To assist individuals with increasing cost of living pressures, eligible pensioners, welfare recipients and concession cardholders will receive a tax-free one-off $250 payment, expected to benefit 6 million Australians.

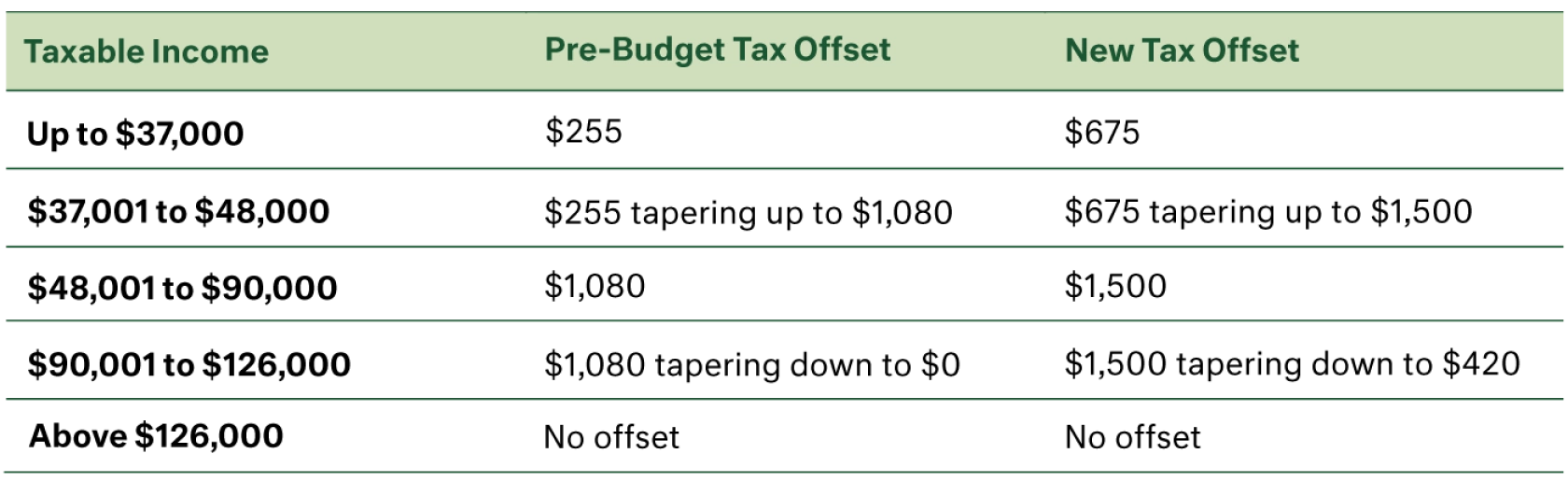

The Low-and-Middle Income Tax Offset (LMITO) was extended to Financial Year 2022 in last year’s Federal Budget and has been boosted again this year. Those who earn up to $126,000 will be eligible for an additional $420 which will be paid to individuals through the lodgement of their FY22 tax return.

Of course, no one is going to turn down the offer of more money in their hip pocket so these relief measures will be welcomed by individuals, but their effectiveness is incredibly short-term. One-off payments do not assist with inflationary pressures over time as prices continue to rise; we have seen this before through the GFC, where one-off cash injections were spent quickly and not where the Government was intending, and in more recent memory, where such payments added to household savings. It is real wages growth that is required to address those inflationary pressures over the medium term and we welcome further discourse on meaningful tax reform to shape Australia going forward.

Fuel excise (a federal tax imposed on each litre of petrol sold) will be halved, theoretically reducing the cost of fuel by 22c per litre to provide immediate relief from the recent spike in oil prices occasioned by the Ukraine-Russia war and increased demand as economies emerge from Covid-19 restrictions. While the cut took effect from midnight, the Treasurer has warned it may take up to two weeks to flow through to the bowser. To ensure the cut in excise is passed on to motorists, the consumer watchdog (ACCC) will be monitoring fuel retailers. The rate of excise will revert to 44.2 cents per litre (plus indexation) from the end of September.

For the third financial year, the 50% reduction in the minimum pension drawdown rates will continue through to 30 June 2023. Given ongoing market volatility, the rationale for the extension is to avoid members being forced to sell assets in order to pay out their minimum pension. For those not dependent on pension income, the continuing reduction means more can be retained in their tax-free superannuation fund for further reinvested growth.

Not a new announcement or change, but affirmation last night that the scheduled increase in Superannuation Guarantee – the rate of employer-paid superannuation contributions – will proceed. From 1 July, the compulsory superannuation rate will increase to 10.5%, with sights set on 12% by FY26.

The Paid Parental Leave (PPL) Scheme will be overhauled to be more flexible, equitable and accommodative of modern-day care giving. By combining the PPL benefit of 18 weeks with the Dad and Partner Pay benefit of 2 weeks, parents will now have a combined total of 20 weeks paid parental leave to share between them as they wish. The Government has also announced the income test for PPL will change to a household income limit of $350,000 per annum rather than the current individual test.

As partners in your investment journey, we monitor, examine and navigate change. The Federal Budget is one such factor in our highly considered investment strategy and wealth management process.

This article is one part of our 2022 Budget series. To read more of our Budget commentary, click the links below:

– Small and Medium Business

– Economic and Fiscal Implications

For more information on our approach to wealth and asset protection, please contact us on +613 9655 5000.

Sourced from: