Despite their growing popularity, these assets are often overlooked when it comes to Estate Planning. From the simplest, most common digital assets such as email and Instagram accounts, to the more ‘glamorous’ such as digital currencies and NFT’s; these intangible assets hold both monetary and sentimental value and can create significant challenges for your beneficiaries and Executor(s) should they not have the appropriate authority, access and instructions.

Digital assets are more prevalent than you may realise; they include:

Bank Accounts

Email Accounts

Social Media Accounts (Instagram, Facebook & Twitter)

Loyalty Program (Frequent Flyer)

Investment Accounts (Share Trading)

Digital Storage Accounts (the ‘Cloud’)

Online Subscriptions

Password Managers

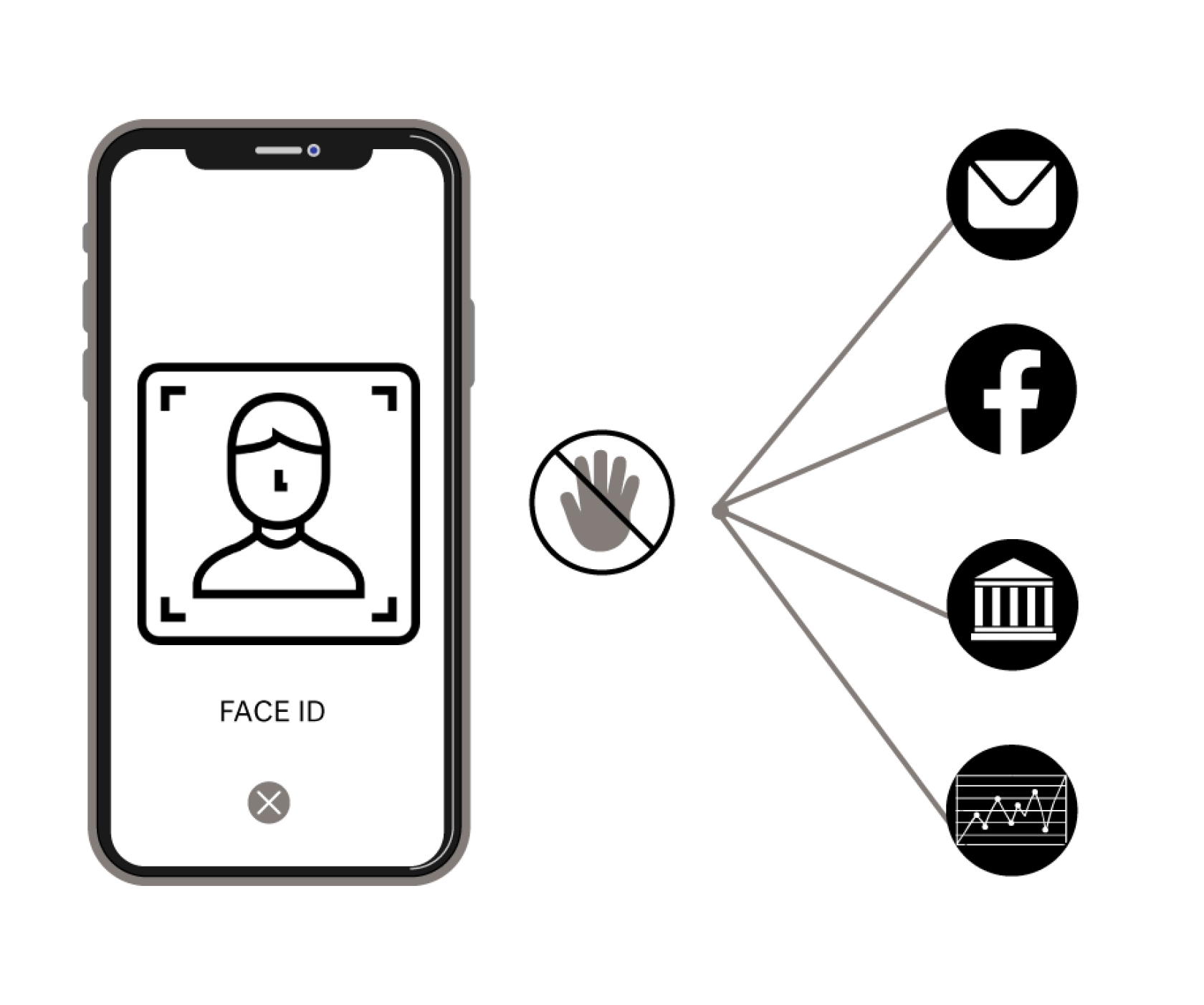

Digital assets allow you to access information and manage your affairs from anywhere, at any time. However, the ease and convenience of digital assets can pose challenges after you have passed or become incapacitated, as these assets are typically protected by passwords. Executors, Trustees and/or Powers of Attorney will require these passwords in order to act upon your digital assets when you cannot.

John and Mary are a married couple in their 60s. John is not a fan of technology, so Mary has tended to manage all of their banking and investment accounts through online platforms. Unfortunately, Mary suffers a stroke, causing short-term memory and speech impairments. John now needs access to their digital assets, but without the login details, he has no access to their online savings account which holds the majority of their cash. This lack of access causes major cash flow problems and significant distress for John until he is eventually able to identify himself with the online savings bank.

Emily, a business owner, maintained various digital assets, both personally and for the business. Most were stored on her phone and accessed through mobile apps. Following her sudden and untimely death, Emily’s Executors were provided with her mobile but were unable to access it as the phone was protected by a passcode and facial recognition. A domino effect ensued – without access to Emily’s phone, her Executors were effectively locked out from accessing her personal digital assets such as email and banking. Similarly, her business associates, were unable to gain access to digital assets owned and operated by the business, such as company bank accounts, website and customer information. This created long delays, significant disruption and additional stress and uncertainty for the Executors and business.

In Australia, we have an inadequate regulatory and legal framework to address digital assets in the event of incapacity or death, with no consistency in data and identification requirements, nor widely accepted ‘best practice’ protocols. In all likelihood, your Executor(s) and Powers of Attorney will be left to ‘battle it out’ with each digital asset custodian to gain control of your asset, resulting in unnecessary legal and financial consequences in what is already an extremely taxing period, both emotionally and administratively.

In this modern age, digital assets should be considered in much the same way as any other asset, requiring oversight, management, purpose and professional advice. It is therefore essential to have a clear and documented plan for your digital assets to ensure they are dealt with as you wish in the event of incapacity and death. An Estate Plan can provide the route map to your digital assets and a framework for their orderly management and distribution.

Cameron Harrison have been advising business owners and their families on asset allocation and intergenerational wealth management for over 50 years. We have demonstrated over a long period our ability to manage investments through both the good times and bad by keeping the client at the centre of our business.

For more information on our approach to wealth management and planning, please contact us on +61 3 9655 5000 or contact our experts here.

Sourced from: