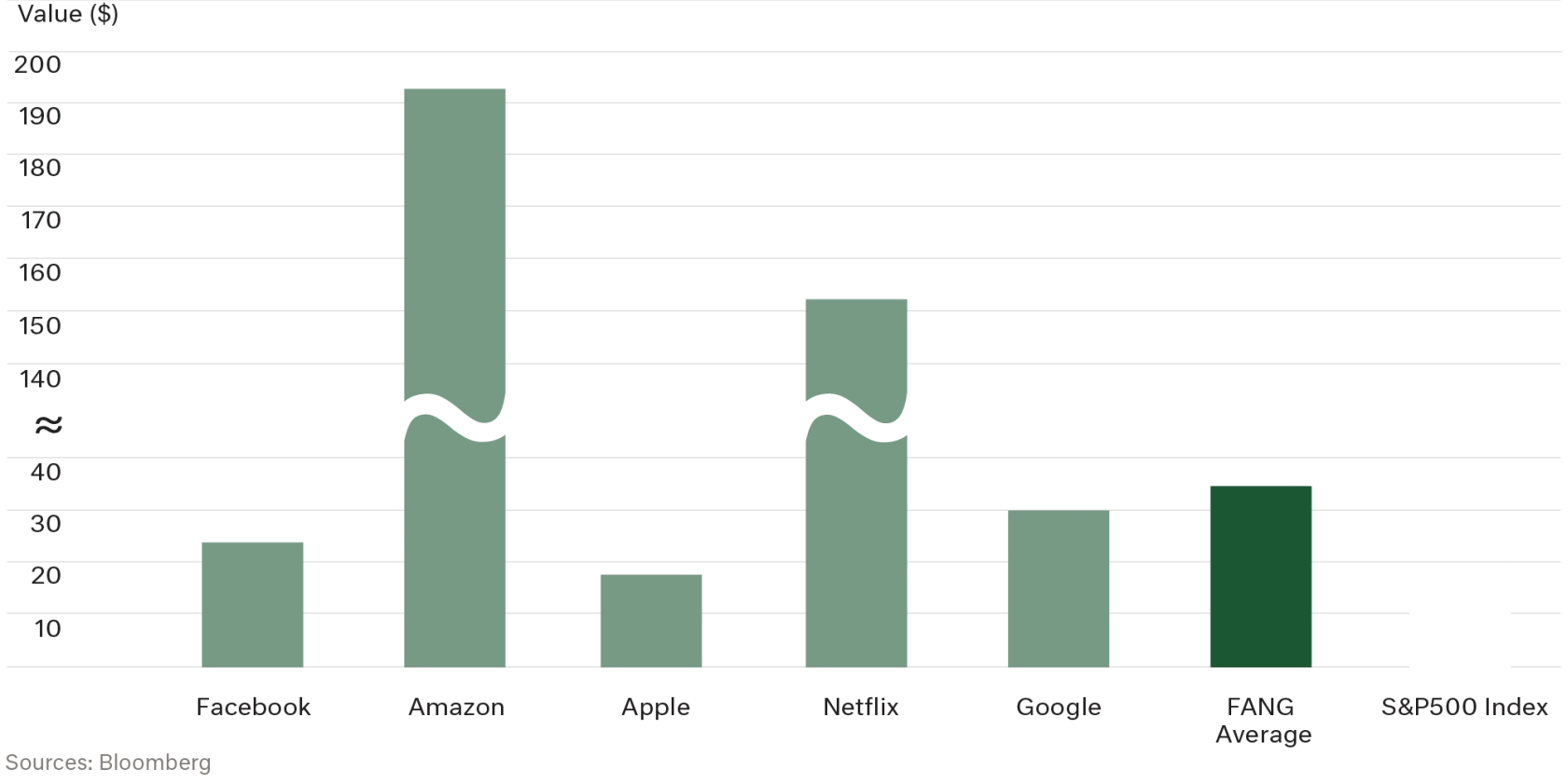

The FANG (Facebook, Amazon, Apple, Netflix, Google) cohort of companies are unquestionably (tech) powerhouses of our times. They trade on a forward weighted PE ratio of 36.9 times, compared to 20.8x for the broader S&P500 Index. The growth rates implied in this multiple assume 43% compounded EPS growth over the next 10-years – that assumes fairly straight line ‘plain sailing’. We like a lot of the FANG business strategies, it is just the valuation and future business performance assumptions we find difficult.

Some FANG’s are indeed ‘long-in-the-tooth’, Apple established in 1976 and listed in 1980 is now over 40 years old. Last week it reached US$1 trillion in market capitalisation, and more meaningfully it today generates profits of $60 billion or 0.28% of US GDP. It is a remarkable success story born out of innovation, determination, ruthlessness, failure, near bankruptcy, and a fair amount of luck. The point is, it was certainly no straight line to success. Going forward, success will definitely be no straight line either.

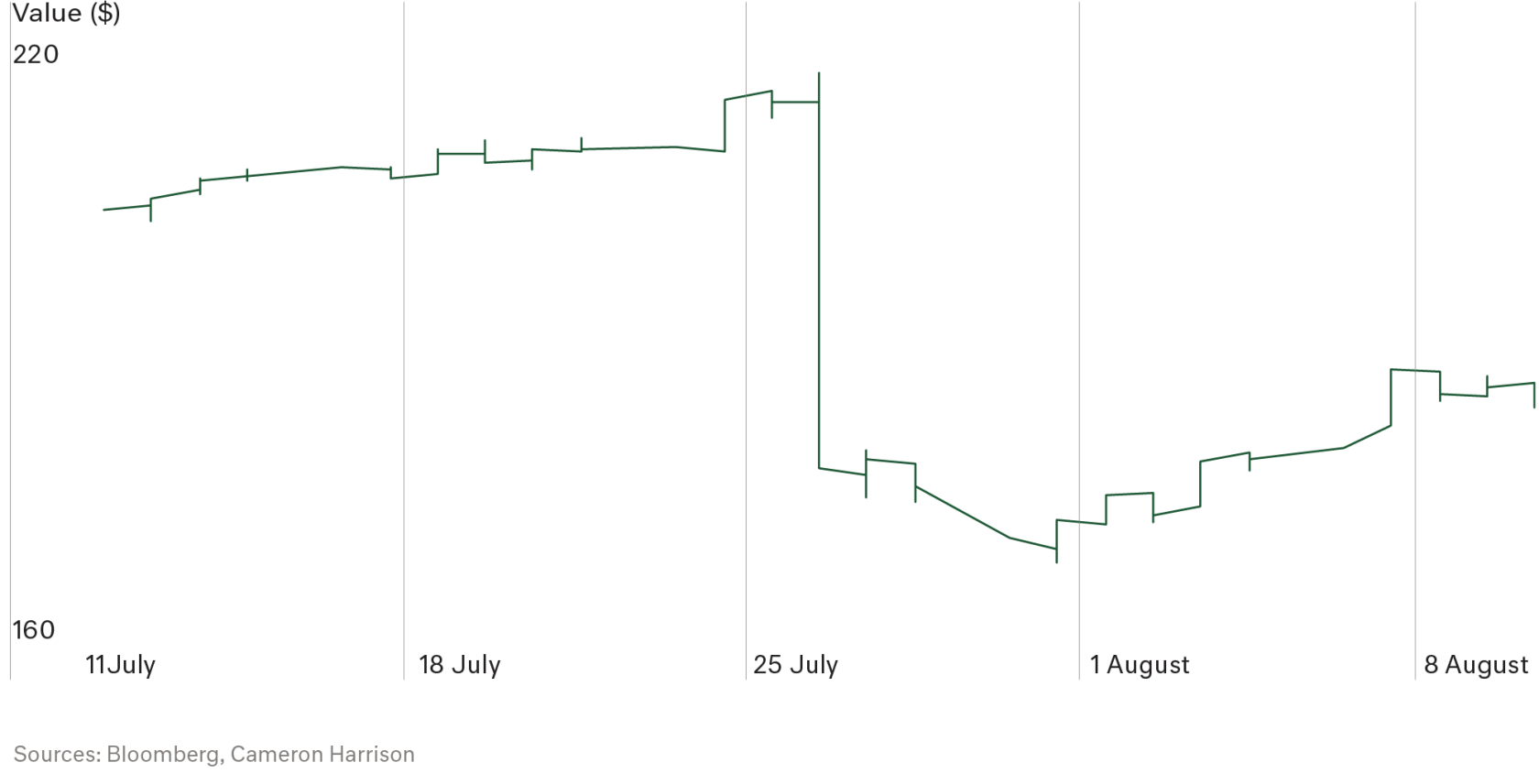

The recent mini-capitulation of two of the fabled FANG stocks (Netflix and Facebook), both down over 25% in the past few weeks (though still up 99% and 7% respectively over the past 12-months), is a timely reminder that the ultimate purpose of a company is to make profits. FANG stocks have embarked on an unprecedented capital expenditure splurge, in a winner takes all arms race for subscribers/users, with profits seemingly unimportant to management.

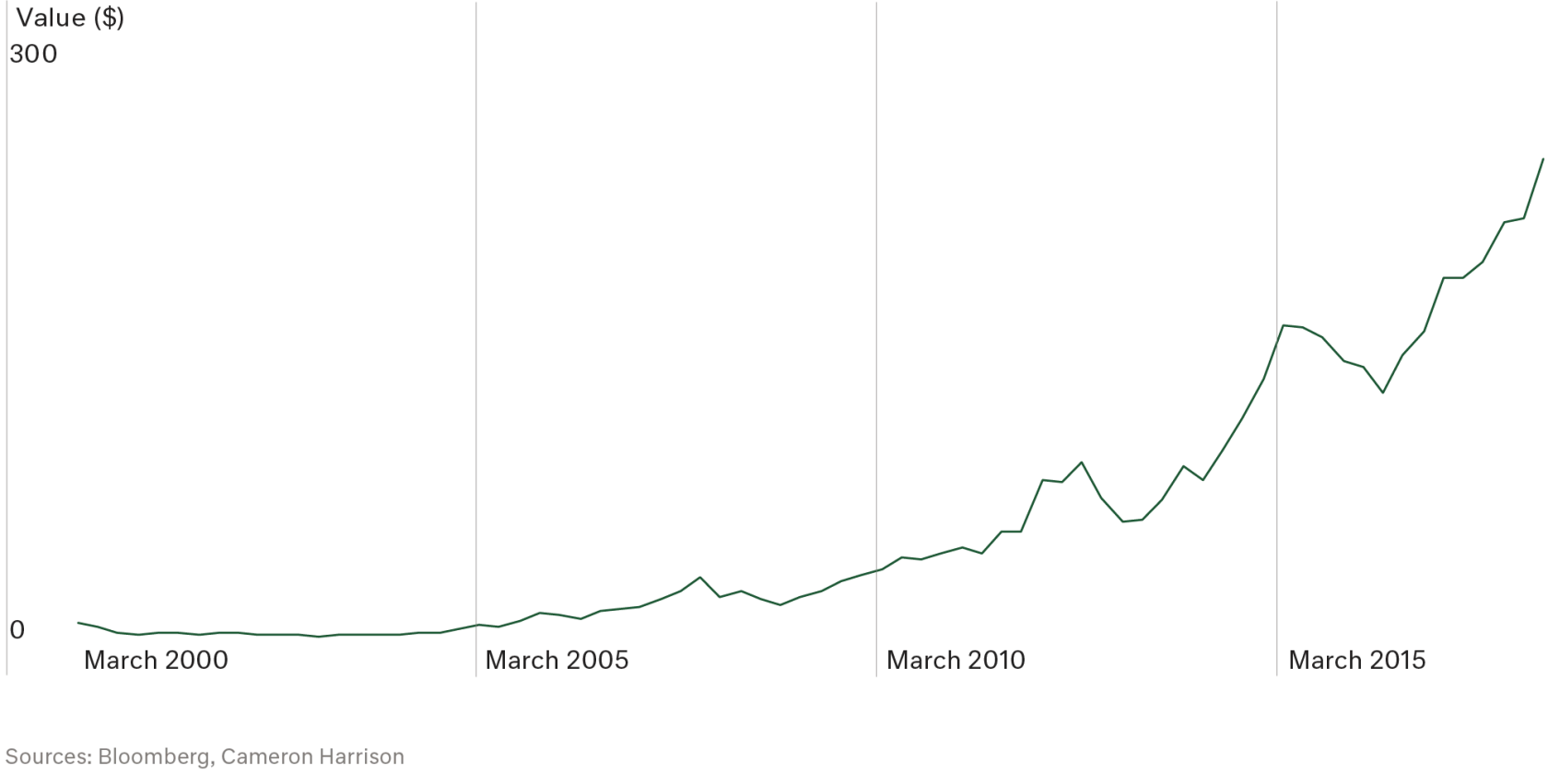

Despite all the noise surrounding the FANG cohort over the past 12 months, Cameron Harrison’s US Equity Portfolio has returned over 27%, with less than half the volatility. It is this considered stable approach based on surplus net operating cash flow that will deliver long-term benefits to investors.

When Cameron Harrison selects a new investment, we are seeking companies that we would be happy to own in 5-years’ time. These companies are assessed against both our quantitative and business quality framework, evidencing a disciplined and focussed management team, generate free cash flow with sustainable profit margins and have low amounts of leverage. Most importantly, they have cash profit that can be distributed to investors and they are reasonably valued, unlike the astronomical PE ratios of Amazon (190x) and Netflix (150x).