Arguably the most significant change to superannuation this year is the indexation of the Total Superannuation Balance, or ‘TSB’. Put simply, this is the sum of your superannuation interests across all tax phases and all accounts. Primarily, it is used as a means of determining your eligibility for Non-Concessional (after-tax) contributions in each financial year. The indexation of the TSB on 1 July has seen this threshold increased from $1.7 million to $1.9 million, with benefits afforded to those with balances below this amount and under the age of 75 years.

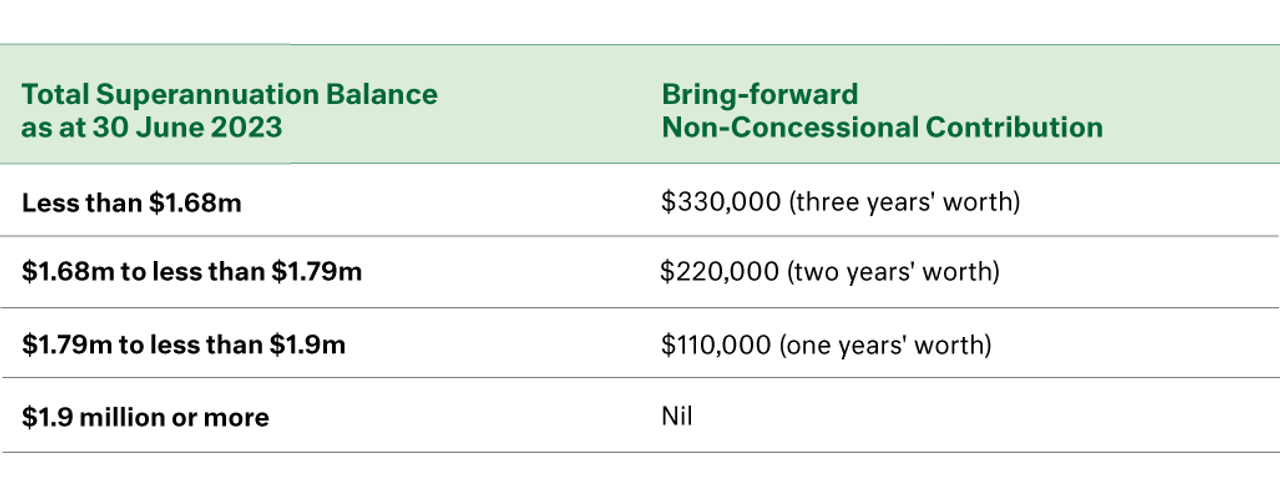

Now, those with TSBs under $1.68 million on 30 June 2023 can 'bring-forward' three years' worth of Non-Concessional Contributions, adding up to $330,000 to their superannuation this financial year – being $110,000 as this year’s annual contribution (FY24), plus $220,000 for the next two financial years (FY25 and FY26). Those with TSBs somewhere in between $1.68 million and the $1.9 million TSB cap have slightly lower bring-forward allowances: