Read David's thoughts on the summary below.

To solve these issues, Argentina recently elected a new President, Mr Milei, who campaigned wielding a chainsaw to symbolise his approach to cutting state spending. He plans to ditch the Peso in favour of using the US dollar as legal tender and will need to restructure the $44bn in loans from the IMF. Even these drastic actions may not be enough as the country’s provinces are largely autonomous and can make decisions over fiscal spending that might undermine the central government.

Whilst Australia and other large, developed economies that have been ratcheting up interest rates are a long cry from the economic chaos of Argentina, it does help to serve as a reminder of what can happen if things start to go horribly wrong. The so-called narrow path that Central Bankers are trying to walk will always err on the side of doing too much rather than too little.

As it stands, the RBA would feel partly vindicated in its heavy-handed approach, given the resilience of the Australian economy so far, with consumer spending surprisingly strong in the face of significantly higher mortgage rates.

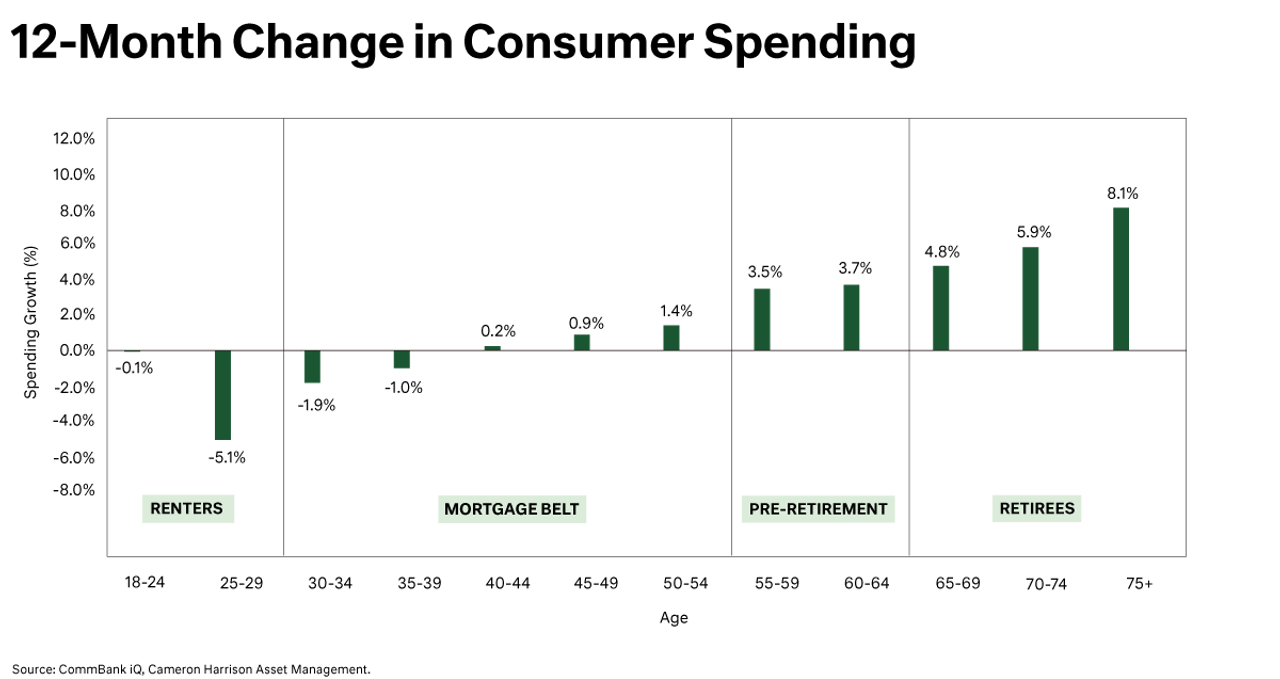

When we look at the spending data in the chart below, we see clear trends in spending growth emerging by age bracket.

At the younger end of the age spectrum, the massive immigration program is colliding with the limited housing supply to ramp up rents. This, combined with falling hours worked per person, is sharply impacting spending.

Next, we have the mortgage belt, which are bearing the weight of a 4.25% rise in interest rates. Within this group we see younger households, who typically have higher loan-to-value ratios, cutting back more than older households.

This cohort is typically represented by households that have paid down most of their mortgage, their children have finished school, and they are balancing spending with greater disposable income that is accumulating into savings (super) for retirement.

A rally in equity markets over the last 12 months and higher deposit rates are supporting incomes, savings, and spending by this over-65 cohort.

As the Australian population continues to age and the superannuation system reaches full maturity in the next couple of years and tips from net accumulation to net outflows, this ‘super buffer’ on consumer spending could become a permanent feature of our economy.

This presents a catch-22 for the RBA.

As they increase interest rates, a large and growing percentage of the population will increase spending, with more heavy lifting to slow the economy placed on a shrinking (by % of population) mortgage belt.

It also provides further support to the position that the best policy tool for managing the cycle in the decade ahead is not interest rates but government spending (fiscal policy). However, given the current spending promises on Defence, NDIS, Clean Energy and Social programs, we see high government spending as locked in.

Many investors believe we will return to the post-GFC economic environment of lower growth and declining interest rates once lumpy inflation is addressed. We think this is fanciful. Investors (and households) should be prepared for the RBA to err on the side of higher interest rates for longer, as they lean against the inflationary forces of deglobalisation and fiscal spending.

At Cameron Harrison we approach our investments via both a top-down macroeconomic positioning on asset allocation and a bottom-up investment selection within asset classes. In the current environment of heightened risk of a policy misstep by the RBA (and other central banks), a ~12-month equity rally, and the highest yields on bonds, we have taken the asset allocation to reduce our equities investment to the bottom of our strategic range.