It must be nice, it must be nice, to have... the commodity cycle on your side.

It must be nice, it must be nice, to have... record low unemployment.

It must be nice, it must be nice, to have... wage bracket creep driving tax receipts.

It must be nice, it must be nice, to... be the Treasurer right now.

♪♪ Washington on Your Side, Hamilton

A year ago, we warned (here) that the Treasurer had delivered “a surplus in name only”, and the year ahead would see high fiscal spending that “adds to the RBA’s inflationary woes”. With inflation proving stickier than many commentators expected and interest rate cuts likely deferred until 2025, the impacts of high fiscal spending on homegrown inflation have emerged.

Whilst the initial wave of inflationary measures was the result of overseas issues, the ongoing stickiness has been given a helping hand by questionable policy decisions. An addiction to overly high immigration has translated to rapidly rising rents (7.7% year-on-year), and a country blessed with abundant energy resource (gas, coal, wind, solar) only has policy to blame for gas shortages and rising costs (7.3% year-on-year).

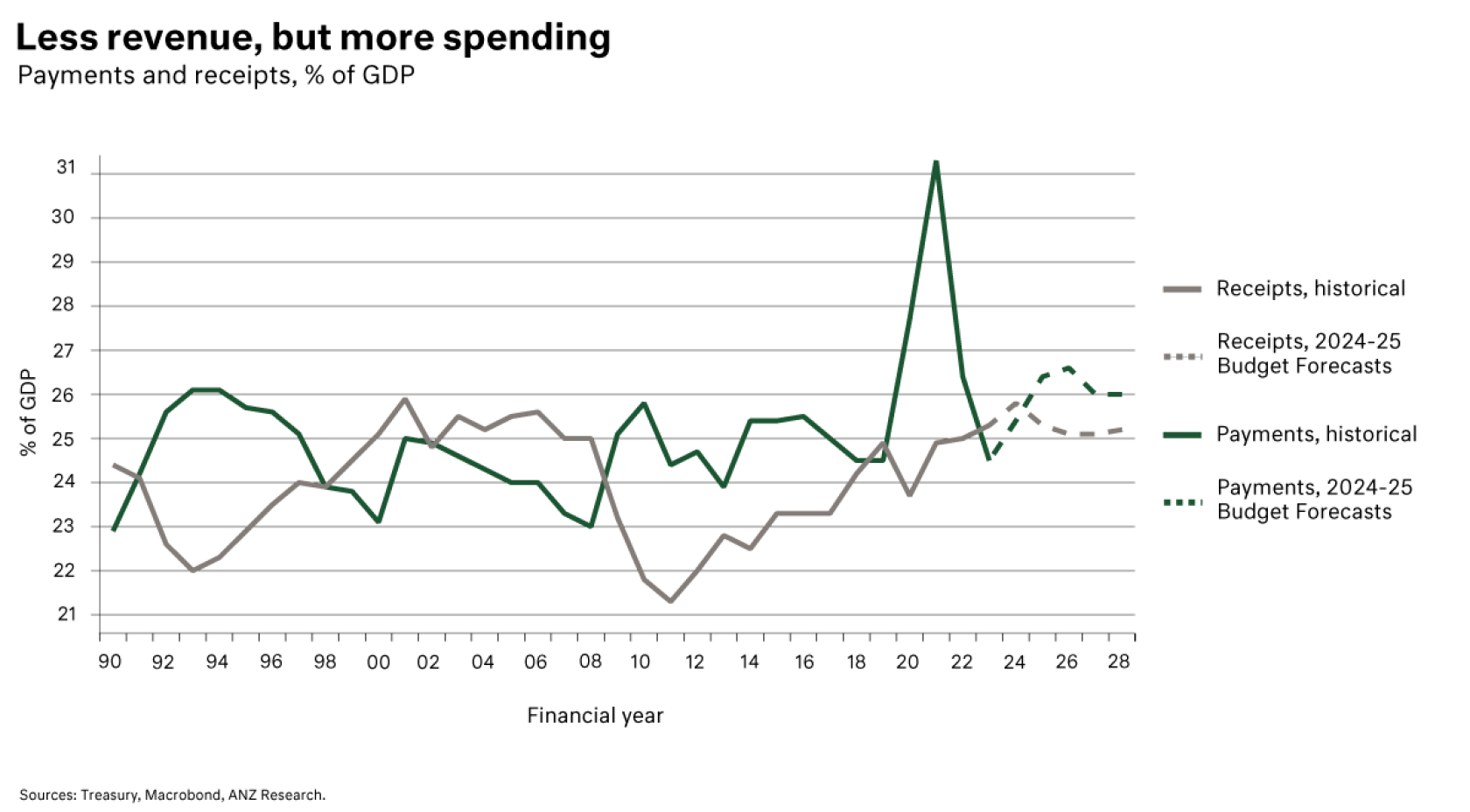

Voters should not be fooled by the cooing of fiscal restraint and the bright lights of a second consecutive surplus by this Government; this is a traditional big taxing and big spending Budget. This year’s surplus was delivered by an additional $24 billion in tax receipts (relative to forecast from a year ago), and is achieved despite spending at 25.7% of GDP, making it the highest spending surplus in Australian history.

Looking to the year ahead, the additional revenue from this year is extrapolated into the forward estimates, so too is additional spending of $20 billion, $25 billion and $24 billion in FY25, FY26 and FY27 respectively. With the Commonwealth and State Governments both adding significantly to the “spending” pulse, we believe the RBA will be careful to maintain/assert its independence and not lower the cash rate until its own measures are satisfied.

The Budget announcements benefit a wide cross section of the community (and hence is electorally supported). However, despite some accounting trickery to manipulate recorded inflation, we fear that this Budget further reinforces the pitfalls of the previous Budget.

In his third Budget iteration*, the message from the Treasurer is as clear as day; the Government view themselves as playing a central role in the economy, a shift away from the Hawke-Keating years of market forces shaping the economy.

Higher receipts will be directed into government spending, including a staggering $1 billion in a quantum computing start-up and a further $1 billion in domestic solar panels in this Budget. The sidelining of independent advisory groups in favour of cherry-picking projects under the guise of energy transition, supply chain resilience and national security, is a concerning trend that is to the detriment of all voters. Time will tell if these gambles pay-off; we won't hold our breath.

The Treasurer seeks to build an economy that is “anti-fragile”. In our assessment, this Budget has achieved the reverse and adds to economic fragility by requiring rates to remain higher for longer, risking monetary policy missteps. In macro terms (as % of GDP), the Government is pushing both its taxation take and spending involvement in the economy to ever higher levels. The result is deficits over the next decade, notwithstanding record revenue from taxation.

Absent from the Budget papers was productivity improvement. Without productivity improvement, real wages growth will likely decline. Government subsidies and cost of living handouts are only credible for so long. Either way, our standard of living stagnates or declines.

Finally, having successfully escaped a voter backlash by targeting new taxes on high-balance superannuants, petroleum producers and high-income earnings, we expect an emboldened approach to higher taxation to follow. The current capital gains discounts may be at risk in future terms, should this Government be re-elected as expected.

As partners in your investment journey, we monitor, examine, and navigate change. The Federal Budget is one such factor in our highly considered investment strategy and wealth management process.

This article is one part of our 2024 Budget series. To read more of our Budget commentary, click the links below:

For more information on our approach to wealth strategy and investment management, please contact us on +613 9655 5000 or contact our experts here.

*Includes the October 2022 mid-year Budget update following the May 2022 election win.

Sourced from: