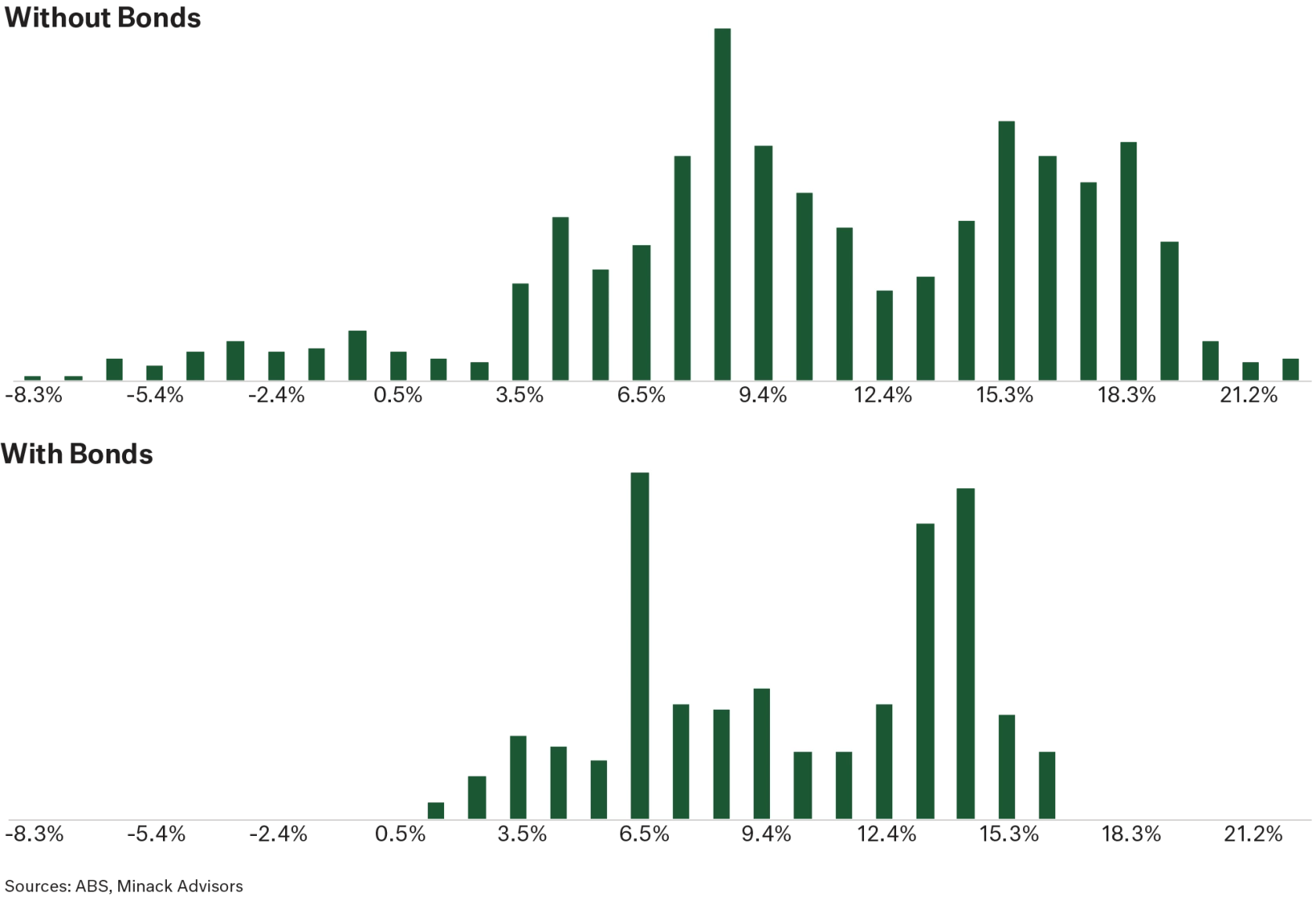

By their very nature a market collapse or economic crises are unpredictable, if they were predictable, then they would be avoided and severe effects mitigated. What we do know, is that the next market downturn is coming, it is not a question of if, but when and how. This is not to fear monger, but merely stating the obvious. The bigger question is how to plan and manage downturns and severe adjustments.

Over the past 90 years, investors had a ~40% chance of a market collapse in any 10-year period and a ~10% chance of two collapses, as happened in the first decade of this century. Investors that entered the US market between November-1999 and August-2000 generated negative returns over the next 10-years, in what was known as the “lost decade”!