The structure of the financial system could not be more different today to 30 years ago – back then an adolescent financial deregulation, to today as a fully integrated participant in the western financial order. We see that much has been observed and learnt in monetary policy setting, but central bankers exercising their hard-won independence retain a stubborn hubris. This hubris is at odds with careful examination of data and its analysis, and an erring for caution in their pursuit of their core objective of moderate inflation.

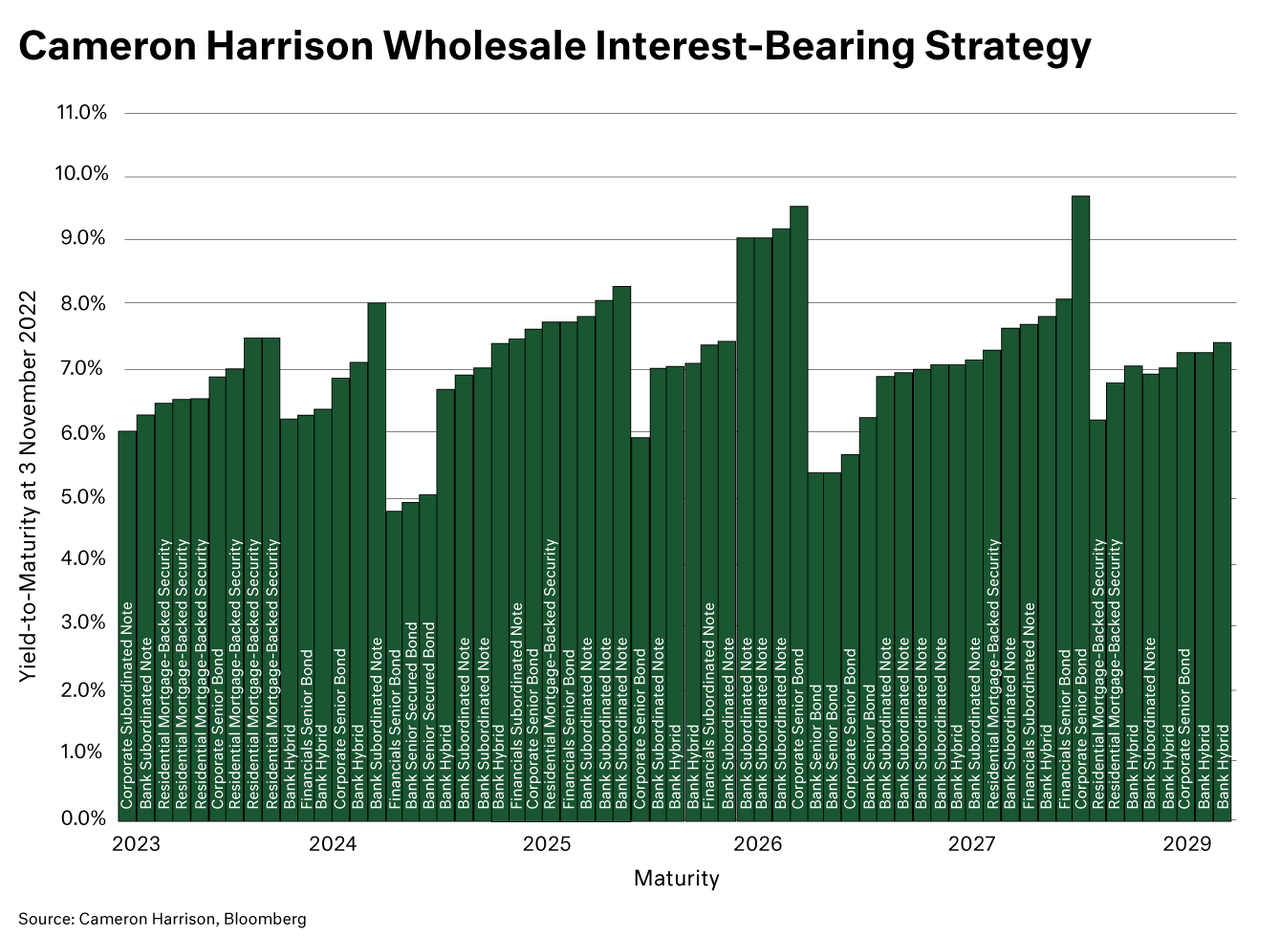

Ours is an approach to interest bearing strategy which is acutely economically focussed strategy, representing over 30 years of careful management of interest rates and the business cycle. The result is a focus to produce sustainable income returns which adapt to the inflation outlook whilst being exposed to a diversified pool of highly rated and quality risk exposures.