To hear Paul's thoughts, watch the interview below. A summary follows.

As matters stand though, markets are priced for soft, and equity market indicators from the S&P500 Volatility Index, CBOE Put/Call ratio, and Meme stock momentum, are all supporting “greed over fear”. The macro data is far less sanguine and points to a contraction. That said, if history is correct, a soft landing is almost always excellent for equity markets, but…

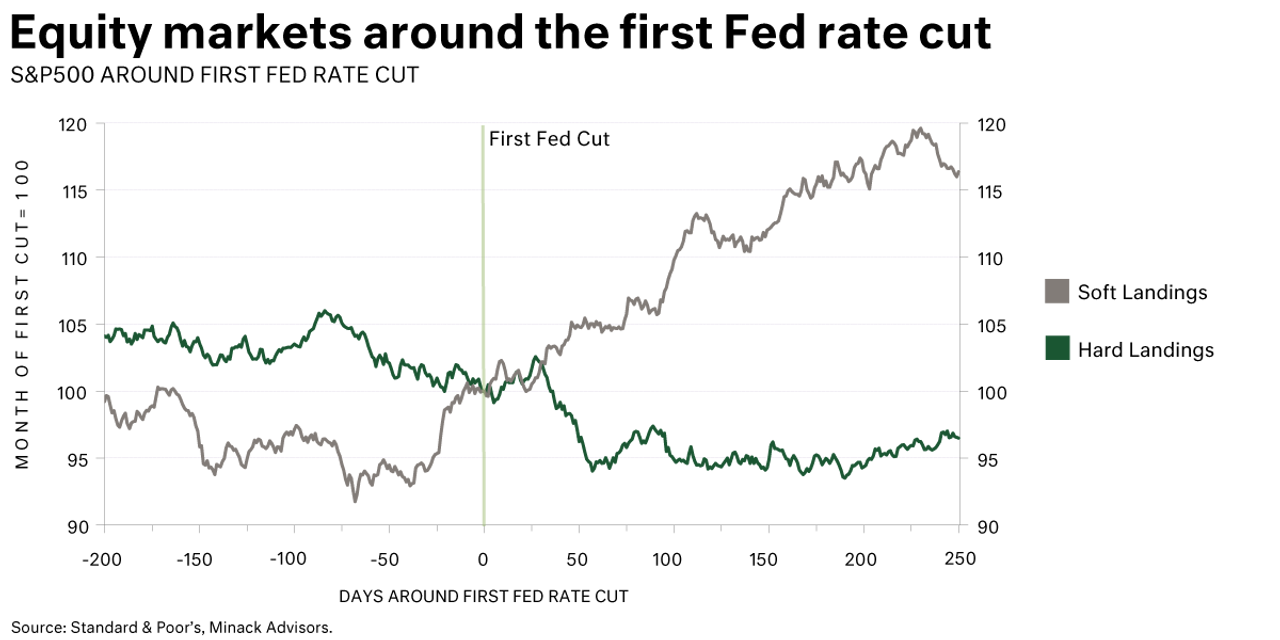

In our chart, you can see that soft landings are unequivocally positive for US equity markets, marked from the point of the Federal Reserve’s first rate cut. Conversely, economic hard landings see deep, widespread destruction in employment, consumption demand, capital stocks, earnings and earnings multiples, and is dismal for equity markets. So, this begs the dual question:

Are markets right to expect a soft economic landing in the US?

If we do get a soft landing, will evidence of past soft landings apply in the current situation?

We do believe there will be a slowing and contraction in US economic activity leading into 2024. Whilst not the market's view, macro indicators do support this. Further, the Federal Reserve may well respond with some further rate hikes given continued tightness in labour markets and with employment growth needing to be below 50,000 per month, not the current 190,000+ new jobs per month, to achieve their wages growth goal and price stability targets.

Government stimulation is also significant at present through the Inflation Reduction Act, and this is providing significant economic thrust which is at odds with monetary policy. There is also a risk that the markets (and Fed) are underestimating the neutral funds rate at 2.5% and that it ought to be closer to 4% to 4.5% (where it was 10 years ago). This last point is obviously nuanced and markets take some time to reflect such a view but it does highlight a downside risk. In all though, it appears on balance that the US economy may well achieve a soft landing in the form of a mild recession.

For fear of saying this time is different, it does appear to be somewhat different. Equities have already had a wonderful run. Cycle-adjusted PEs are presently a very healthy 31 times compared to similar stages for other soft landing cycles of 19 times in 1966, 9 times in 1984 and 20 times in 1995. We also see long bonds rising later in this cycle which adds relative attractiveness to the duration of stocks.

The other major factor which has been touched on is the neutral Fed Funds rate. The scope for significant Fed rate cuts past the cycle high may well not be that generous which may hinder the extent of the equity rally.

A soft landing is to be welcomed. The equity ‘ticker tape’ parade may, however, be underwhelming.

Sourced from:

Photo by iStock