COVID-19 health and social interaction policies are likely to persist longer than expected, and maybe longer than community expectations. This warrants consideration of the broader economic impacts of the strategies being implemented to combat infections. In Australia and other countries like the UK & US, the Australian economy is officially 'hibernating' at a likely direct and indirect cost to the economy of well over 40% to GDP - both the direct cost and indirect cost will be monumental and the economic policy effects enduring for the next 20 years.

The Imperial College of London (who has been advising the British Government), in collaboration with the World Health Organisation, has estimated a no-intervention situation would result in the death of 2.2 million Americans and 510,000 Britons, with hospitals overwhelmed by the second week of April. It is therefore no surprise that governments around the world are racing to slow the spread of infections, or ‘flatten the curve’, as quickly as possible.

While the specific measures implemented have varied country-to-country, they all aim to either mitigate the spread of COVID-19 or suppress it entirely. What does mitigation versus suppression mean? The difference between the policies has a huge impact on health and economic outcomes.

1. Mitigation: slowing, but not stopping the spread to reduce peak healthcare demand and protect those most vulnerable to the disease (Figure 1).

Less disruptive approach where the population develops immunity over time, eventually resulting in a decline in infections and severe cases.

Measures include home isolation for people or households with symptoms, closing schools and universities for 3 months, and social distancing for those over 70 for 4 months.

The optimal mitigation scenario (grey line, Figure 1) still results in peak demand for critical care beds of 8 times over the available capacity in the US and UK (black line, Figure 1), meaning this approach is not feasible without a substantial surge in emergency capacity.

2. Suppression: reducing the infection rate until the number of confirmed stops increasing (Figure 2)

Aggressive strategy currently which essentially shutdowns all non-essential services to contain the spread. This approach has been implemented around the world, including Europe, the New York City/California and now Australia.

Measures include population wide social distancing, home isolation of people with symptoms and education facility closures for at least 5 months.

It is estimated suppression will keep demand for critical care beds below capacity as long as measures are maintained, but the risk is a resurgence in infections if restrictions are lifted before a treatment or vaccine is developed, as shown in Figure 2 below. This could take over 18 months, well above current forecasts and giving rise to inexorable economic costs.

As mitigation is not feasible without overwhelming the capacity of our healthcare systems, suppression continues to be the preferred strategy in countries able to implement the restrictive controls required. While suppression has thus far been effective in China and South Korea, the strategy entails considerable social and economic costs which will radiate far beyond the period restrictions are in place.

Record stimulus packages will provide support to struggling businesses and relief to people who have lost work, but there is no avoiding the 'asteroid' hit to the economy. The impact will be particularly severe for the education, retail, hospitality and tourism industries, which rely on social interaction. Current consensus is for a large contraction in GDP this quarter followed by a recovery in late 2020, but we believe this underestimates the potential for suppression to continue for longer than a couple of months.

The challenge is that restrictions must be maintained for as long as the disease is in circulation, or until a treatment or vaccine becomes available. If all controls are lifted prematurely, we could quickly find infections skyrocketing and healthcare systems being overwhelmed. A gradual lifting combined with modulation up and down on controls is most likely.

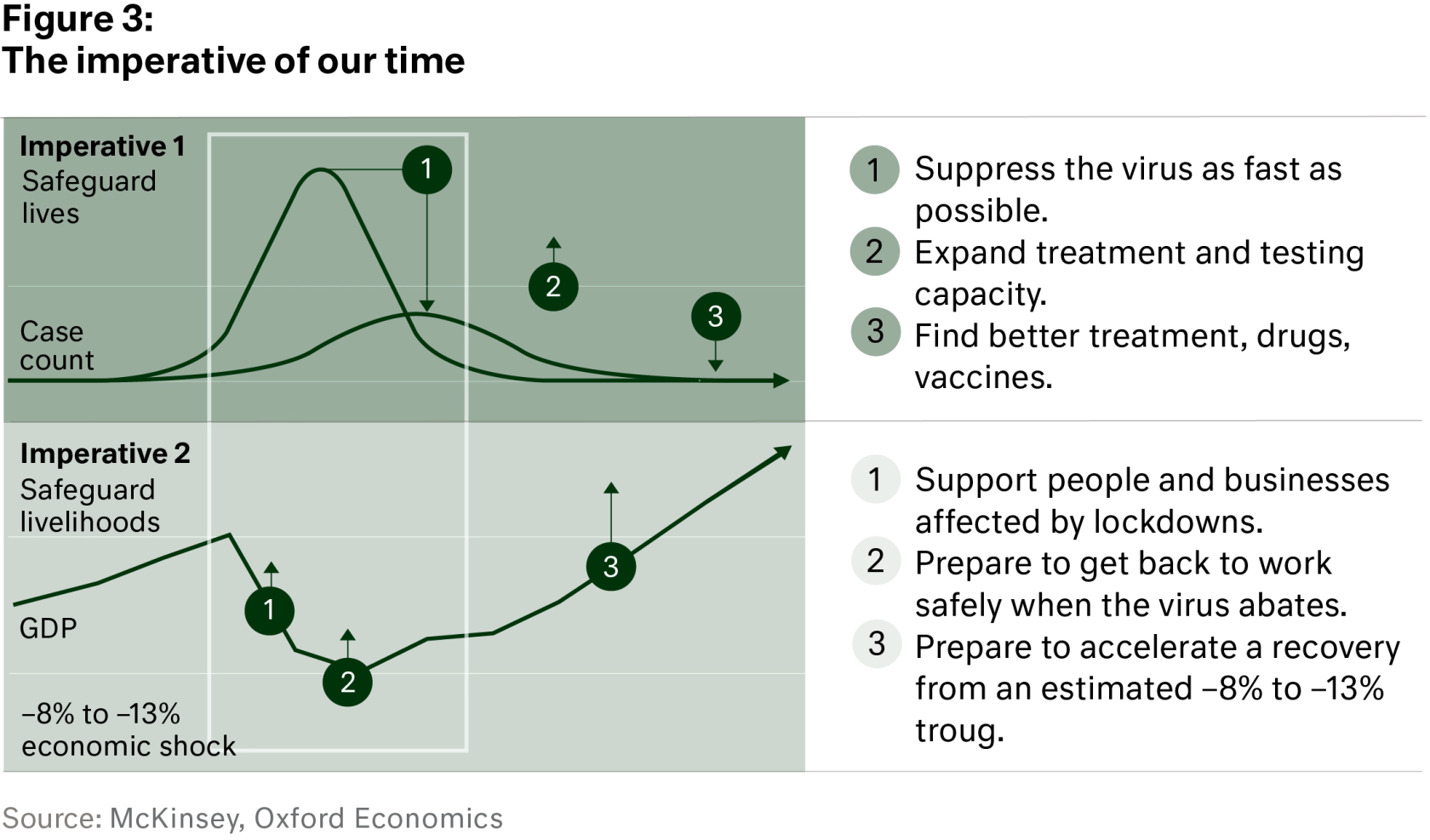

In Figure 3, we clearly see the trade off at hand for policy makers. Policy seeks to both safeguard lives and to safeguard the livelihoods of households. Other than Sweden, the world has largely adopted suppression (the lower curve in Imperative 1). The implication is that social distancing and the more extreme lock-down strategies rely on an eventual treatment or vaccine to materialise sooner rather than later, whilst government supports the economy with economic 'hibernation' policies which hopefully permit businesses to 'awake' - the assumptions being firstly, that businesses do not need to hibernate beyond 3 to 4 months, and secondly, that businesses can in fact survive for this period. The suppression approach also needs to fundamentally address the situation of no effective vaccine materialising.

We have detailed below two scenarios on economic recovery. The first is based on virus containment with a slow recovery (Figure 4). This is predicated on control of the virus over a 3-month period and that China returns to normality first then followed by the US and Europe. For example, we see that Wuhan has concluded its lock-down which would be consistent with this outlook, having been approximately 3 months in isolation/lock-down. Through this period, Government fiscal policy and monetary policy are used to support household and business basic costs, which is in fact what is occurring. Under this scenario, GDP growth would return to pre-crisis level in early 2021. Whilst this is possible, at this stage it looks like the remoter possibility.

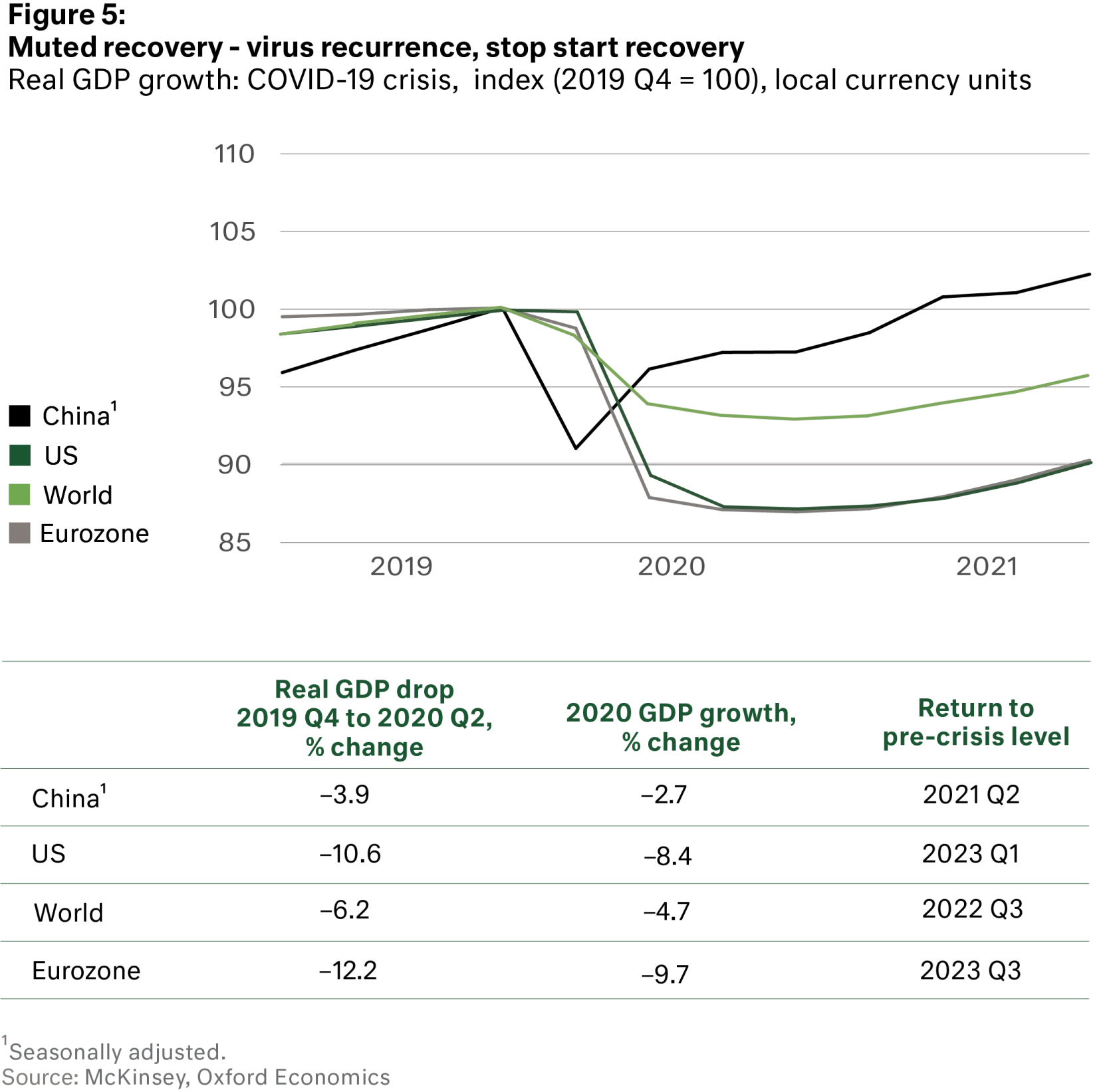

A more severe scenario is that pending an effective treatment and vaccine, that regions fail to contain the virus in a 3-month period and it spills over 6 months, with the high likelihood of recurrence and the need for strict social distancing to be continued. In this scenario, Europe and the US struggle for containment and China has recurrence. This is shown in Figure 5, and represents a starkly poor economic outlook with return to pre-crisis economic growth not till late 2022 or early 2023. In an environment of unknown unknowns, this probably reflects a more pessimistic outlook, but does serve to highlight the delicate policy balancing act between saving lives and saving livelihoods.

Taking a balance of scenarios, a mid to late 2021 rebound to pre-crisis levels appears more realistic.

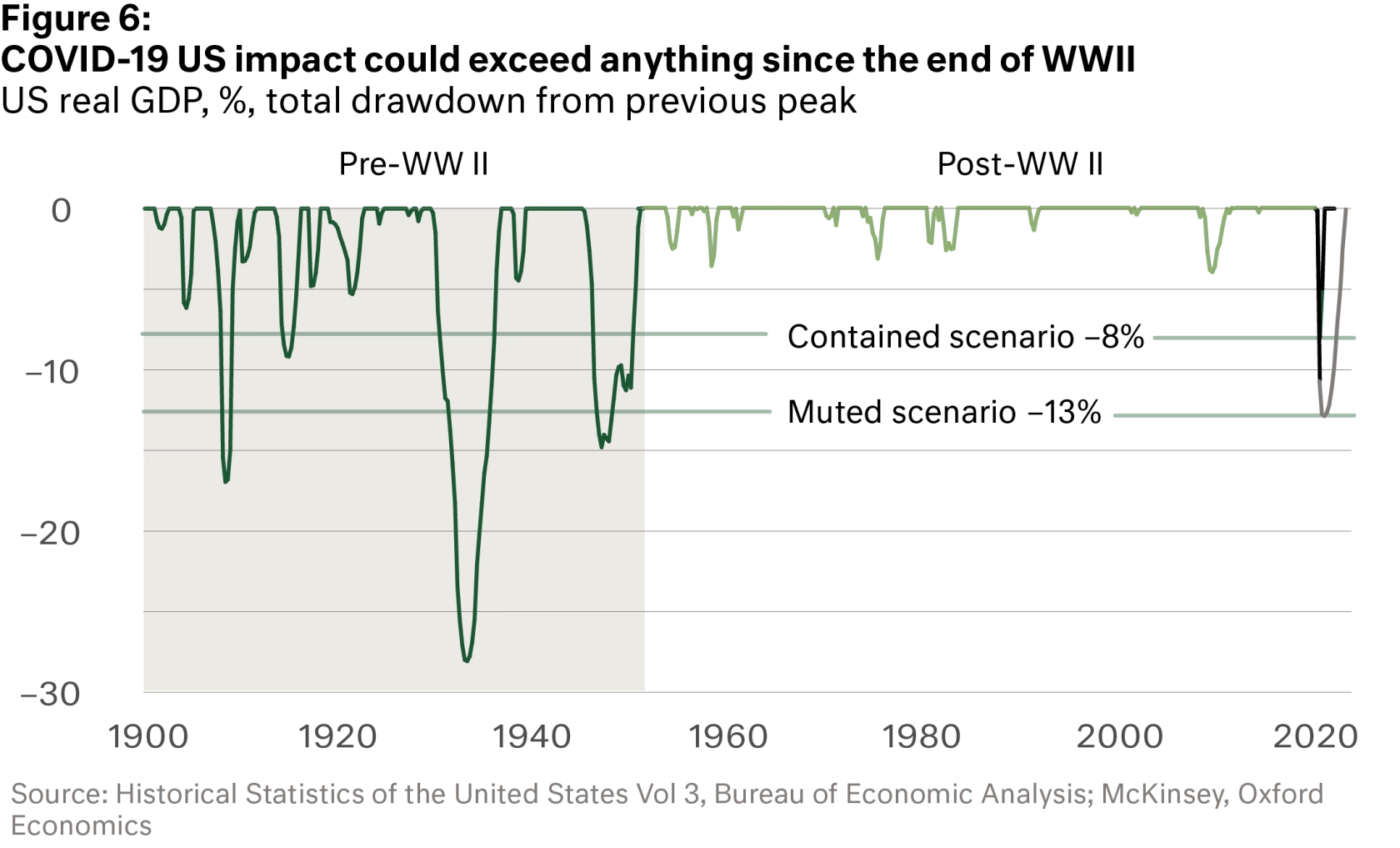

Another way to picture this and understand the scale of the two scenarios is seen in Figure 6 which considers US GDP drawdown from peak. Basically, the cost to GDP growth through growth reversal is equivalent to anything experienced since the end of World War 2 when the war machine suddenly halted.

In Australia, we see a very difficult economic period ahead. It is almost certainly going to result is recession by traditional measure over at least two if not three quarters, and on a per capita basis likely to be a longer, more painful recession. The household and business environment were stagnant going into the COVID-19 crisis. Whilst 'hibernation' policies are the right policy for where the health crisis and economy finds themselves at present, a sustained suppression strategy comes with a monumental economic cost for which one wonders whether the community understands the full elements of the trade-off. That said, if sustained suppression is the pursued policy, then to buttress economic growth through 2021 and probably 2022, the Coalition Government is going to have to reverse its aversion to deficits, and go a whole lot harder. If not, the alternative will simply be awful.

Cameron Harrison have been advising business owners and their families on asset allocation and intergenerational wealth management for over 50 years. We have demonstrated over a long period our ability to manage investments through both the good times and bad by keeping the client at the centre of our business.

For more information on our approach to investment strategy or any other inquiries, please contact us on +613 9655 5000.

Sourced from: