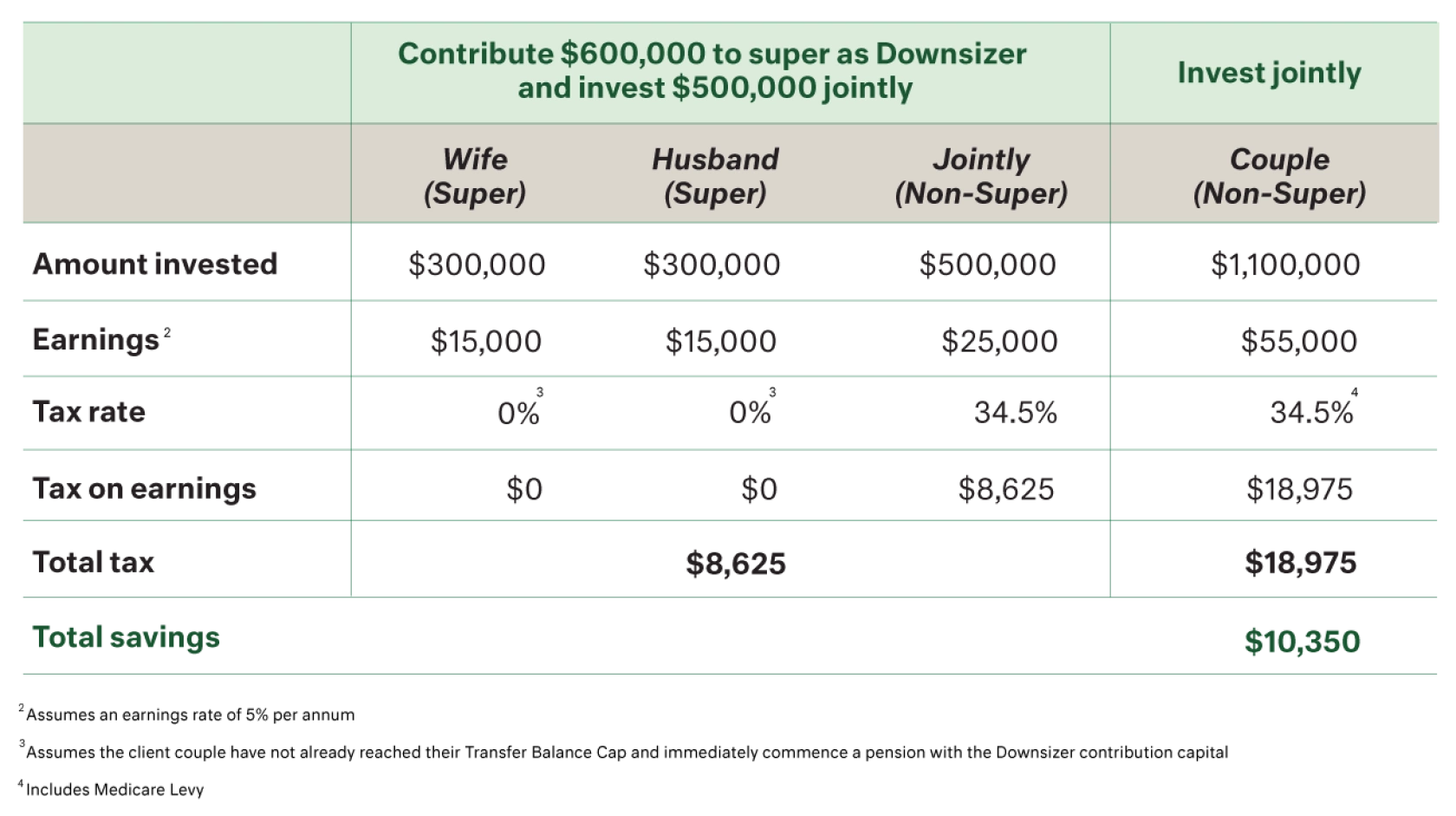

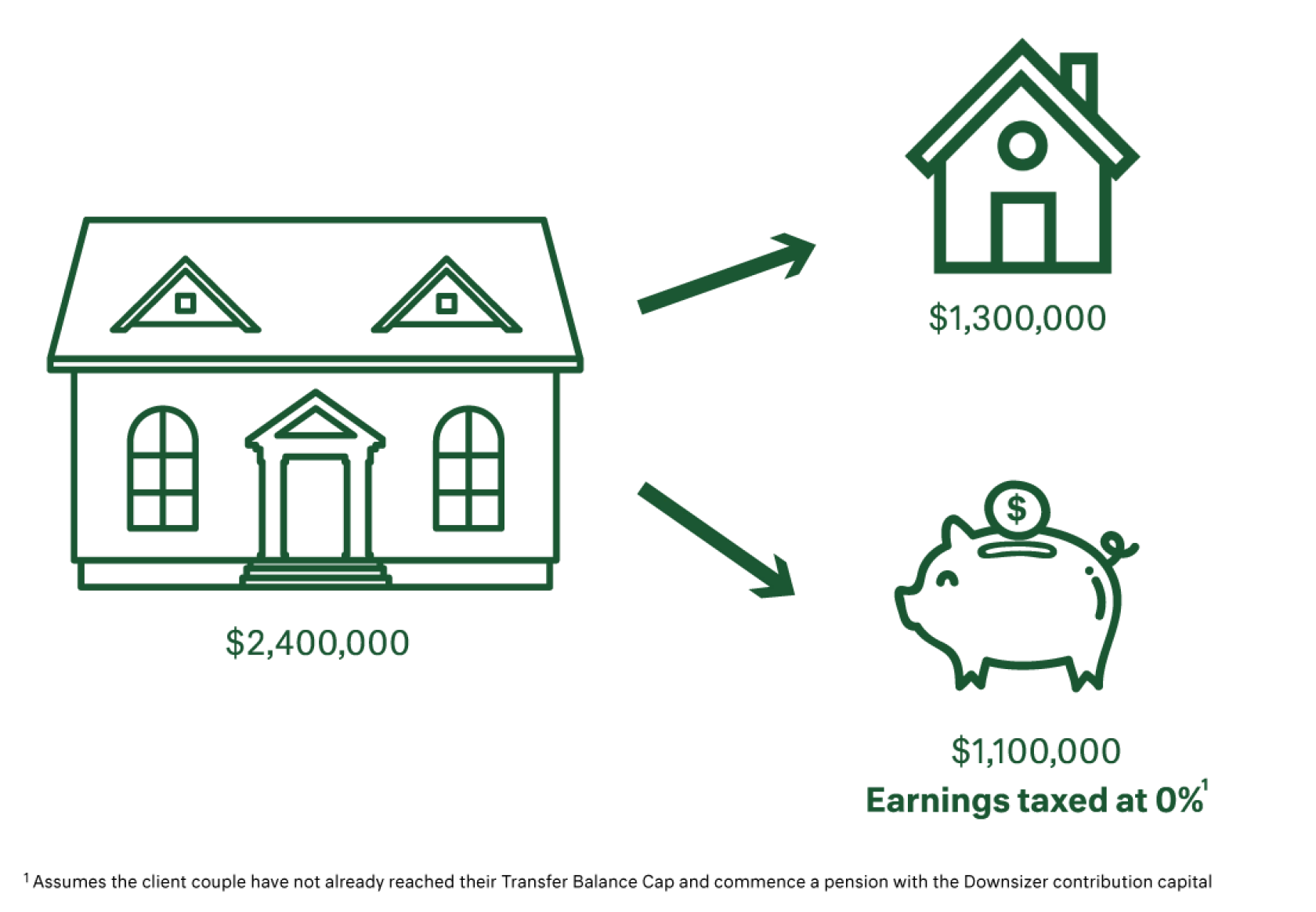

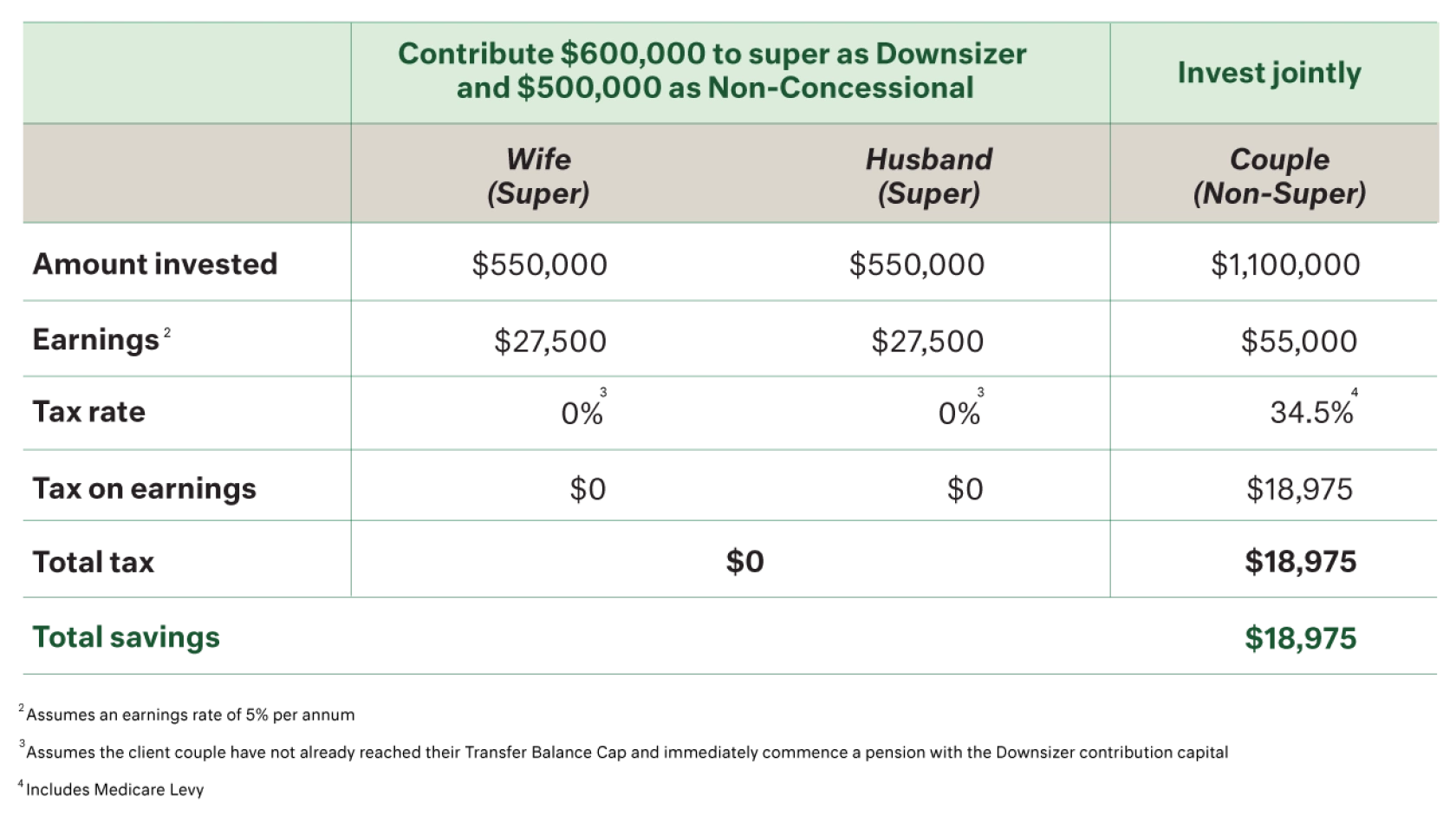

First introduced in 2018 as a measure to address supply-side housing affordability issues, downsizers now have the opportunity to contribute part of the proceeds from the sale of their home to superannuation, bypassing ordinary contribution caps. An individual aged 60 or over can contribute $300,000 to superannuation from the sale of their main residence (or former main residence), and a couple is eligible to contribute $600,000 combined. That age limit could also soon lower to 55 years if legislation introduced into Parliament last month is passed.

Presenting the opportunity to both boost retirement savings and take advantage of the tax savings that come with it, the appeal of ‘Downsizer contributions’ is growing with 6,000 people contributing $1.5 billion in the first year (2018), rising to 15,000 people contributing nearly $4 billion last year.