To hear Paul's thoughts, watch the interview below. A summary follows.

On the face of it, a headline that reads: ‘80% of index return was attributable to 7 stocks’ makes a great headline. It also potentially causes some soul-searching, particularly if your US equity exposure doesn’t include these companies, and you may well have underperformed the S&P 500 Index.

There are however a lot of implied assumptions in that simple statement. Assumptions, which may or may not be misleading, and may or not have any relevance to an investor in US equities, and why ‘Oils ain’t Oils’.

The S&P 500 Index is market cap-weighted, meaning the performance contribution is skewed to the largest companies by capitalisation, and conversely, smaller companies have lower weightings. So, it stands to reason, that the 7 companies above, which are quite simply the biggest companies in the US, will have a disproportionate influence on the Index performance.

Yet, there are plenty of other very successful and significant listed businesses in the

$27 trillion US economy (Australia is $1.7 trillion), that performs as well, if not better. However, because they do not carry the same Index weight as say Apple and Microsoft (equal to a combined 15% of the Index), they don’t make the same simplified headline as the ‘magnificent-7’.

For 30 years, Cameron Harrison has invested using equally weighted portfolio construction, not market index weight. We select based on our quantitative and qualitative multi-factor framework, being defined as quality factors. Whilst free float and liquidity are important to us, being the largest companies of itself is a poor selector. Added to this, there are portfolio management issues that add to risk without commensurate return benefits (diversification, bias, and downside draw risk).

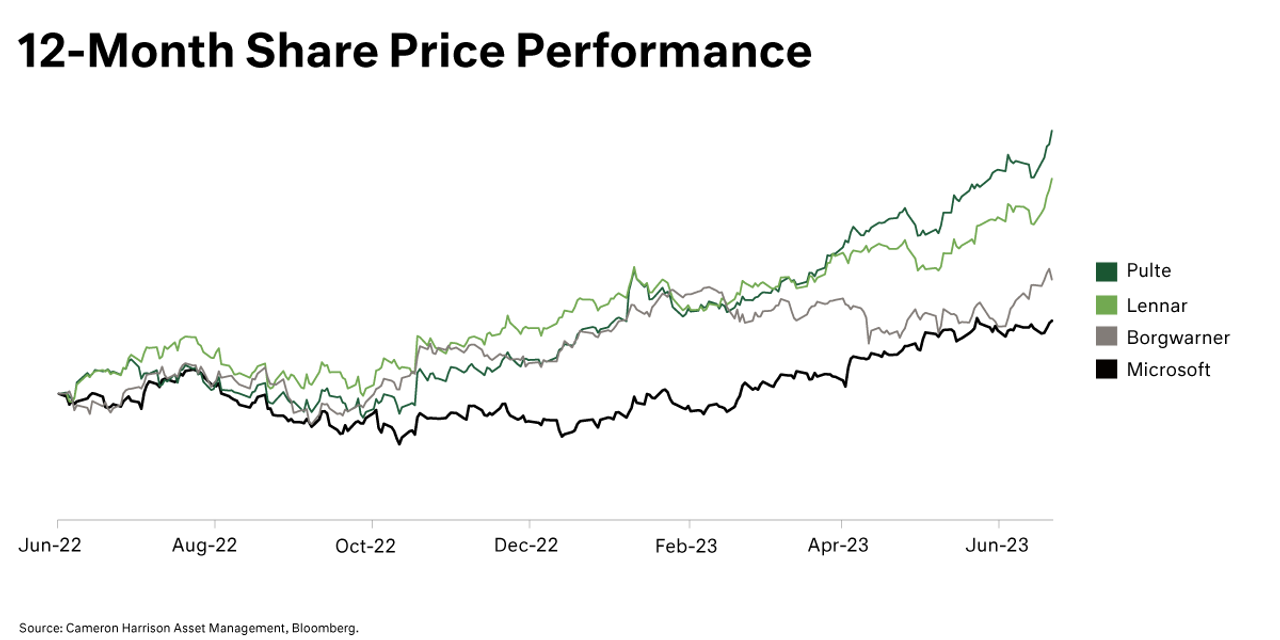

As an example, let’s look at Pulte Group, a home builder. It has a market cap of USD$18 billion. In Australia, it would be a big company, similar in size to Coles Group. In the context of the ‘magnificent-7’, it is a mere minnow, although it is an excellent business operating in a vast economy and a leader in household construction. As we can see in the following chart, over the last 12 months, Pulte Group is up 83% from a PE of 3.5x to now 6.8x together with earnings per share growth of over 25%.

Microsoft is also in our US Strategy but on an equal base with 21 other businesses. It trades on 37x PE and earnings growth of a little over 10%.

These two businesses are quite different, with the point that outside the US, investors anchored to headlines, big brands and size, potentially miss the opportunity to experience similar or better returns with lower portfolio risk.

Translating this into a portfolio performance, in the 12 months to 30 June, the Cameron Harrison US Equity Strategy (AUD) produced 27.97% pre-fees. This compares to the S&P 500 (AUD) which produced 23.91% pre-fees. An excess return of 4.06%, with measurably lower portfolio risk.