Easing lockdowns

As we noted earlier in 2022, China’s lower number of hospital beds per capita, lack of an mRNA vaccine, and lower vaccination rates has inhibited their reopening in 2022. Whilst many of these challenges remain, the balance from policy makers has shifted to a pro-opening stance to reduce the negative economic impact.

The timing of the reopening will be dependent on a scaling up of medical preparation but it is likely to start in the second quarter of 2023. We expect that China’s pathway to reopening will be a stop and start process similar to the experience of Taiwan, with Covid cases surging due to lower prior infection and vaccination rates, leading to mobility restrictions and likely production issues (worker absenteeism).

The relaxation of restrictions is a positive step forward for Chinese growth, albeit with a short-term drag, that should drive above-trend consumption growth in the second half of the year as pent-up demand enters the market.

No Inflationary Pressures

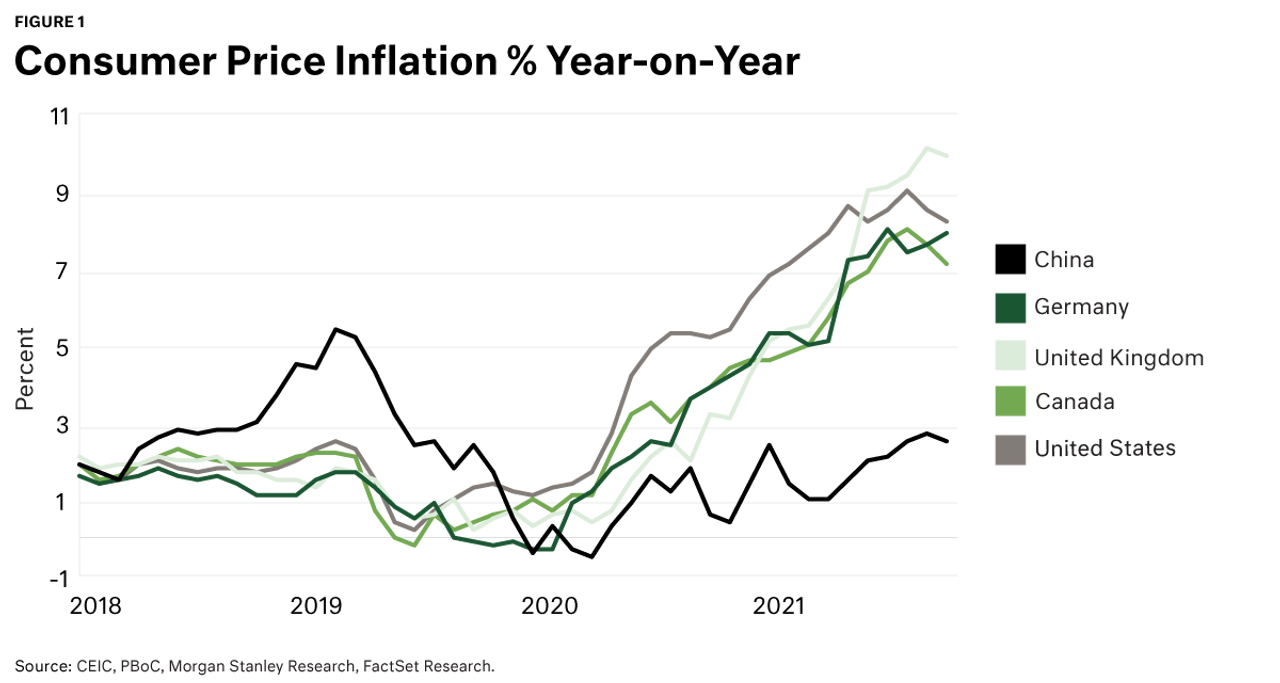

As a major exporter of goods to the world, China has been largely immune from the supply-chain inflation that impacted global economies during Covid. This, coupled with its non-participation in the Russian oil embargo and extended lockdowns has kept inflation relatively low at 2.1%.

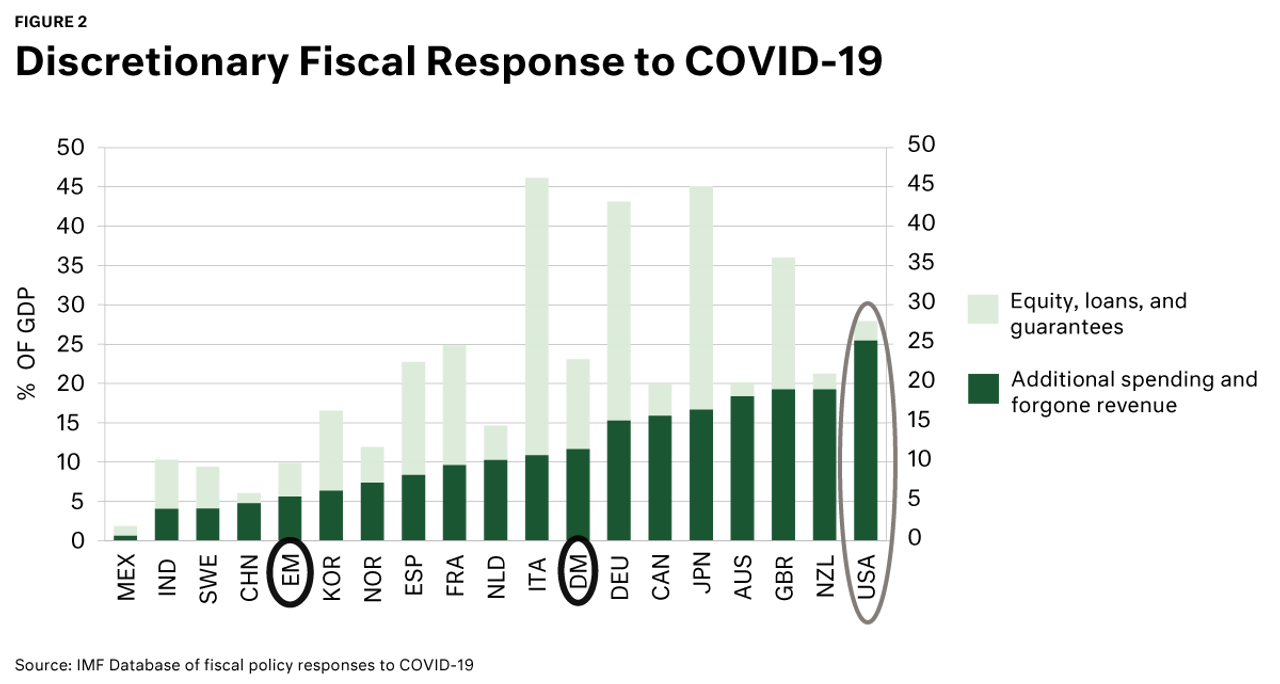

Consequently, China is at a very different point in the economic cycle to developed world economies with the ability to deploy additional fiscal and monetary stimulus to support the economy during its (likely) stuttering reopening. Using credit impulse as a proxy for monetary policy, we can see that the tighter restrictions in 2020 were relaxed at the end of 2021, and this is expected to flow through to the real economy as it reopens.