, albeit with an overly low assessment of downside risk.