To hear Paul's thoughts, watch the interview below. A summary follows.

Between the 1970s and 1990s, the opposite was true, stocks and bonds were positively correlated – so, as stocks went down, bonds also went down. The post-COVID boom again saw a positive correlation, as stock prices declined, so too did bonds, giving rise to rather poor returns for balanced investors (otherwise previously used to bonds delivering counterbalancing returns to declining stock prices).

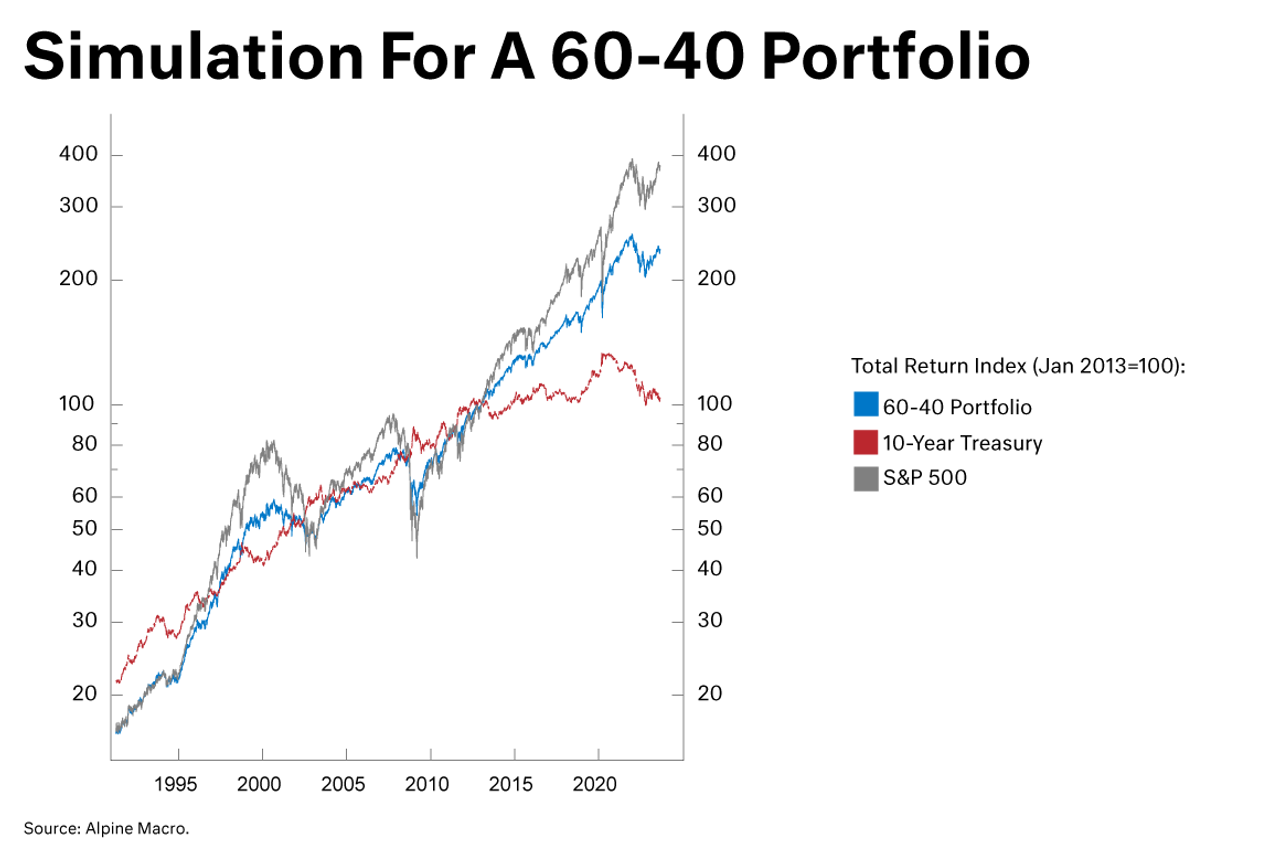

The implications for diversified, balanced investors as we move forward are significant. Putting aside investors' individual risk tolerance, should investors be 80% stocks and 20% bonds? For the last 12 months, this portfolio mix has certainly outperformed. We can see in the chart below how, since 2020, and again in 2022, stock prices accelerated (grey) whereas bond prices reversed (red). Stocks added to performance and long duration (10-year US Treasuries) detracted. As a result, we can see the simulated performance of the 60% stock/40% bond strategy has diverged from the strong, consistent performance of the last 20 years.

This largely hinges on whether we return to the pre-COVID period, of lowish growth, low inflation and low(er) rates. There is certainly reason to be more optimistic that inflation will lower, with lower growth and lower rates of interest. The outlook is somewhat tempered by governments’ COVID/Health/Defence spending addiction and accumulation of debt. On balance, a return to at least a weak form of negative correlation seems probable as the world economy moves to a position of balance.

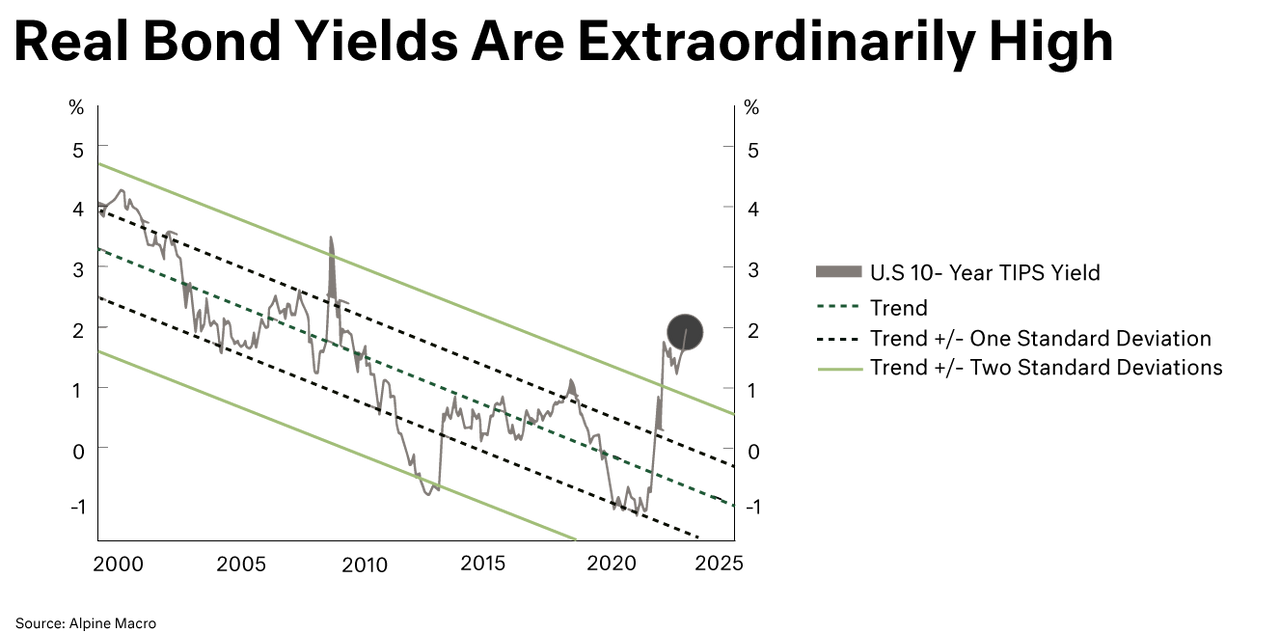

In getting to this more balanced outlook, we do think that bonds represent somewhat good value over the next 12 months. For example, the next chart shows that US TIPS (Treasury Inflation Protected Securities) are trading at 3 sigma above the historical trend. In Australia, we still find value in mid-tenor fixed bonds in the well-rated corporate segments and higher-quality bank funding stacks.

Whether we avert or go into a recession is still fairly ‘line-ball’ at this stage, but a Federal Reserve (and RBA for that matter) that seeks to ‘doubly’ ensure its lower inflation prize is likely to hold rates higher for longer than what equilibrium may require. Their language and posture are consistent with this, which supports a balanced risk diversification to asset holdings, and certainly a lower relative exposure to stocks over the next 12-15 months.

Sourced from:

Photo by iStock