Strategy: If you are aged 60 years and over, you are probably aware that any amount you withdraw from superannuation is tax-free, but did you know the same is not necessarily true after you pass away? Every superannuation balance is categorised into tax components; the two most common being ‘taxable’ and ‘tax-free’, and the proportion in each of these components will determine how much tax your nominated beneficiaries will pay when inheriting your superannuation. This is a crucial but often overlooked factor in superannuation and estate planning.

If your nominated beneficiary is your spouse or a dependent (for example, a child under 18 years of age), your superannuation balance will always be paid to them tax-free, even if 100% of your balance is made up of a taxable component.

If your nominated beneficiary is not a dependent (for example, you nominate an adult child), the underlying components of your superannuation determine the tax. The proportion of your balance that sits in the tax-free component will be paid to your non-dependent beneficiary as the name suggests: tax-free, but the proportion that sits in the taxable component will attract tax of 17%.

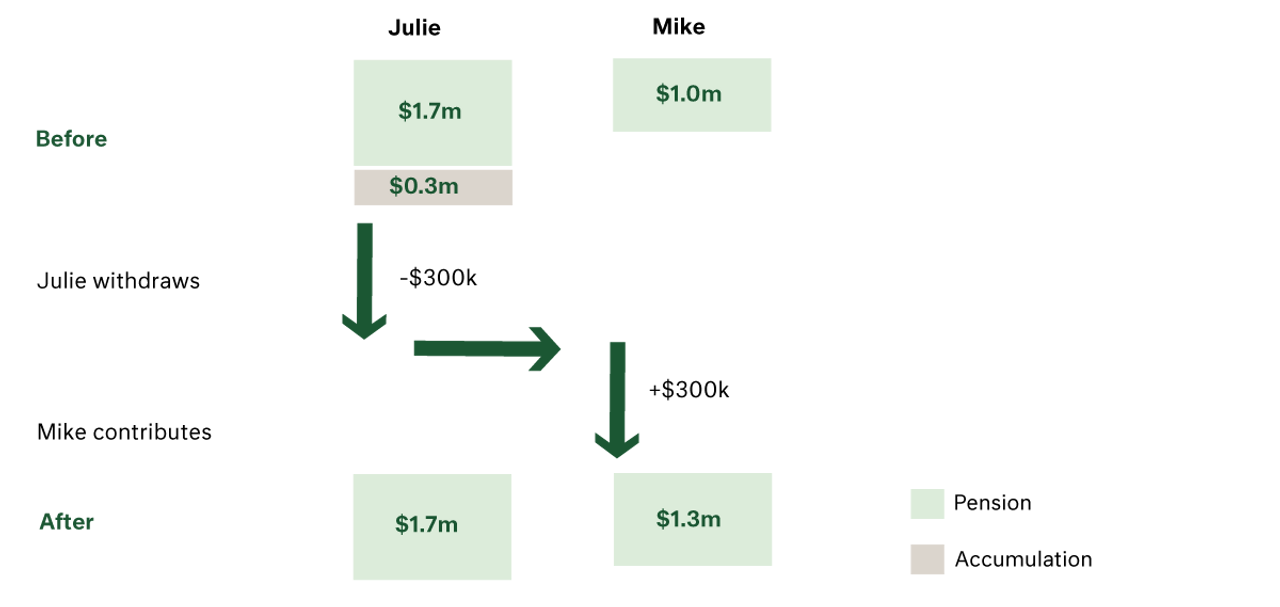

To minimise the tax paid by your beneficiaries, the objective is therefore to maximise your tax-free component. This can be achieved through a ‘recontribution strategy’ whereby existing superannuation monies are withdrawn and recontributed as a Non-Concessional Contribution (NCC), which are treated as additions to the tax-free component.

An example

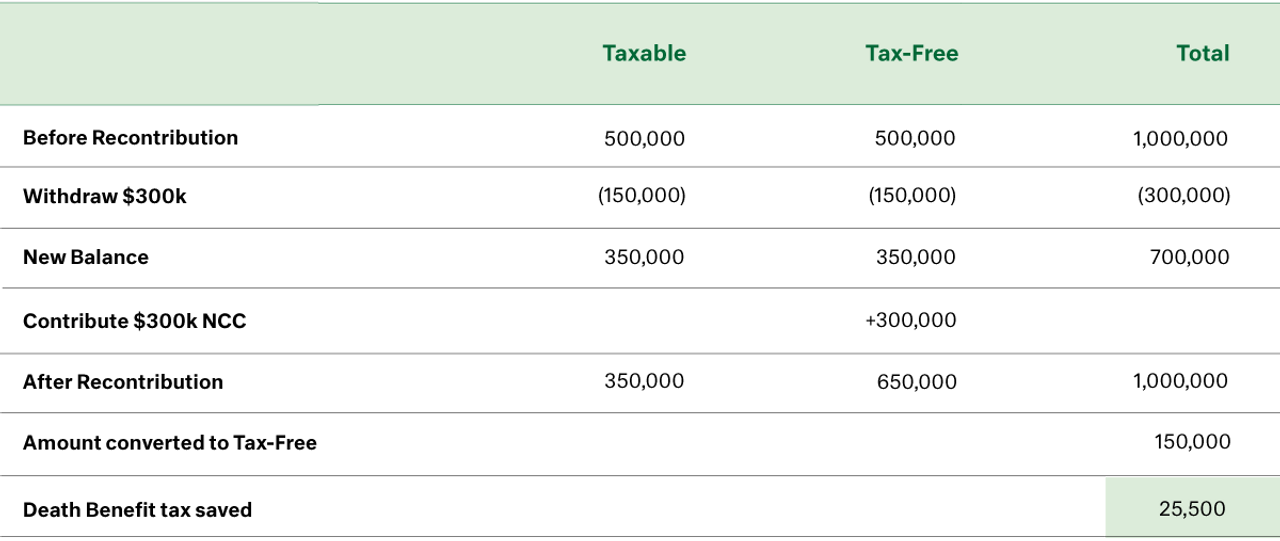

Say you have a balance of $1 million; a $500,000 taxable component and a $500,000 tax-free component (50%/50%). You wish for your superannuation to be paid to your two adult children on your passing. Assuming you have met a condition of release, you could withdraw $300,000 which is treated as a proportional 50%/50% reduction in tax components. This leaves a balance of $700,000 made up of $350,000 in each of the taxable and tax-free components (50%/50%). You could then recontribute the $300,000 as an NCC, returning your balance to $1 million. However, an NCC is always a tax-free contribution, so your post-recontribution components are now $350,000 taxable and $650,000 tax-free (35%/65%). This example shows that without reducing the total funds in superannuation, a recontribution strategy has converted $150,000 from a taxable component to a tax-free component, reducing the potential ‘death benefit tax’ by $25,500.