The Hayne Royal Commission has identified corruption, immoral behaviour, deception, but most significantly, cultural and structural failure in banks and large financial services. Whilst current ‘heads are rolling’ it is important not to lose sight that large banks and financial services companies have been perpetrating this abuse for decades. In the merry-go-round of board directors, some ex-directors will feel they have missed a culpability ‘bullet’, but they are perhaps more culpable as they supported, encouraged and built up these organisations without proper moral and culture compasses. They have failed in their fundamental duty as directors. As for governments of both political persuasion, they have long been ‘hoodwinked’ by the bank mantra of big is best, big is stable and big is good for financial stability. It’s plain self-interested ‘hogwash’.

Cameron Harrison’s Australian Equity Strategy has never invested in ASX listed insurers or financial advice companies and holds a materially lower exposure to banks than the ASX 200 Index. Some could call this socially responsible investment, which it probably is. We have assessed these organisations over many years as failing certain fundamental ‘CH Business Success Criteria’. It has meant underinvestment to financials when credit growth was free-flowing, sometimes resulting in short-term underperformance. Irrespective of short-run outcomes, we assessed that the cores of these organisations were ‘rotten’ and that in time their ‘day of reckoning’ would come. This is at the essence of our responsible, long-term management of capital; to do that which we warrant to our clients even if in the short run it looks contrary to the pack view.

We have held the view for over 25 years that clients’ best interests must be anchored to transparency, accountability and acting without conflict in the management of portfolios.

Directly invested portfolios offer transparency as to holdings and fees, where investments are in the name of the client, managed professionally and without conflict, and provide peace of mind for investors.

Cameron Harrison provides specialist advice solutions across our clients business, passive wealth and family affairs, and bespoke investment management. Our expert portfolio managers have over 25 years of collaborative investing experience and the skills to guide investments in domestic and international equities, fixed income and multi-asset class strategies. And we have a published track record to illustrate this.

Investment strategies are managed by our in-house investment management and research team and applied directly to client portfolios through sophisticated portfolio modelling software.

Our clients benefit from directly-invested portfolios and an investment philosophy that is designed to protect and grow wealth over the long-term, with an acute focus on capital preservation and risk management.

Cameron Harrison and its partners have been at the forefront of directly managed client portfolios for over 25 years and are specifically licensed by ASIC to provide this service, being one of only 254 Managed Discretionary Account licensees in Australia. As an MDA licensee, Cameron Harrison is held to the highest standard of ASIC reporting and risk management requirements.

Cameron Harrison’s portfolio management offering through a suite of Complete Solutions, provide bespoke, transparent and professional portfolio management based on 25 years of experience managing client portfolios.

Direct ownership

Clients retain beneficial ownership of their assets and enter into a direct agreement with the APRA-regulated custodian. We do not own or have access to any client assets, and this is purposefully by our design to afford clients absolute flexibility and allow independence as between the manager and the money.

Directly invested portfolios

Combining the expertise of an independent, APRA-regulated custodian with Cameron Harrison’s Wholesale Bond Facility, we can manage, report and administer2 directly invested portfolios across almost any asset class:

ASX-listed Australian equities listed property and interest-bearing

International equities (NYSE, LSE, Europe, Asia)

Over-the-Counter interest-bearing assets

Foreign currency

We operate under our own AFSL and are not restricted to financial products issued by a particular brand or organisation.

Tailored portfolios

Every client is different. Some may have externally held illiquid property/business positions or a preference to avoid businesses in particular industries (e.g. tobacco). Using sophisticated portfolio modelling software, we modify the investment strategies applied to individual client portfolios to account for these differences and properly manage your risk exposures.

One simple, transparent fee

Our fee structure is simple: clients pay one monthly fee which covers investment management, administration, custody and accounting (if applicable), and our fees are known in advance. We do not accept commissions, placement fees or any other fees that put us in conflict with acting in clients’ best interests.

Peace of mind

With professional portfolio management based on 50 years of business advisory experience, our investment philosophy has stood the test of time and weathered financial and economic crises over the journey. Our philosophy is based on long-term wealth accumulation with an acute focus on risk management and capital preservation.

This approach provides our clients with peace of mind in their investment affairs, allowing more time to be spent on what matters: your long-term goals and how to address these.

A directly invested, managed portfolio is suited to those investors who value a high level of transparency and accountability through directly owning their shares, bonds and property, but do not want the responsibility or hassle of day-to-day decision making, management or administration. Through our suite of Complete Solutions, clients receive an efficient implementation of an agreed and tailored investment strategy, with a significant focus on personal plans, goals and risk tolerances.

Cameron Harrison’s partners have been delivering specialist advice to business owners and families for over 50 years. Through our defined planning methodology, our clients gain access and receive a careful and properly integrated wealth framework.

For more information on our approach to directly invested and managed portfolios or any other inquiries, please contact us on +613 9655 5000.

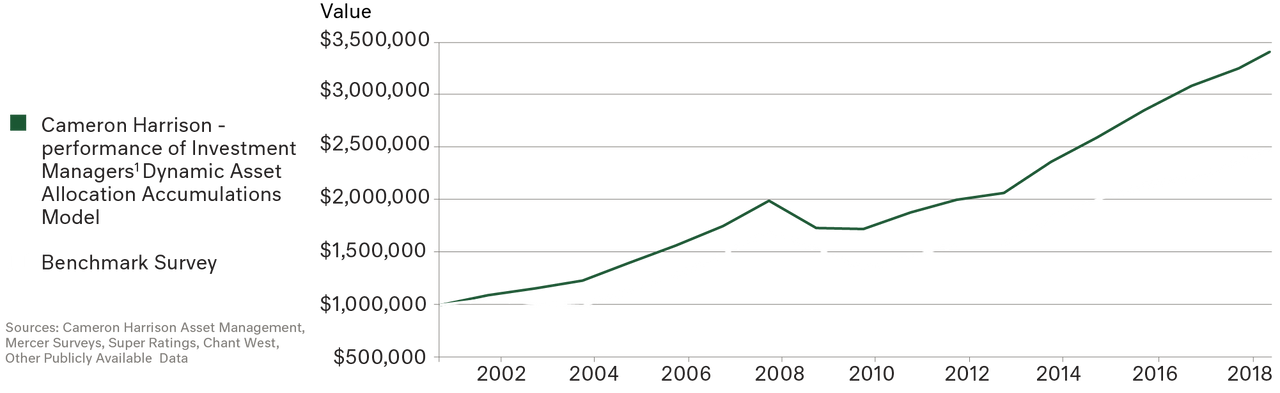

¹Cameron Harrison Asset Management (Cameron Harrison) commenced operations in January 2012. The investment strategy and portfolio decision making, and hence resulting investment performance of Cameron Harrison is under the control of Paul Ashworth and John Clark (CH Managers). A reference in this document to past investment performance of CH Managers for any period that pre-dates the commencement of Cameron Harrison is to the published investment performance results derived by an Australian public offer superannuation fund, wholesale Australian equity fund, wholesale United States equity fund, or wholesale United Kingdom equity fund, as the context states (Prior Funds), which were operated over the relevant period with Paul Ashworth and John Clark then acting as executive directors and responsible for investment strategy and portfolio decision making of the Prior Funds. The financial service now provided by Cameron Harrison may not correlate exactly with the Prior Funds for which investment performance predating Cameron Harrison is quoted, and there is no connection between Cameron Harrison and the Prior Funds other than the common involvement of the CH Managers. It should NOT be assumed that, hypothetically, if Cameron Harrison had been operating over the relevant period under the leadership of the CH Managers, Cameron Harrison would have achieved the same performance as was actually achieved by the Prior Funds as relevantly quoted. Past performance will not necessarily be repeated and is not a reliable indicator of future performance, as investments can rise and fall. Performance figures are quoted after fees. Performance figures should not be relied as a basis of making current and future investment decisions. Careful and proper review of investment strategy, systems, personnel and risk (amongst others) should first occur. Investors should seek professional financial advice before making a financial decision.