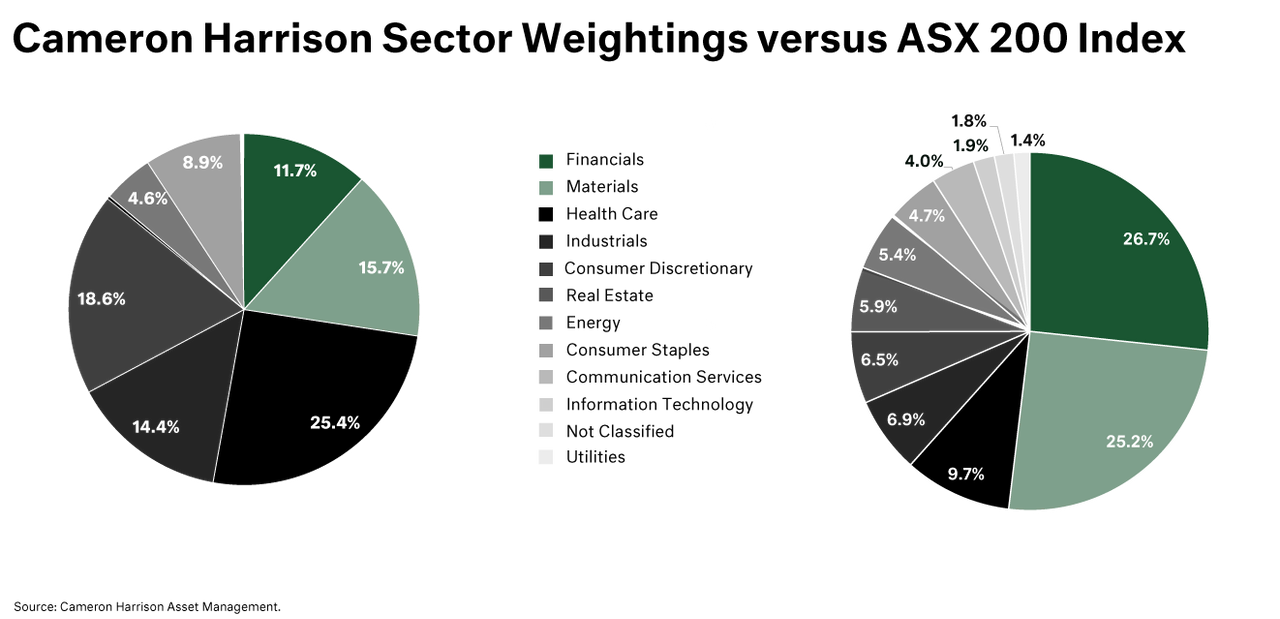

Let’s start with the underlying assumption of market weighted strategies: larger companies will, on average, outperform smaller companies over time. This relationship has been investigated many times by academics going back as far as 1981, and it has never been found to be accurate. Larger companies often have good past performance but as the adage goes, past performance is not an indicator of future returns.

To the degree that there is any relationship between size and returns, it actually works in reverse, smaller companies outperform larger companies on a risk-adjusted basis. This phenomenon, known as the size effect, is well documented in academic papers from the world’s leading business schools and increases when combined with a quality filter(*).

Market Cap indices were designed to be barometers of overall market performance and were not designed to be the basis of portfolio construction. However, passive fund managers started to track these indices, because the implementation costs were cheap, and they produced benchmark-like returns.