Official Cash Rate cut: As expected, the RBA used its final conventional monetary policy 'bullet' and lowered the cash rate to 0.25%. This is effectively the lower bound for monetary policy given previous statements on the ineffectiveness of negative rates (though we do not rule out negative rates).

Quantitative Easing (QE): The RBA will now start buying government bonds in the secondary market to fix the three-year Australian Government Bond rate at ~0.25%.

Funding for SMEs: Authorised Deposit-Taking Institutions (ADIs) will be able to access three-year funding from the RBA at a fixed 0.25% per annum on all loans to businesses, especially small and medium sized businesses. For example, for every extra dollar of loans to SMEs, the ADI will have access to an additional $5. This window is designed to remain open until the end of September. The funding access is ear-marked for at least $90 billion.

AOFM $15 billion fund: The Australian Office of Financial Management (AOFM), in co-ordination with the RBA, will provide $15 billion for non-ADI and ADI lenders through the securitisation markets. The collateral is broad covering mortgages, asset-backed security and SME lending. This supports the RBA which is precluded from operating in these significant financing segments. Again, preference will be given to those institutions who grow their lending.

Reciprocal Currency Agreement: The RBA and US Fed have established a US$60 billion swap line to provide US dollars in exchange for Australian dollars. The deal has been mirrored by a number of other central banks and can be seen as supporting access to US dollars as part of a wider strategy to provide order to debt and credit markets.

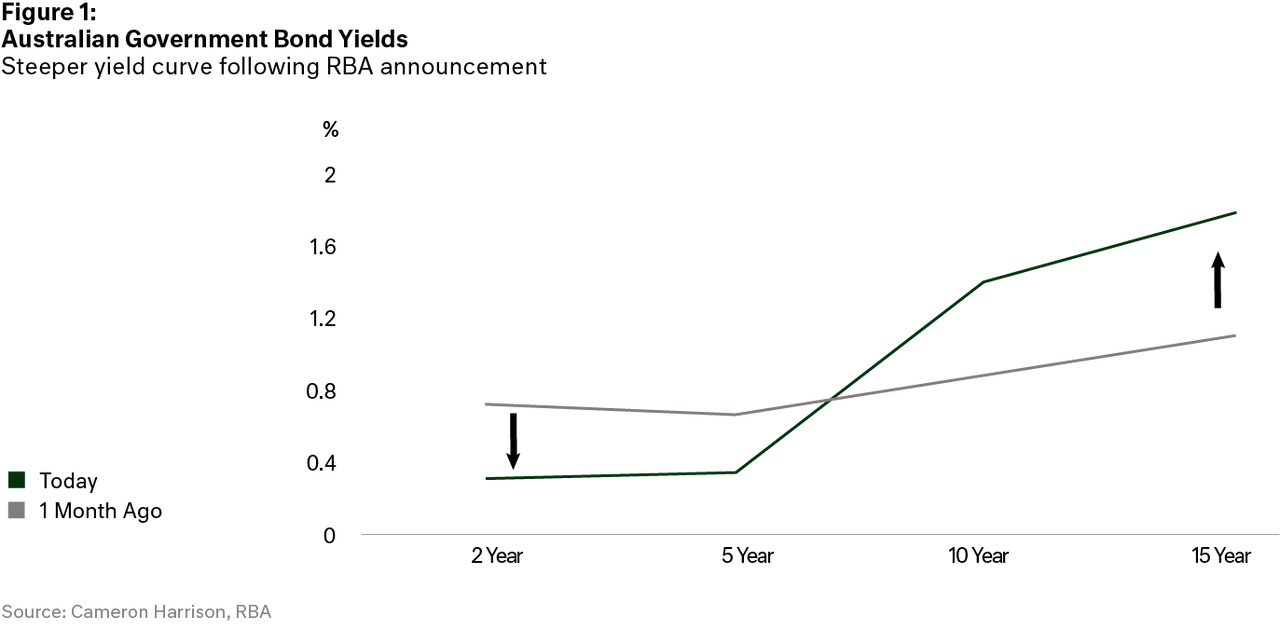

The announcements had an immediate and significant impact on rate markets, with government bonds of duration's above 5 years selling off (yield increasing) in favour of shorter dated bonds. The net effect is a steepening of the yield curve, see Figure 1 below.

The world is now (again) awash with cheap money as central banks globally loosen monetary policy in a concerted, synchronised manner. However, the key medium-term measure of policy success for governments and regulators will be avoiding a brutal economic shock that decimates businesses and jobs. The macro measures here are the unemployment rate and economic growth. At the enterprise level, it is revenue and cashflow which will also require substantially more fiscal stimulus.

We expect to see further announcements of fiscal support for the economy next week, with an expansion of the $20 billion package to at least $85 billion. Ultimately, we think the government will provide stimulus of $100 billion to $120 billion which equates to up to 6% of GDP. This would be direct stimulus spend, which then needs to be combined with lost tax receipts now and for at least the next two years. The total cost to the Federal budget is likely to reach upwards of 15% of GDP (assuming a modest virus infection rate). The States' finances (GST, stamp duty and infrastructure spending commitments) are a separate (and very concerning) matter altogether.

Beyond the immediate crisis, the funding curve up to three years is deliberately very attractive and depending on duration of the health crisis, support and stimulus for risk assets. Further, the RBA has anchored itself to a cash rate of 0.25% stating that this position will remain until 'progress [is] made toward full employment and that [they are] confident that inflation will be sustainably within the 2-3 per cent range' (Philip Lowe, RBA Governor, 19 March 2020). This will take us to at least late 2022/2023. We view both the three-year curve and cash rates as being very supportive for a significant period to come.

Cameron Harrison have been advising business owners and their families on asset allocation and intergenerational wealth management for over 50 years. We have demonstrated over a long period our ability to manage investments through both the good times and bad by keeping the client at the centre of our business.

For more information on our approach to investment strategy or any other inquiries, please contact us on +613 9655 5000.

Sourced from:

Photo by Mitchell Luo