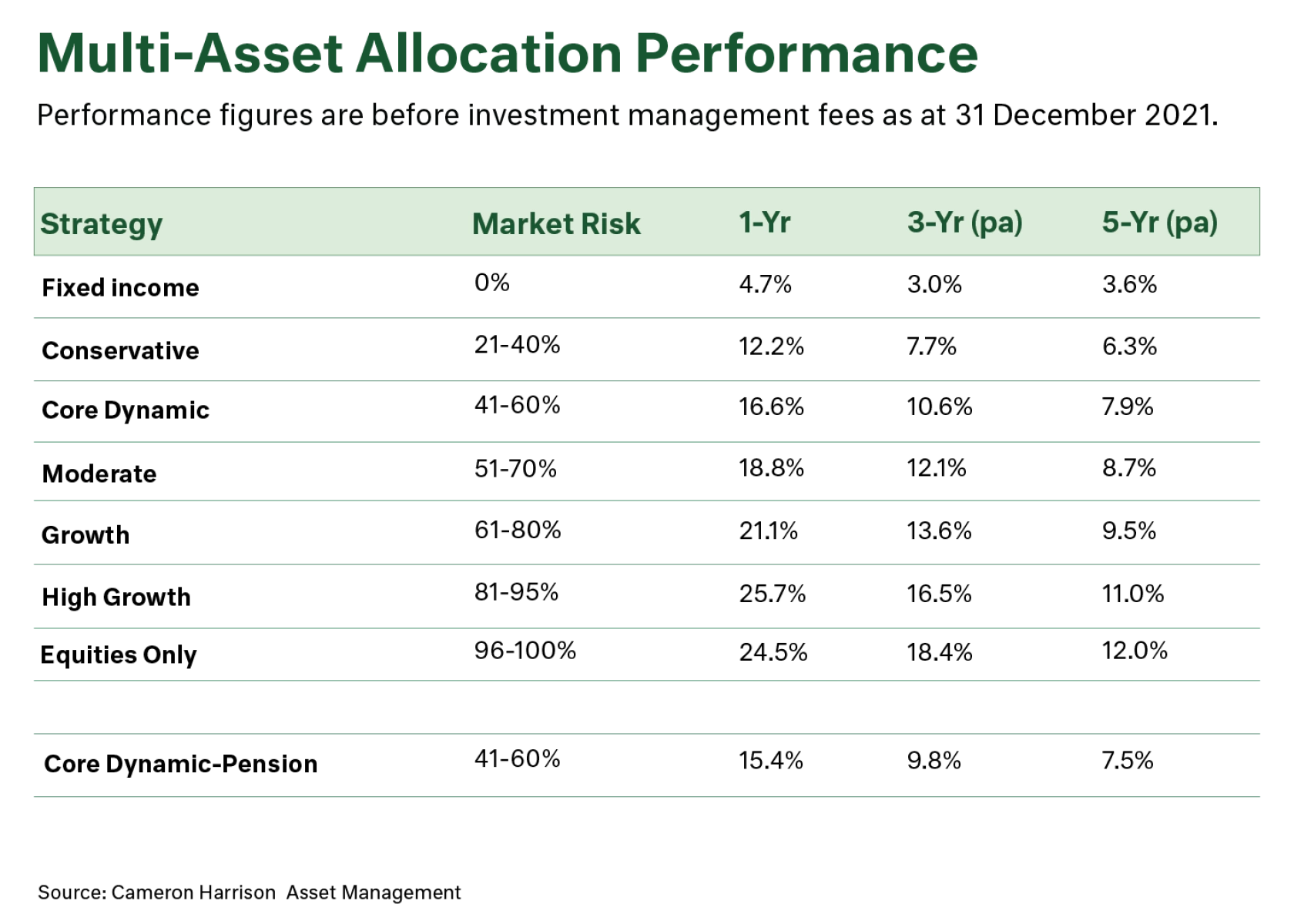

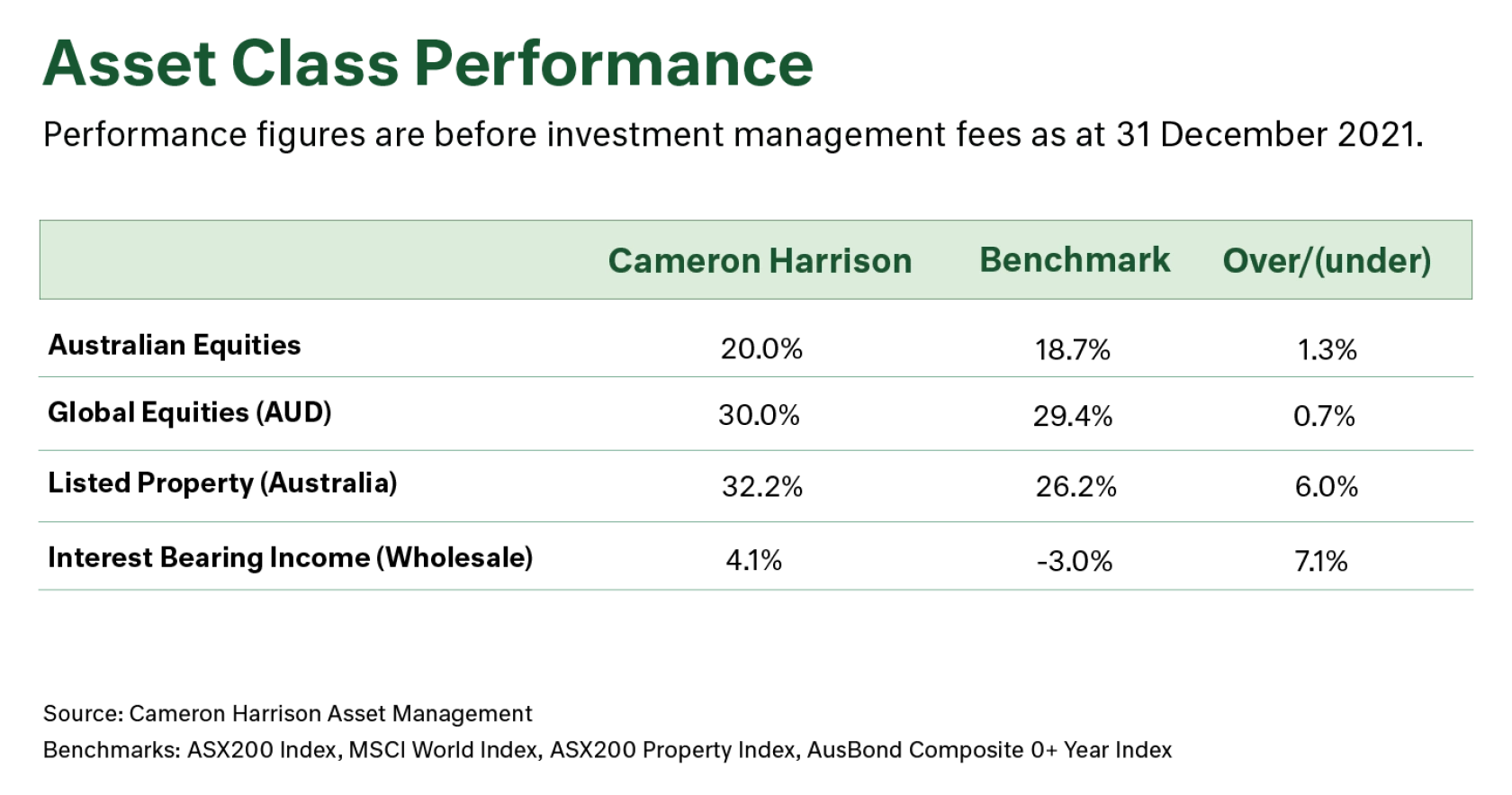

Cameron Harrison is pleased to provide a summary of investment performance for the year ending 31 December 2021. This covers both our multi-asset allocation strategies and individual asset class strategies. The results reflect strong performance across all investment timeframes from short-term (12 months) and long-term (3 years and 5 years).

As private investment managers to families, business owners and not-for-profit institutions, our investment management team have a performance track record that spans over 21 years; a unique position in wealth management in Australia. This demonstrated performance track record underscores Cameron Harrison’s core value set of transparency and accountability.