On 8 July 2025, the Reserve Bank of Australia (RBA) held the official cash rate steady at 3.85%, delaying the anticipated rate cut to August 2025. This decision reflected a tactical pause rather than a directional change, with the RBA awaiting June quarter CPI and updated labour data before proceeding further.

Despite the higher-than-expected holding period, the interest rate outlook remains firmly on an easing bias. The RBA has already delivered two cuts in 2025 (February and May), with markets now pricing in a 0.25% reduction in August, and potentially one or two more by year-end. This delay in relief has maintained average variable mortgage rates at around 5.3%, sustaining pressure on borrower cash flows and expectations.

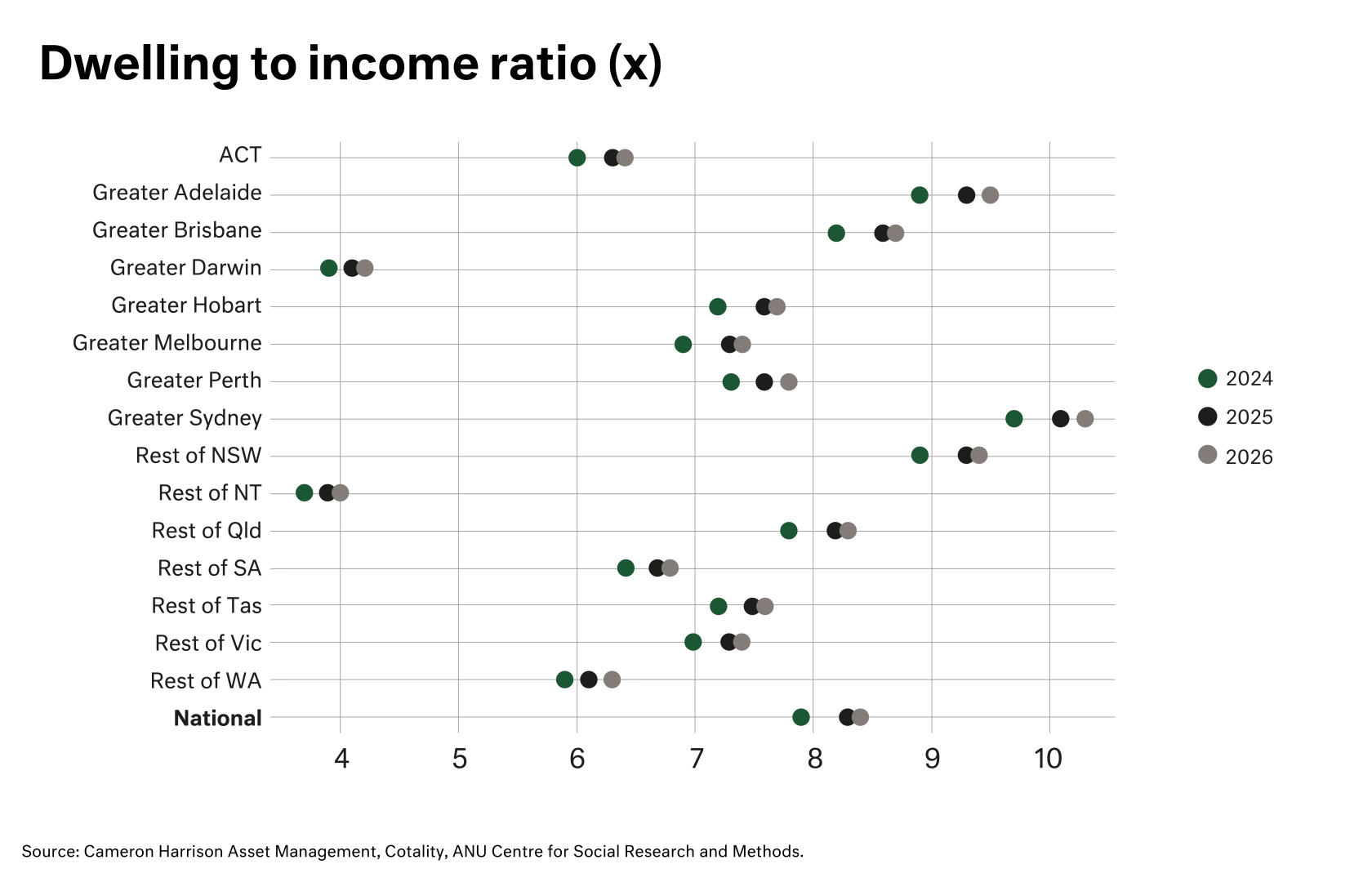

However, property values have continued to rise, with Cotality’s Home Value Index marking five consecutive months of growth, and June delivering a 0.6% national increase, led by Darwin, Perth, and Brisbane. The resilience of the housing market in the face of sustained interest rate pressures highlights the growing dominance of supply-side constraints.