To hear David's thoughts, watch the interview below. A summary follows.

Australian households diligently accumulated approximately 17% of income as excess savings throughout the pandemic via a combination of government support payments and a lack of spending opportunities due to lockdowns.

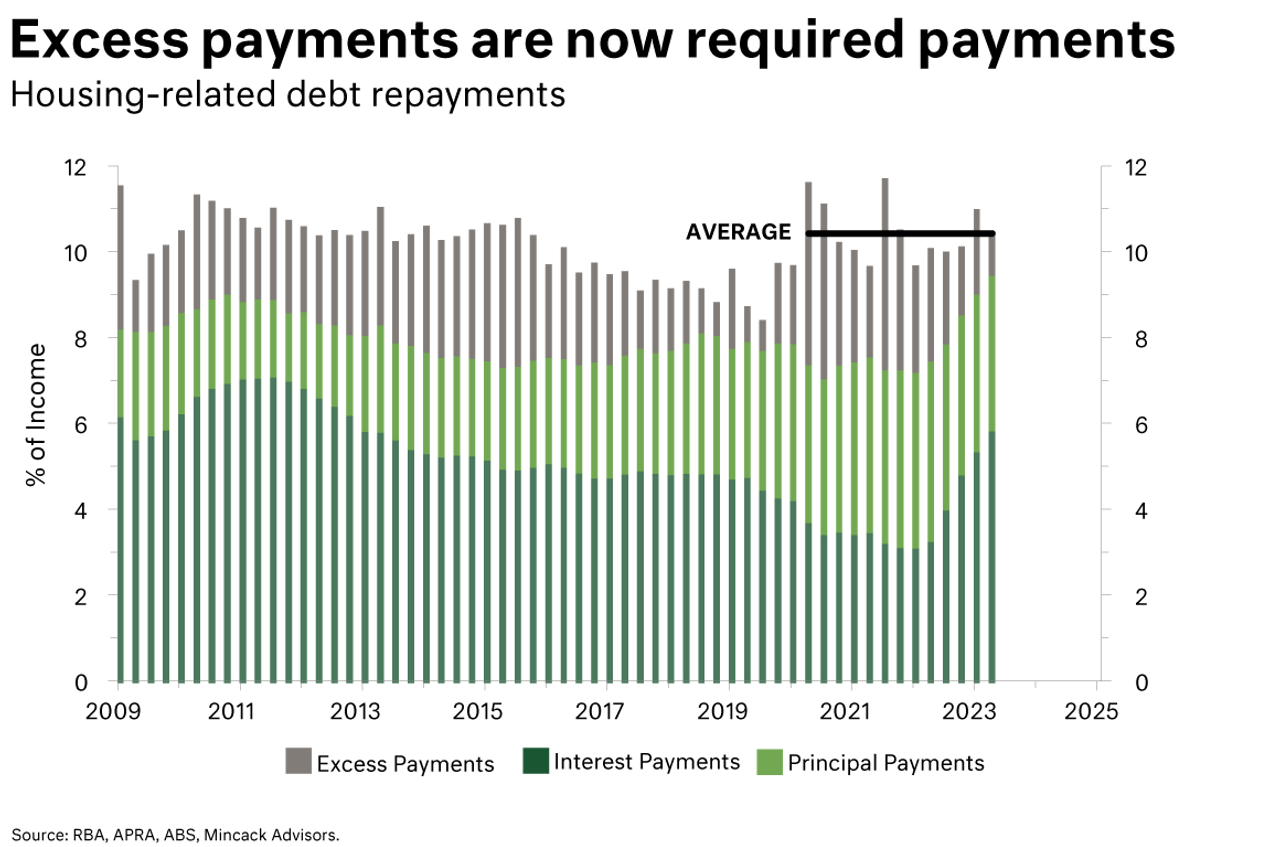

These savings were used by many mortgage holders to make additional or excess payments on their debt, totalling an equivalent to 9.5% of income (see grey bars on chart). This was a sound financial strategy.

The remainder has provided a buffer for household spending against higher interest rates and debt costs, with the growth in consumer spending over the last 12-months predominantly funded by a falling savings rate.

So far, approximately two-thirds of monetary tightening has flowed through to mortgage rates. This means that required mortgage repayments will continue to rise in aggregate (dark green bars), even without any additional RBA cash rate increases, as fixed-rate mortgages expire, and borrowers shift to variable rate payments that at 50-60% higher.

These payments will need to be funded from household income now that these excess savings have been largely utilised. This is likely to lead to cracks emerging in household finances, particularly mortgage arrears and consumer spending.

Mortgages written between 2019 and 2021, when lenders tested serviceability using a buffer of 2.5% above the borrower’s interest rate, are more susceptible to deterioration in performance, as the cash rate is now above this buffer.

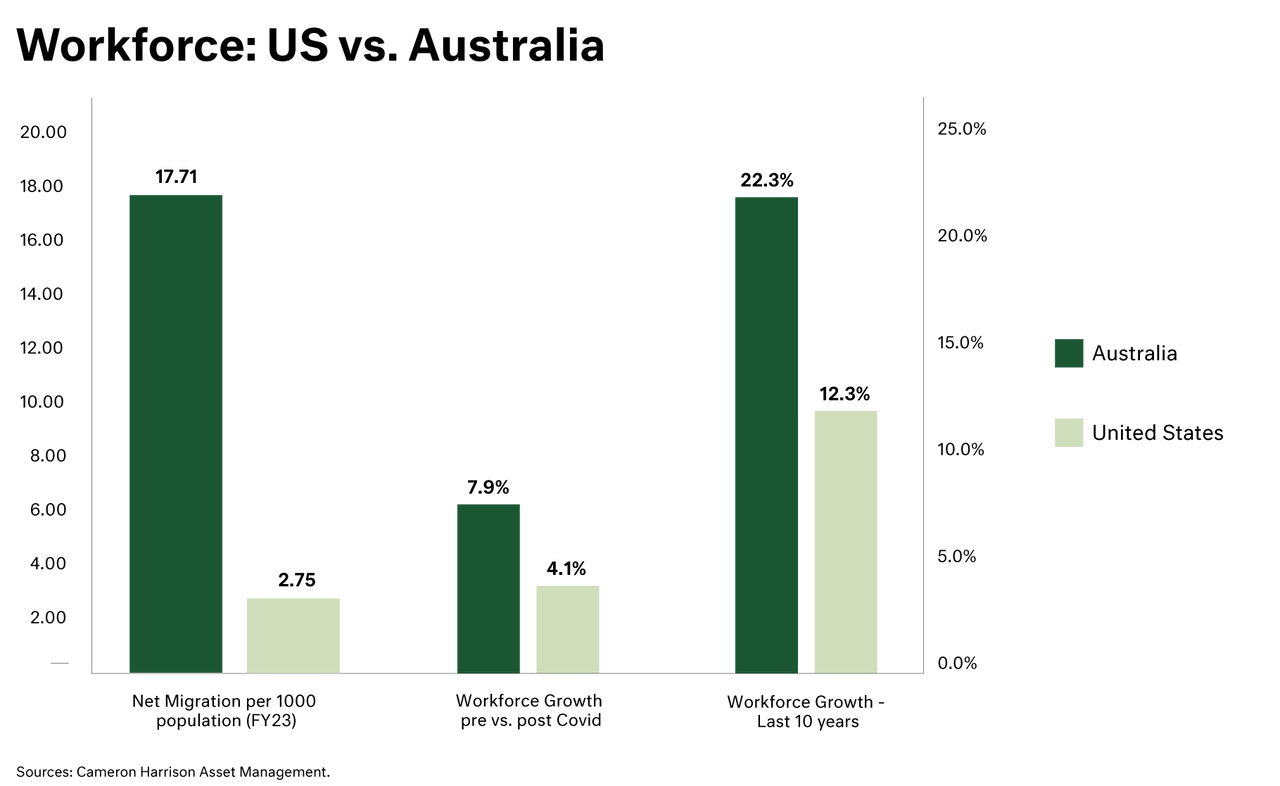

While households are coming under pressure of higher housing costs (debt or rents) a massive wave of immigration looks set to add to labour supply, increase underemployment, and flatten wages growth.

In the past 12-month the net migration into Australia has been over 450 thousand people, to put this in context, on a per capital basis the growth in the Australian population via net immigration was 6 times higher than the US.

The additional workers have added resilience to the economy in the short term and supported aggregate GDP (as opposed to per capital), as more people equates to more consumption and tax payments but will ultimately come at the cost of slower wage growth, lower business investment, and lower productivity growth.

We appear destined to return to a pre-pandemic mixture of underemployment, weaker wage growth. Whilst, more regulation points to continued low productivity, and weaker demand from China adds to our economic malaise.

Sourced from:

Photo by iStock