The Cameron Harrison Australian Equity Strategy operates across three allocation themes of large cap, mid to small cap and financials. This provides discrete and dynamic allocation, particularly given the skews that exist in the Australian equity market. Our purpose is to generate a consistent balanced long-term return, combining income through dividends and capital growth. We achieve this through investing in listed businesses that exceed in terms of financial health and our ‘business success framework’ which evaluates strategy and its effective delivery. Our equity management operates within an overall framework of risk amelioration which ‘underpins’ the primary hallmark of capital preservation.

The key factor driving asset class returns in 2023 and into 2024 is central bank tightening to curb inflation. Bonds have performed very poorly whilst equities in relative terms have performed better. Our view for the Australian economy is that the economy will go into recession in 2023. We think signs of economic pullback will become evident in early 2023. The household sector is now in significant restrictive economic territory and increases in unemployment will begin to be observed (but without the severe job loss pain of the early 1990s). The shift in restrictive policy will begin in 2H2023. It is an environment for bond yields to decline and equities earnings to come under pressure. We do stress however that whilst we do see central banks getting on top of inflation, inflationary pressure and a higher level of interest rates than otherwise existed over the last 12 years will exist.

Earnings estimates we view are too optimistic. We expressed this view in ‘Have equity markers skipped the earnings revisions?’ (Aug 2022). Whilst there have been moderate declines in estimates, markets certainly favour a benign economic contraction. Whilst we think that is true for absolute levels of labour, the domestic economic environment led by the household stands to deteriorate significantly through 2023 impacted by a reduction in house value wealth and constricted finances.

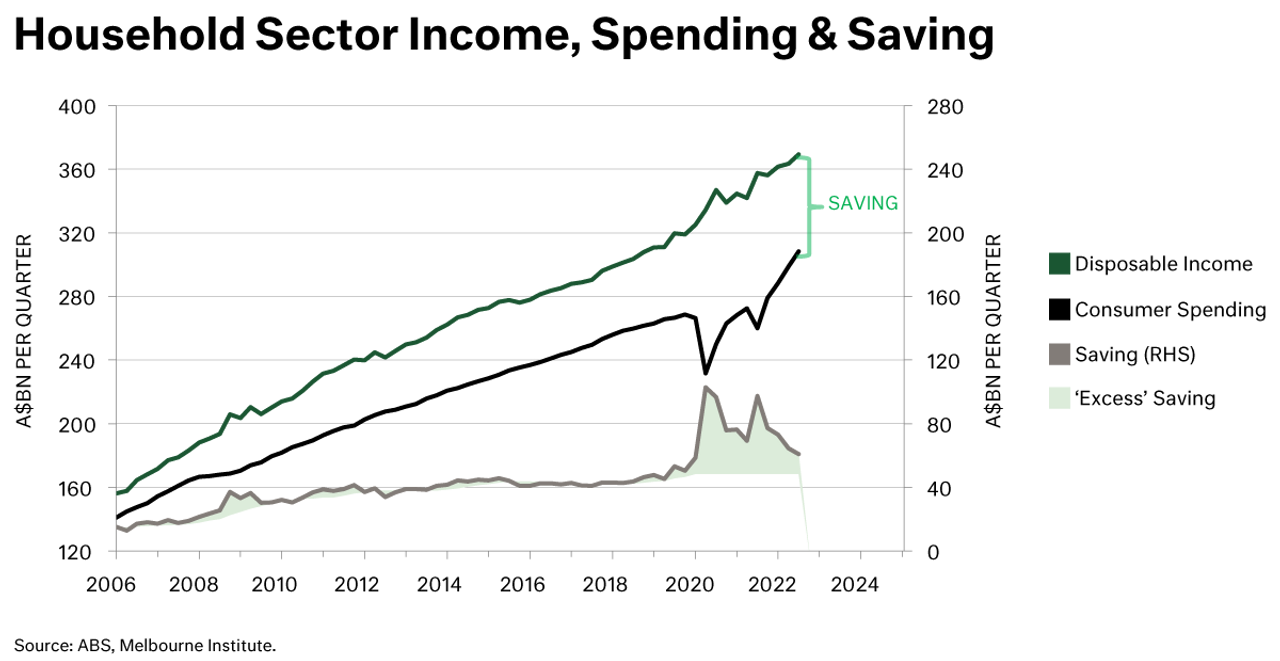

Even before the lagged impact of mortgage rate increases has taken effect, we can see below that the bounce back in real spending from COVID has been funded by savings drawdown. The combination of savings drawdown and negative real wages growth in combination is a drag on activity and illustrates households’ spending rates are approaching a decline as savings are dissipated. This is important to moderating Domestic Final Demand which was running at 6.9% for the 12 months to 30 September 2022.