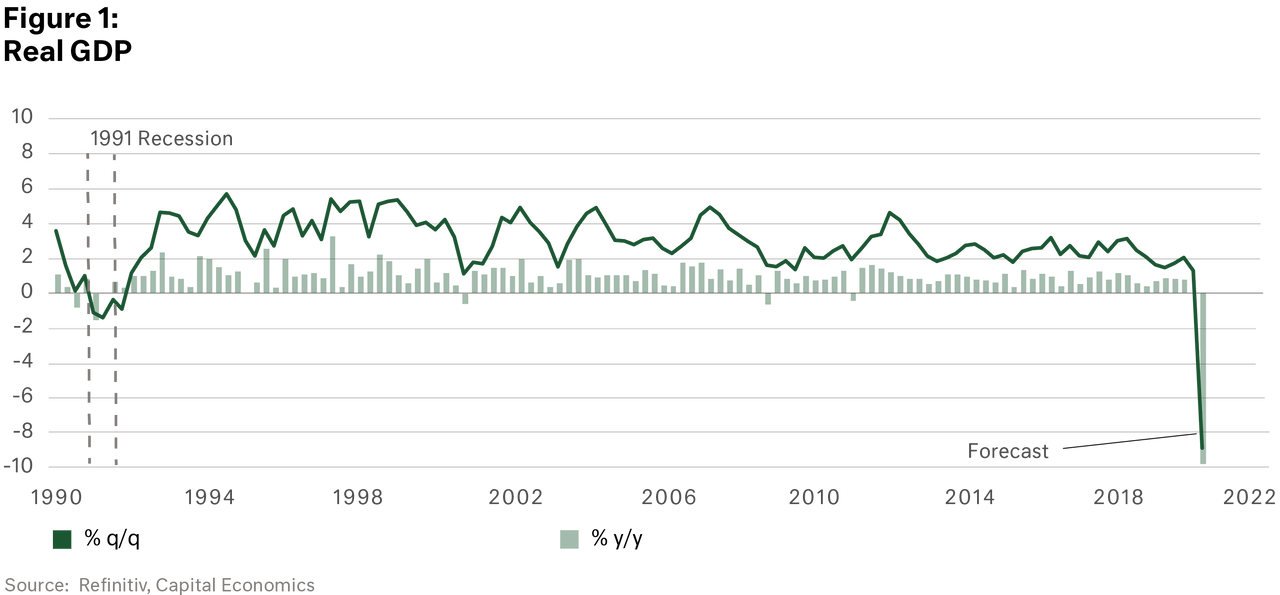

A bit like the Artful Dodger in Charles Dickens 'Oliver Twist', the Australian economy has dodged and weaved the technical definition of a recession (that is, two consecutive quarters of negative economic growth) for a record 29 consecutive years. It is a feat lauded universally by other OECD countries. It has now come to an end.

The Q1 GDP result was a decline of 0.3% from the previous quarter. This is a combination of bushfires and the initial impact of COVID-19 restrictions which started in the back-end of March. What it also clearly illustrates is that the economy and households were already in a parlous state coming into COVID-19 as evidenced by weak household consumption and increased savings – trends which only amplified over Q2. So the decline in Q1 GDP is just an entrée to the main course disaster of Q2. Beyond this we think will be left with a bitter after-taste for some time thereafter.