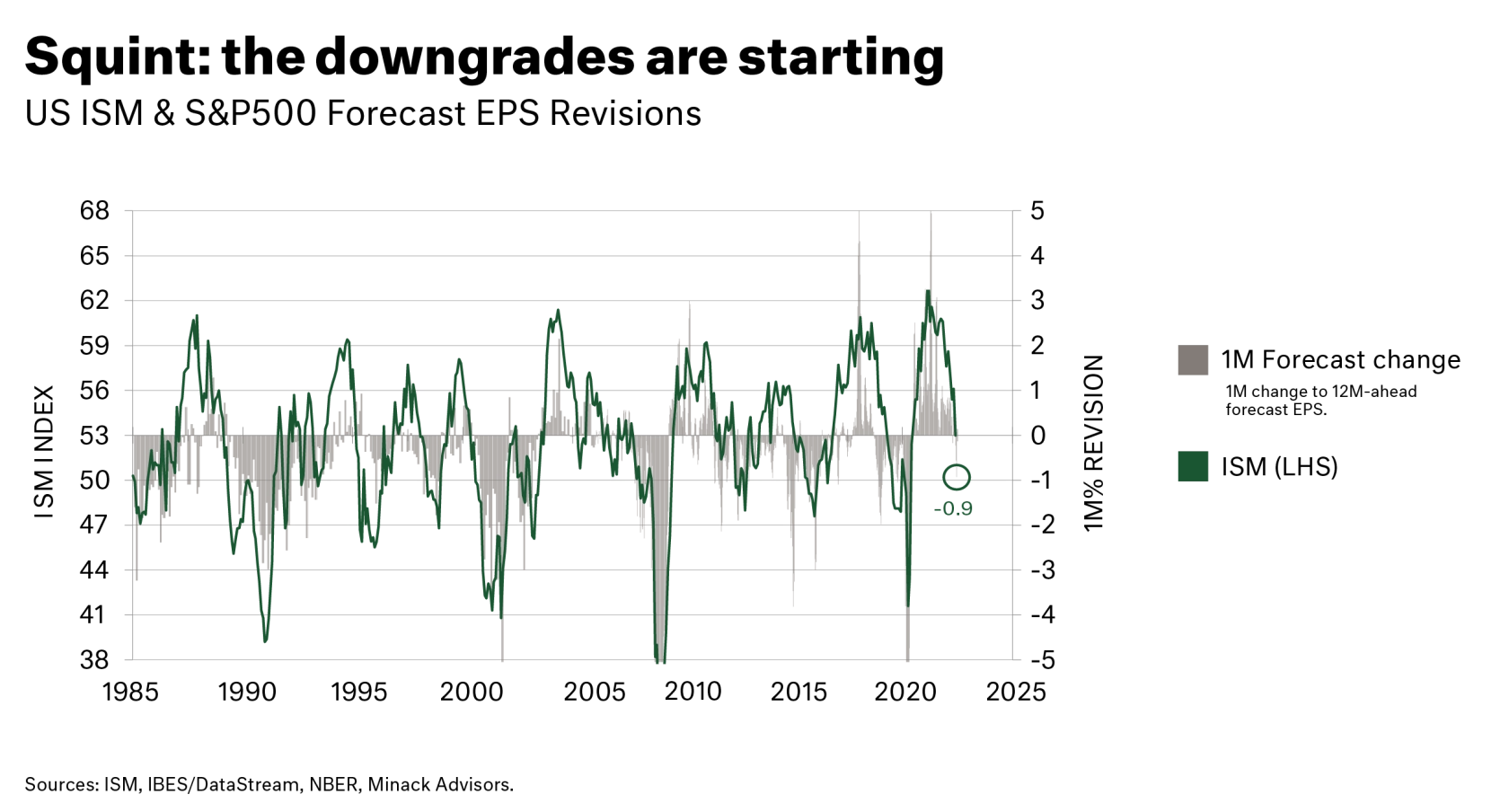

A key question for us is earnings growth, in the context of an economic growth wind back or contraction, and the extent it is being incorporated into the current equity market’s assessment. Either it has been incorporated and therefore the market is satisfied to move on, or it hasn’t and the market is underestimating the risk. Given the uniqueness of this cycle, we think the latter.

It’s fair to say that the US went sideways over the last two quarters, albeit slightly negative. The Federal Reserve would normally be concerned, but this rate cycle is squarely about inflation control and economic growth is the necessary casualty. We have noted this previously.

Watch the interview and read the summary, below: