Unemployment in the mid-3% and the strongest wage growth in a decade should be a recipe for economic growth, but below the surface, cracks are emerging in mortgage arrears and household spending.

The RBA is no longer happy to sit and wait for inflation to gradually decline to target and will embark on tighter policy to ensure an expedient return to ~2.5% inflation.

Lags in the transmission of monetary policy, and the RBA’s gung-ho approach, heightens the risk of overtightening and makes an Australian recession more likely than not. Read more.

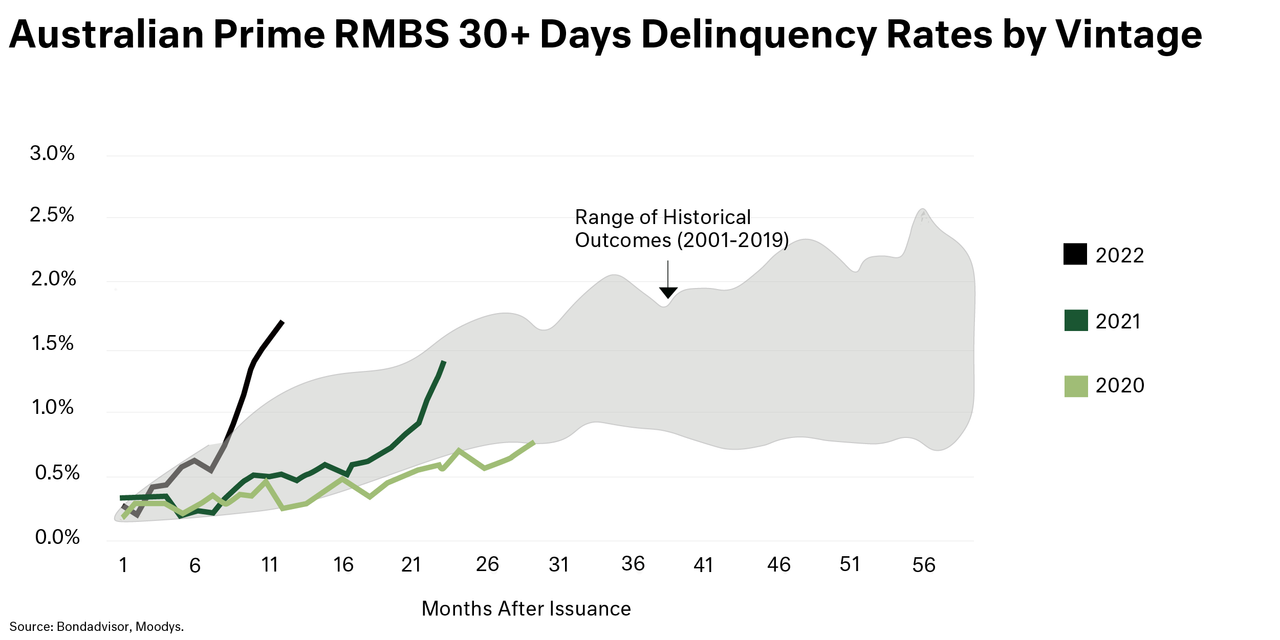

Mortgage arrears are on the rise, particularly for borrowers during the ultra-low interest rate period of 2021/22.

The chart below plots the delinquency rates for loans issued in 2020, 2021 and 2022 against the historical range of mortgage delinquencies since 2001. It shows a striking divergence in the fortunes of the three cohorts, with the 2020 vintage at record low delinquency rates and the 2022 vintage at record highs.

2020 Cohort: Typically has lower loan to value ratios (LVR) and a higher proportion of fixed mortgages at very low interest rates. As a result, they have so far felt minimum impacts of higher mortgage rates and have record low levels of delinquency.

2022 Cohort: Higher property prices lead to higher LVRs, and the start of the RBA tightening cycle sent fixed rates higher, leading to a greater proportion of variable mortgages issued.

The record delinquency of the 2022 vintage after just 11-months illustrates that the impact of tighter monetary policy will not be felt evenly across households, elevating the risk of forced sales and zombie mortgages.

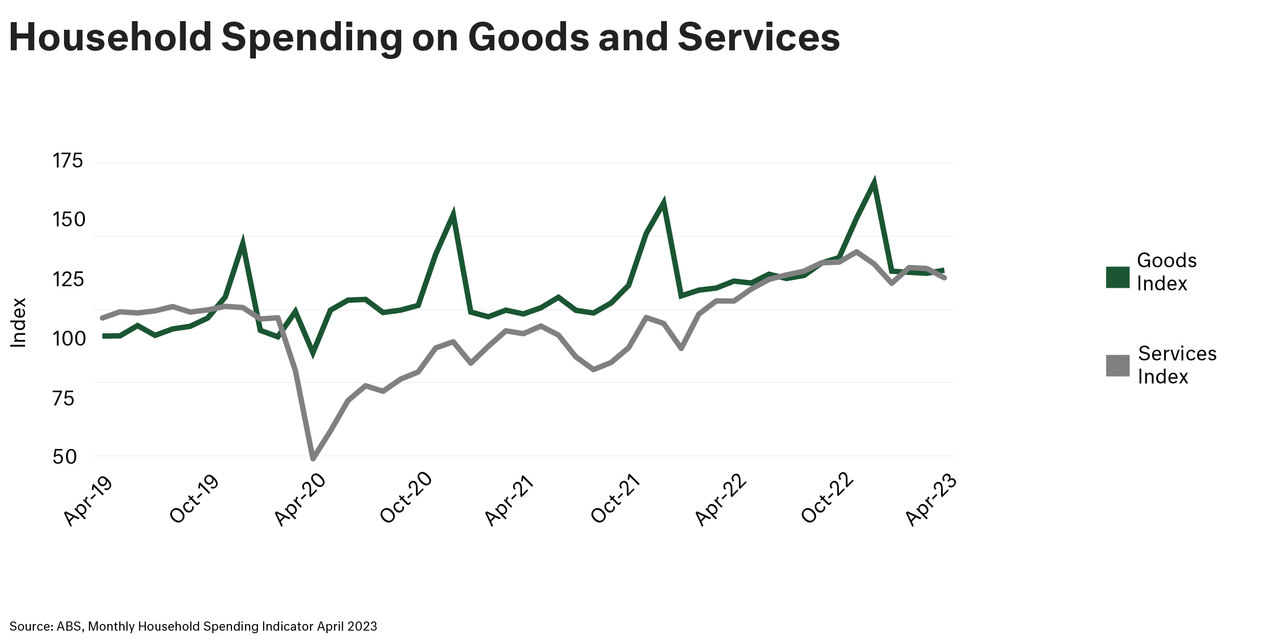

Aggregate consumer spending has fallen since the start of the year despite record levels of population growth; this points to a steepening contraction in disposable income and per capita spending.

The seismic impact of Covid on the consumer spending split between Goods and Services dissipated by the end of 2022 and we are now seeing a downward trend in spending on both, despite the highest levels of immigration in Australian history. This points to a broadening of financial discomfort across the economy as higher housing costs (mortgages and rents) start to bite.

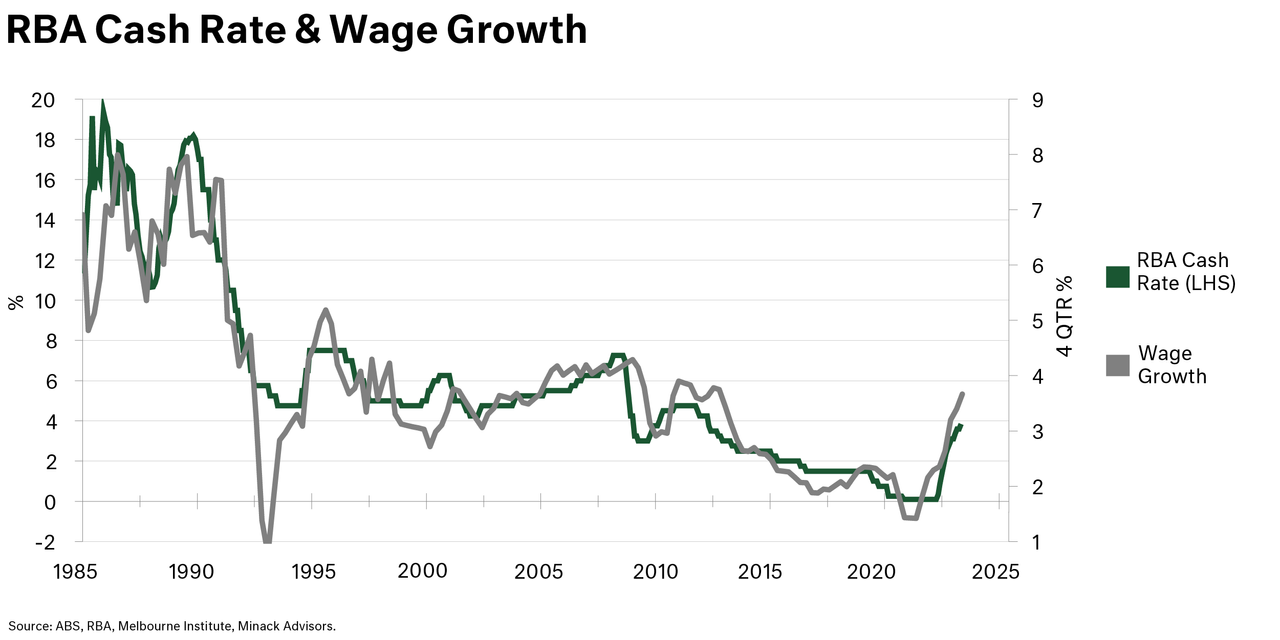

Accelerating wage growth is an upside risk for inflation. We expect the RBA will wait until an inflection in wage growth before ending this tightening cycle.

Wage growth is a key measure for Central bankers across the globe due to the influence it plays on the cost of Services and the risk of a precipitous wage-price spiral. Whilst wage growth is lower in Australia than other developed countries, the rate of growth is accelerating rather than declining. The upside risk to wages was highlighted by the Fair Work Commission's 5.75% increase in the minimum wage in May.

Given the Federal Government's election promise to increase real wages, we think it unlikely that the RBA will ease its tightening cycle until it sees a flattening in wage growth.

A rapidly growing population underpins increased government tax receipts and the expanded role of Government in the economy.

Rising mortgage arrears due to falling disposable income will test the banking sector with mortgage rescheduling and restructuring a likely outcome.

A growing working-age population but falling disposable income supports non-discretionary spending in healthcare and staples over discretionary spending on consumer goods and experiences.

For more information on our approach to investment management, please contact us on +613 9655 5000 or contact our experts here.

Sourced from:

Photo by iStock