A more prosperous global society makes for a more charitable one. As countries develop and grow wealthier, so too do philanthropic efforts. Along with the rise of charitable efforts, the philanthropy world has become more professional and developed; in this, the US leads the way. Two trends we are seeing in the US are redefining the field:

The rise of “no strings attached giving”. Novelist and philanthropist Mackenzie Scott is leading the charge of this somewhat ‘new’ version (i.e. not tying the capital to a particular program), having donated more than US$16 billion from 2019 to 2023; and

An increasingly professional industry, making philanthropy simpler for private individuals.

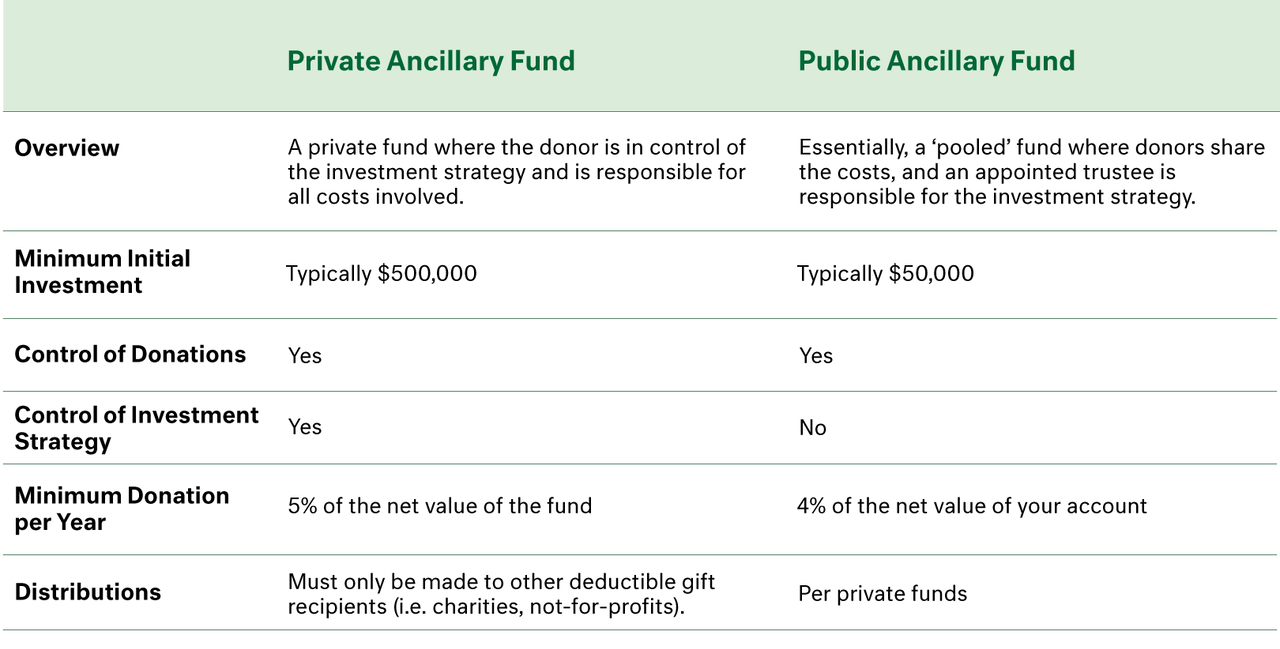

The increasing professionalism is having a profound impact in the way private individuals can manage their philanthropic efforts, particularly in enabling greater longevity in their gifting programs. With proper investment management and guidance, individuals are now able to better manage donations over time, in terms of both tax efficiency and investment strategy.