After months of speculation and reaffirming support for the ‘Stage 3’ tax cuts which were due to come into effect on 1 July, the Albanese Government has backflipped. In a bid to relieve cost of living pressures, the Government has announced their proposal to revise the already-legislated tax cuts to better target ‘middle Australia’. But we will leave the behavioural and reputational analysis of this move to the political commentators…let’s cut to the chase (pun intended).

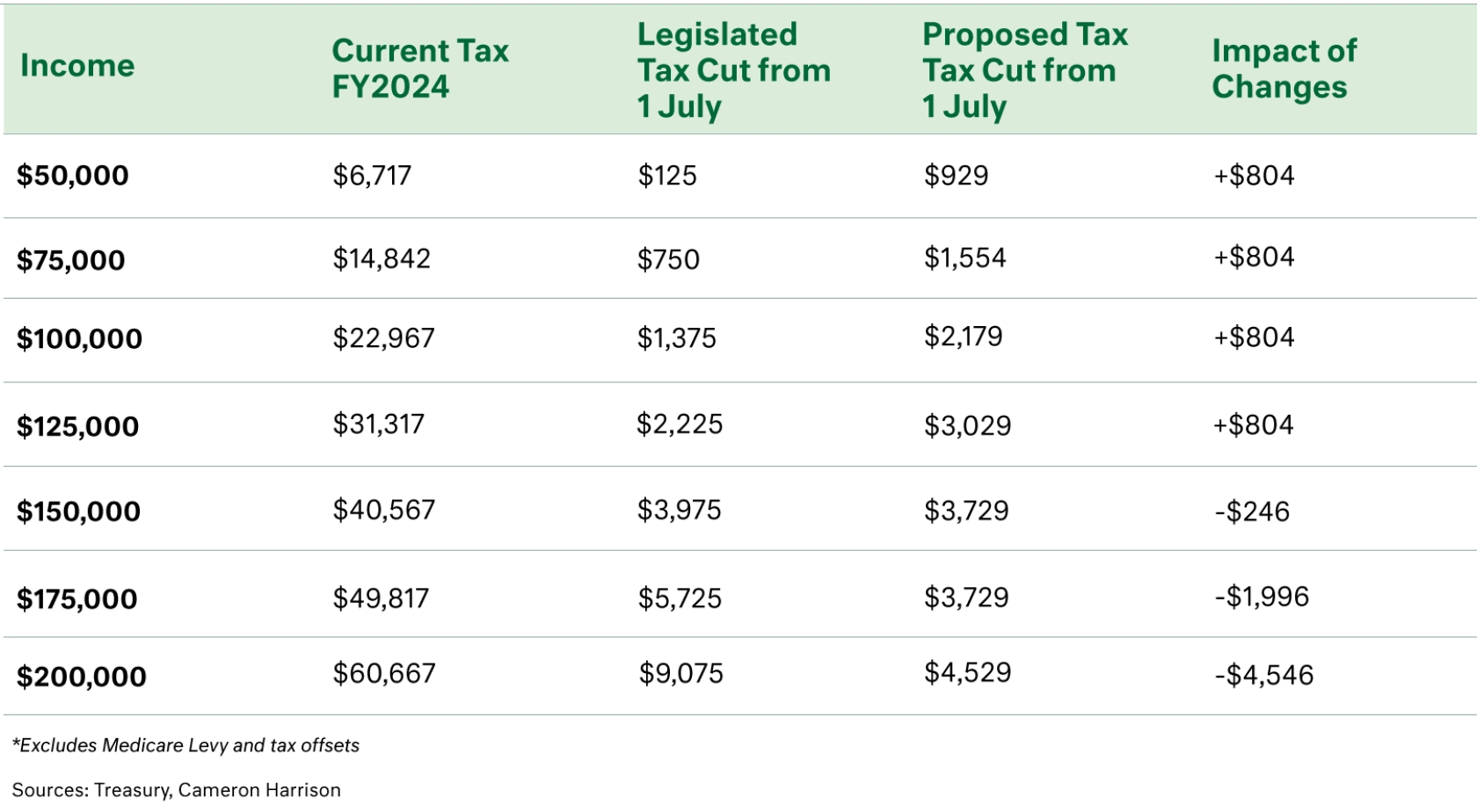

Where the previous Stage 3 tax cuts benefited those on higher incomes, the proposed changes will now benefit those earning below $150,000. It is not all bad news, however, as the changes include a reduction in the lowest marginal tax rate (from 19% to 16%) and modest widening of the higher tax brackets (as compared to current rates) to deliver at least some increase in take-home pay to everyone.

An increased tax cut for lower- and middle-income earners puts more money in the hands of consumers that are likely to spend, rather than save, the windfall. The changes will add to aggregated consumer demand and hence inflation, however, we expect that the magnitude of the impact, compared to the original Stage 3 tax cuts, will be only marginal.

It should be noted that these changes must first be legislated, and with only five months before they are due to come into effect, the Government’s attention now turns to lobbying the Greens and crossbench for support.

Cameron Harrison have been advising business owners and their families on asset allocation and intergenerational wealth management for over 50 years. We have demonstrated over a long period our ability to manage investments through both the good times and bad by keeping the client at the centre of our business.

For more information on our approach to wealth management and investment strategy, please contact us on +61 3 9655 5000 or contact our experts here.

Sourced from: