This article is a transcript of a webinar held by Cameron Harrison on 23th July 2020.

— Watch the recorded session here.

— Download the presentation here.

In this brief webinar format, share our thoughts on Global Equity Strategy and more particularly, the global equity market and how we are positioned particularly in light of the drive and momentum of the FAAANM stocks and technology more broadly.

Our purpose today and as always is to be forward looking, but cognisant that past episodes and behaviours are instructive. Having been managers for over 30 years we are well aware that human behaviour repeats itself and therefore has a certain predictability about it. Let's consider the current circumstances.

Is a harmful virus or pathogen new to mankind? No

Is the world and the world economy as interconnected as it ever has been? Yes

Are humans generally short term in their focus and measurement of outcomes? Yes

Have governments around the world ever had to concurrently address a pandemic in an interconnected world? No

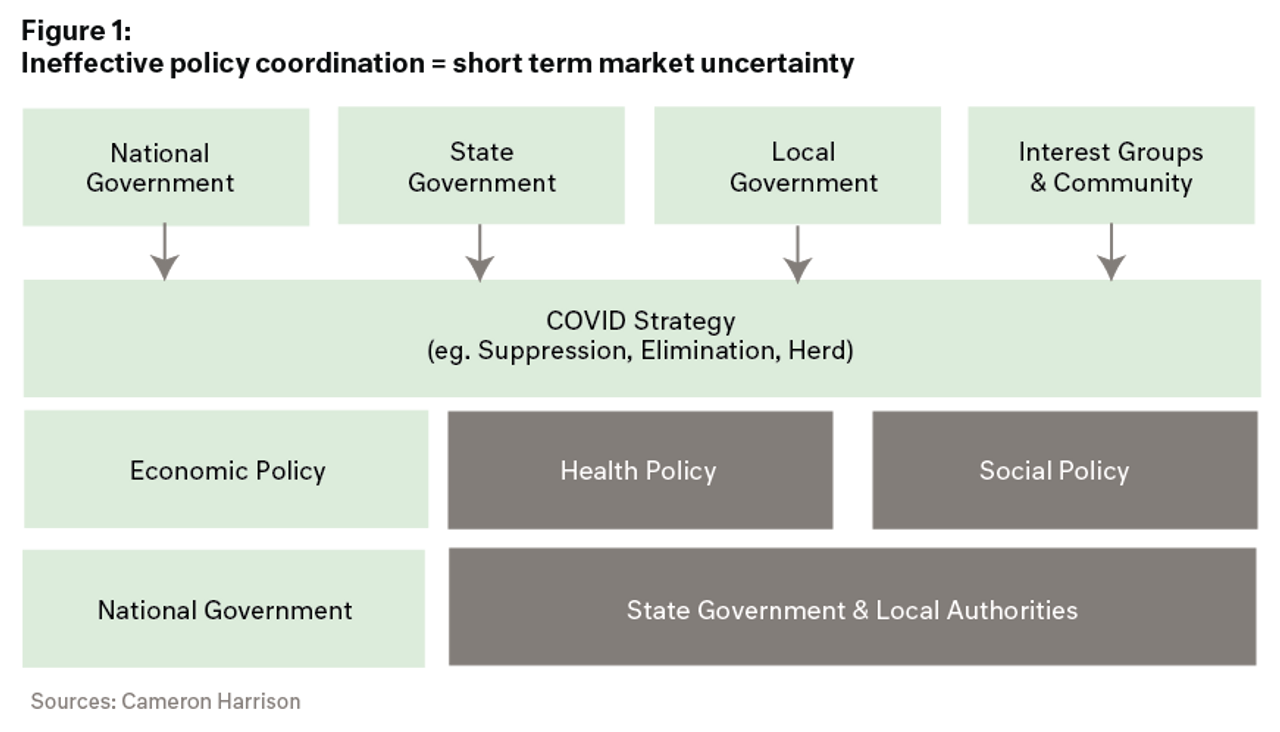

#1 Ineffective policy coordination = Short-Term market uncertainty

Over the medium term, COVID will eventually be addressed and managed - but probably not in a timeframe most hope for. Therefore, resolution will not be a smooth line but rather, messy, at times hopelessly uncoordinated, but with each step or misstep we learn a little more.

We note this not to dispel the significant short-term challenges ahead but to provide some realism to the medium-term path ahead. As for the magic bullet of a vaccine, we noted in our early May webinar on Investment and Economic Strategy Beyond COVID Suppression (read more about this webinar), our base case is that no effective vaccine is developed. Since then, our optimism has slightly improved but not sufficient for us to alter our base position. This means we need to live with this coronavirus and formulate effective, integrated policy which addresses and integrates economic, health and social policies.

The ability of governments around the world and within individual countries to concurrently and effectively address pandemic responses across health, social and economic policies is proving to be problematic.

On the positive side, probably due to the experience of the GFC, leading western economies have responded impressively with their economic measures across monetary policy and fiscal policy. This demonstrates a learned policy response. We would contend that economic policy is easier to manage because the major levers of monetary policy and fiscal policy are controlled by a national government whereas to integrate health and social policy tends to be the responsibility of state and local governments. We see this strain playing out in Australia and the US and in contrast, is less evident in Sweden and Germany.

#2 Economic Policy

The global economic policy response to COVID and policies of suppression, elimination or herd immunity have been marked and impressive by western, developed economies, and notably the United States.

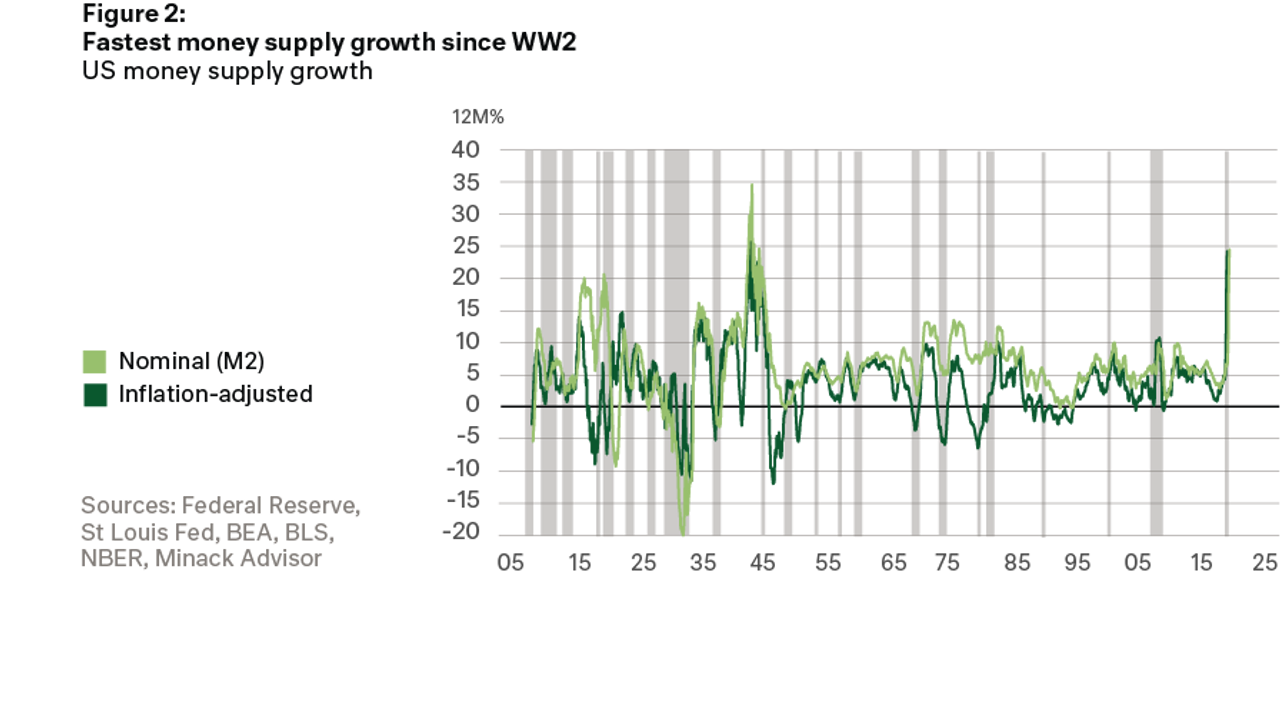

This brings us to second point: The response of central banks in concert with governments has seen both unparalleled liquidity and fiscal spending. From a liquidity perspective, we can see that money supply growth is at war-time levels. In the US alone there are some 16 different liquidity programs on foot. This has provided financial markets with significant liquidity and we particularly see this reflected in credit margins returning to more normal levels. The Federal Reserve has provided an ‘all it takes’ implicit guarantee. It’s a bit like surfing a wave knowing you can’t really fall off or hurt yourself. Given that there weren’t really any serious risk buildups in the financial system coming into COVID, this very generous liquidity provision is supportive for markets.

Like monetary policy, the response of government spending through fiscal policy has been both rapid and world war in size. A key point to emphasize here is the speed of policy implementation. Unlike the GFC where government spending in the US and Euro region took over 12 months to really get going, the COVID response has been rapid and gargantuan in size. This is a significant learned response providing significant stability in household and business income whilst suppression strategies are employed.

We can see in Figure 3 below, the dark green line the massive expansion in the US Government deficit from $1 trillion to $3 trillion. What is significant is that the Federal Reserve has expanded its balance sheet in a similar size, largely acquiring US Government Treasuries. We can see the Federal Reserve’s balance sheet expansion in the light green line in Figure 3.

This is what we call an unsterilized increase in the money supply which sees the government’s spending financed by bonds which the Federal Reserve is acquiring by increasing its balance sheet. This is very potent, powerful and stimulatory for the present. We do caution, however, that whereas the Federal Reserve can create its own evergreen policies, US spending is time-limited by Congress & the Senate. Getting Congress and the Senate to agree to new spending, especially going into a Presidential election year is highly unlikely. Our base case is that substantial government spending will be required well into 2021 especially if rolling shutdowns in activity persist.

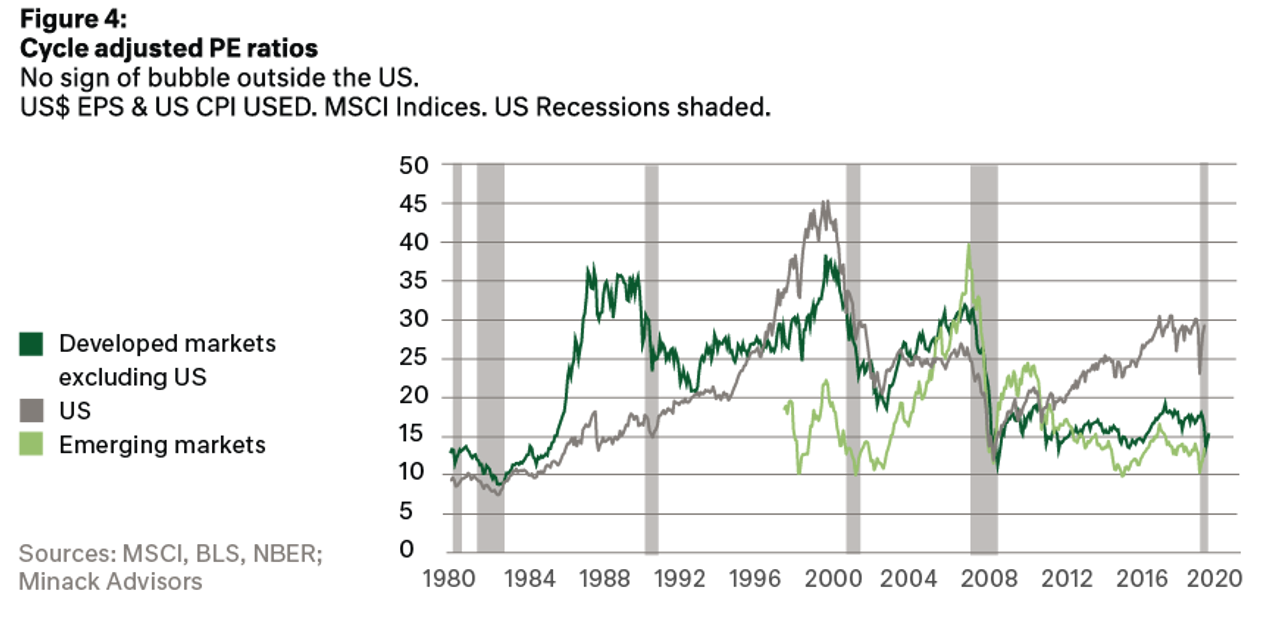

#3 Equity Market Valuation

How does this look in global equity terms?

In cycle adjusted operational earnings terms or the CAPE measure of PE valuation, equity valuations look quite reasonable. Yes, the short-term earnings prospects look very poor but valuations other than the US appear to reflect this over a 2+ year basis. In the US, valuations on a cycle adjusted basis are high. In many respects, this is partly justified for the US due to its economic growth engine, robust financial system and household good health. That said, a more discrete dissection of the US equity market does provide a clearer picture and an insight into the FAAANM market and the broader equity market.

#4 US Equities – FAAANM

Here we see the dichotomy between the so-called FAAANM stocks which are represented by the grey line in Figure 5. The price performance and valuations are significant. In the light green line we see the S&P500 minus the six FAAANM stocks. Together with other developed economy equity markets the price performance for the broad US equity market ex the FAAANM’s is much the same as the rest of the world, and as we saw on the previously on Figure 4, valuations on a cycle adjusted basis quite reasonable.

This brings us to the issue of investment into technology and questions like:

— Is technology better pursued on a business to consumer basis or a business to business basis?

— What are reasonable valuations and how long can price to sales valuation be justified?

— When ultimately is it earnings and dividends to shareholders that matter in the long run?

Shutdown Drives Divergence

US technology stock and in particular FAANG stocks have certainly captured a lot of attention recently and the reason is clear when you look at the performance of these companies versus the wider market.

A slightly different way of viewing the performance of the FAANGS is to divide the market into three groups, FAANG stocks, companies in sectors significantly impacted by COVID (airlines, departments stores, casinos, etc) and then all other companies.

Figure 6 demonstrates that these Technology stocks have become the unlikely defensive allocation throughout the pandemic, with their value now approximately 20% higher than the beginning of the year. In contrast, companies in shutdown exposed sectors are still 40% off the start of the year.

The performance has grabbed a lot of attention and headlines, but before we dive into whether to FAANG it or Not?, let’s look at the drivers.

1. Immunity from COVID-19.

FAANG have emerged as a proxy for the stay-at-home economy.

At a visual level, it seems that these companies are immune from the impacts of COVID-19 related shutdowns, as people settle into a life structured around greater time indoors and at-home, consumer technologies, streaming and delivery occupy a greater proportion of our attention. As a result, many investors have used them as a proxy for the stay-at-home economy.

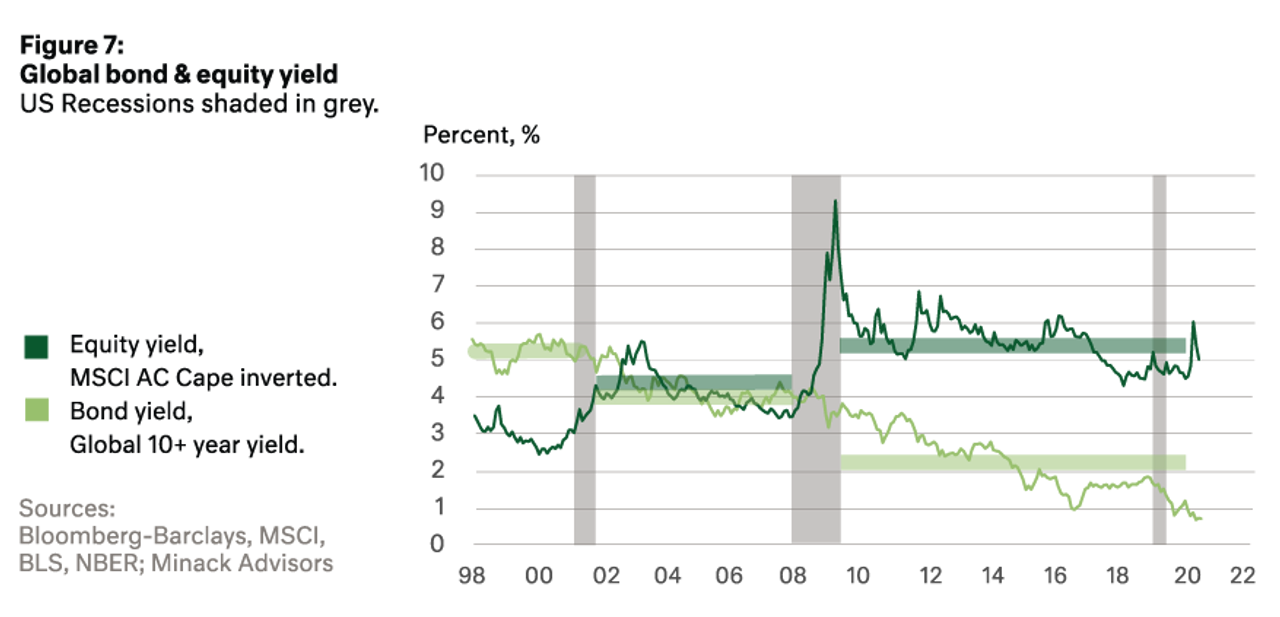

2. Lower Interest Rates

To avoid a depression type event, rates have been cut to near-zero.

We have seen rates slashed to near-zero or below. In the bull market preceding the pandemic, it was common to hear that risk assets have re-rated due to falling interest rates. Whilst, this is true of bonds, and other assets with very stable, resilient cash flows (for example residential property and utilities). At an aggregate level, this has not been the case for equities.

As Figure 7 demonstrates, we have the average equity market yield in the dark green and the bond yield in light green. We have seen the yield on bonds steadily fall from one cycle to the next as prices have risen. We do not see the same trend for global equities as a whole. The reason being, that the economic conditions that produce low rates are also seen as headwinds for corporate earnings.

3. Secular Growth Credentials

Ability to generate earnings growth, regardless of the cyclical economic environment.

The exception to this and the third reason behind the performance of FAANG stocks, is secular growth - earnings growth that is independent of wider economic conditions. For the moment, the earnings of these companies are forecast to grow regardless of the economic cycle. With the inherent thinking that no-matter what the shutdown looks like we will continue browsing Facebook on our iPhone while also watching Netflix and Googling everything, we need to have it delivered the next day through Amazon Prime… It goes without saying that we think the danger lies in this assumption.

4. FOMO / Irrational Behaviour / Robinhood Investors

It has been the increased activity of retail investors since the start of the crisis. With retail account openings running at 3 to 4 times the normal rate. The exact reason for the increase in retail investors is not precisely known but is likely a combination of more time at home on a computer, the rise of brokerage-free trading through companies such as Robinhood and finally more time on people hands.

Even it is not strictly a FAANG or technology stock, Tesla ‘the car marker’ helps to illustrate some of the irrational exuberance that has crept into the trading of some stock. Tesla’s share price is now double the start of the year and it trades on a PE ratio of 10,000 times earnings.

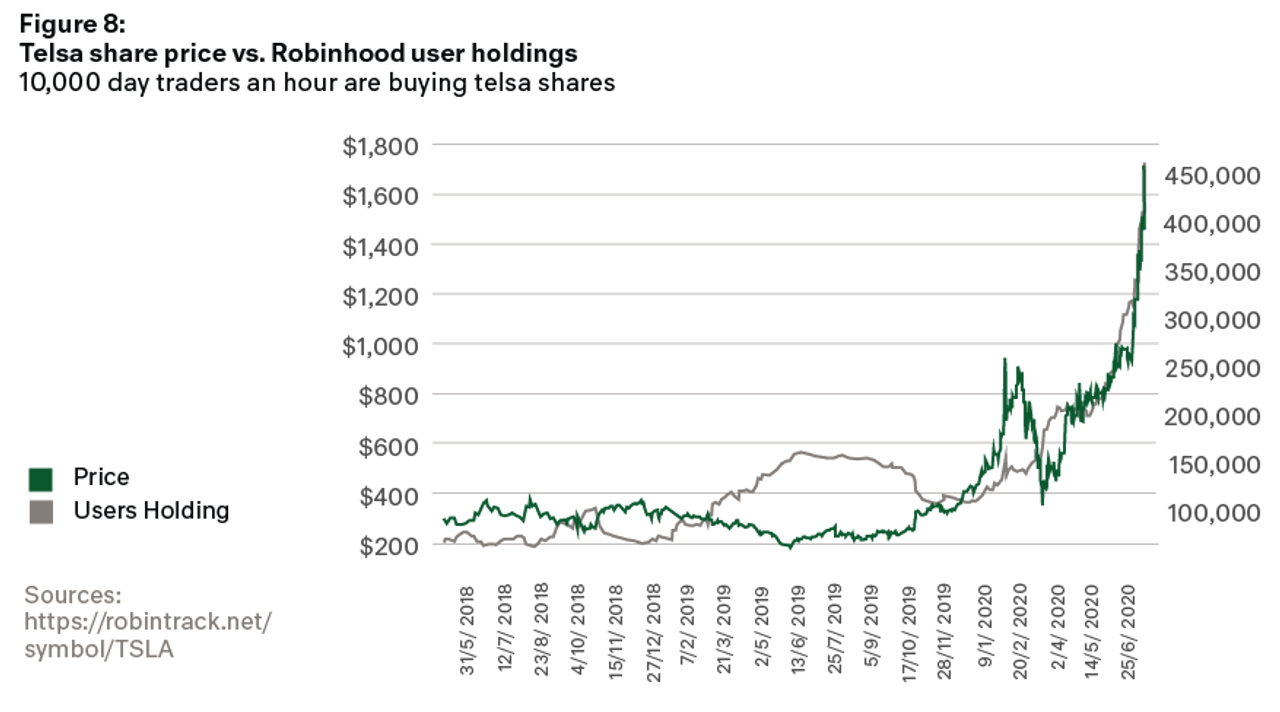

The company’s valuation is now greater than many large established car companies, including General Motors, Ford, Fiat Chrysler, Ferrari, Honda, Hyundai. Tesla is now worth more than those 6 companies combined. It is interesting when you overlay the trading in the company through Robinhood (grey line in Figure 8) with the share price (green line in Figure 8), you can see a striking correlation.

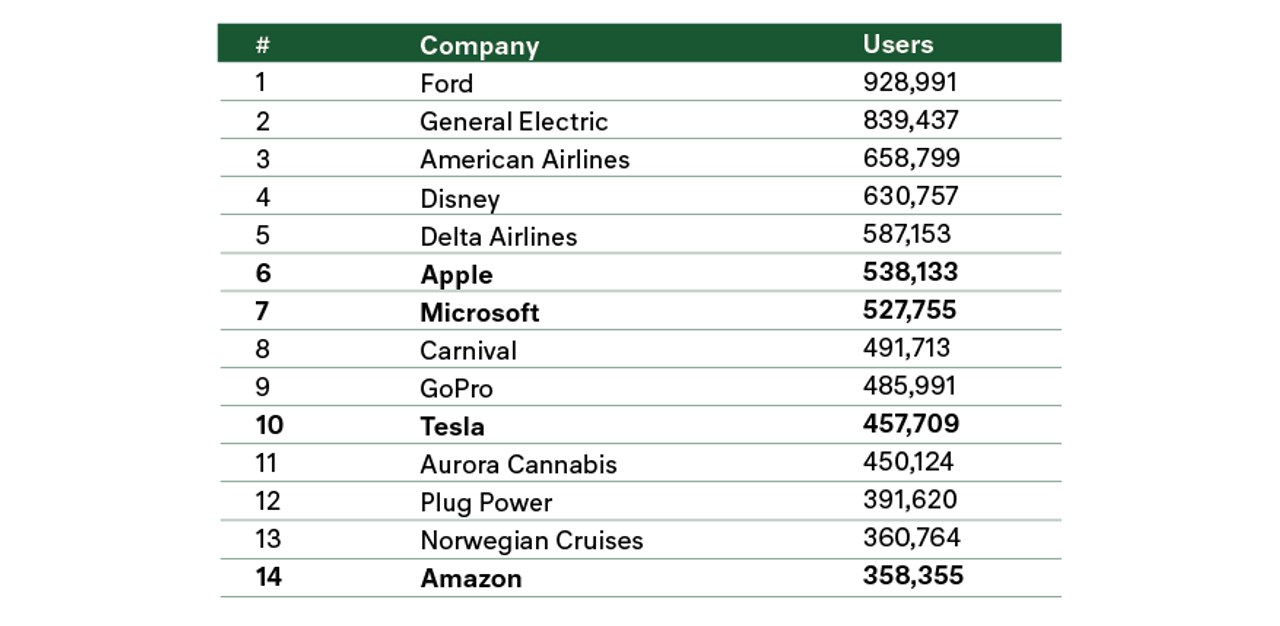

The table below shows the highest 14 companies in terms of number of investors on Robinhood. The retail market appears to be infatuated with companies that have been in shutdown sectors (airlines and cruise ships) and companies that they use (technologies, GoPro, a Cannabis company).

In our opinion, these appear to be top-down driven investment approaches that have seen valuations diverge from fundamentals.

Firstly, as I alluded to in the previous section - no man is an island, and either is a company. This idea that tech companies can operate in a bubble and deliver earnings growth while the rest of the economy in in recession, is fanciful.

Many of the FAANGs are vulnerable to the same headwinds are other, less fancied, sectors. For example, a slashing of advertising spending – as happens in most recessions – would directly impact Google and Facebook. In a similar vein, it seems probably that computer acquisition budgets will get slashed, as will appetite of consumers to upgrade to the latest and greatest iPhone – extending the phone cycle times.

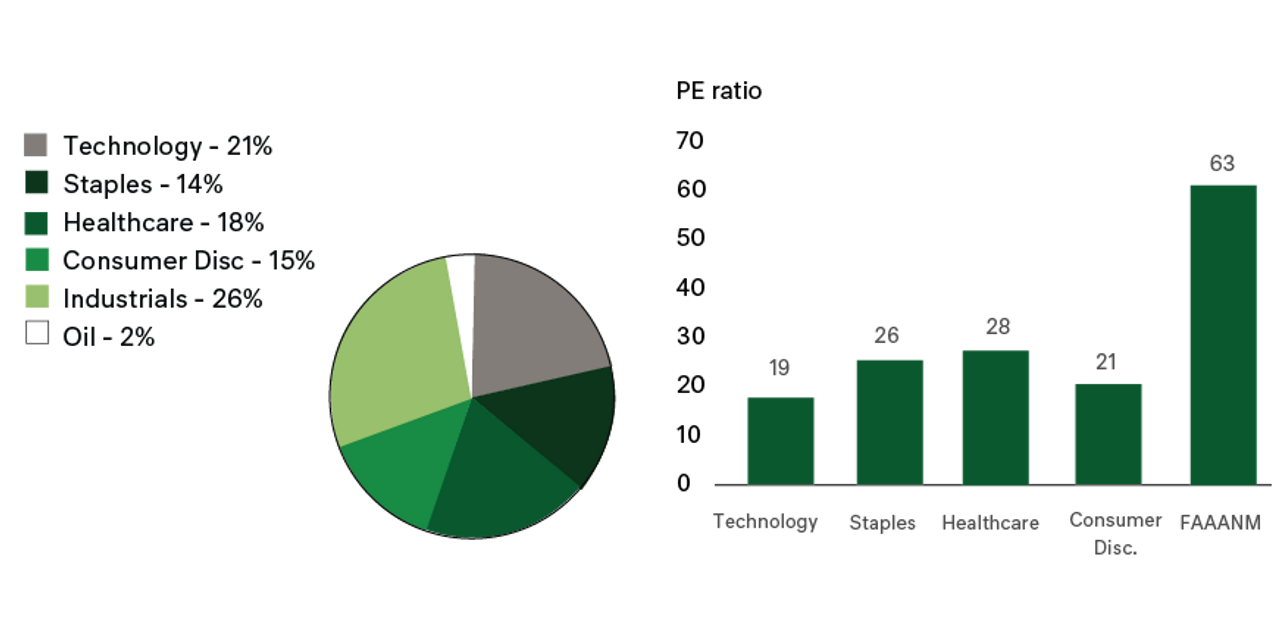

Further, at the current valuations we view these companies as vulnerable and expensive, given the potential for regulatory intervention and PE ratios that are at least 40% higher than the market average.

Finally, it is worthwhile remembering that tech is more prone to disruption that other sectors. If you were to look at the ten largest cap technology stocks at the peak of the tech bubble, all ten underperformed the market in the next decade.

Technology still represents over 20% of our US investments, just not in these high-profile companies.

When we look at technology companies, we like to split them into 3 categories:

— Business to Consumer: Exposed to consumer whims: Apple, Facebook, Netflix.

— Business to Business: Some good companies, but now expensive: Microsoft, Amazon.

— Industrial: Wider MOAT, attractive pricing, good management.

In the B2C segment history is littered with companies (such as Kodak, Sony, Nintendo) that have been dominant with consumers for a period of time - eventually found it difficult to maintain the level of innovation and creative destruction required to capture the eye of consumers. They tend to be more fickle and quicker to transition to the next ‘latest’ thing.

In particular it is very difficult to dominate through different technology paradigms. For example, moving from Business Computers to PCs to Mobile or VCR to DVD to Streaming, each paradigm shift has seen the emergence of a new dominant player.

On the other hand, Cameron Harrison tends to like companies in the industrial technology area, that is technology that is aligned to a specific industry or niche and has an established end-use case. A couple of current examples of these companies are:

— Honeywell: in automation and control technologies.

— Broadridge Financial: in communications and analytics provider for financial services.

— IBM: in data, cloud, artificial intelligence for corporations.

Part of the reason we like this area, is they are often more established players, with higher barriers to entry for the competition and clearly defined and addressable markets - less likely to get disrupted.

The other point worth making is whilst, technology has had a lot of attention from the media, it is not the only game in town.

I’ve extracted our US holdings in Consumer Staples (Walmart, Procter & Gamble), Healthcare (Agmen, Abbot Laboratories, Johnson & Johnson) and Consumer Discretionary (Home Depot, a US Bunnings, and Best Buy a consumer electronics retailer) which combined represent half the portfolio and are up 10% for the year based on improved profitability and not just sentiment. They also have materially lower PE ratios and less scope to be a bubble.

— Healthcare, Staples and Consumer Discretionary holdings are all in positive territory of the year.

— Performance is driven by higher revenues and not sentiment.

— Materially lower PE ratios, less scope for a bubble.

Within our US equity strategy, we are seeking to provide a diverse exposure to quality companies, often in industries that are underrepresented in Australia, or priced at a premium. As a result, the portfolio has no banks or mining companies. We are not looking to make thematic bets as demonstrated by the broadly even allocation across Technology, Staples, Healthcare, Consumer Discretionary and Industrials in the pie chart below.

Within these sectors, there are quality companies that are more reasonably priced. That have a better of balance of risk assessment for future returns.

Cameron Harrison have been advising business owners and their families on asset allocation and intergenerational wealth management for over 50 years. We have demonstrated over a long period our ability to manage investments through both the good times and bad by keeping the client at the centre of our business.

For more information on our approach to investment strategy or any other inquiries, please contact us on +613 9655 5000.