In our (link: http://cameronharrison.newterritory.studio/resources/are-you-30-june-ready text: Are You 30 June Ready article), we outlined the limits, eligibility criteria and advantages of making contributions to maximise your accumulated superannuation. In this follow-on instalment, we introduce two strategic opportunities to optimise the tax effectiveness of your benefit, even if there are no surplus funds available to contribute to superannuation.

Where financial resources may not be available to add to superannuation, non-concessional contributions can still be utilised to maximise the tax effectiveness of member accounts for the benefit of future heirs. Superannuation benefits paid to non-tax dependents, such as adult children, following the death of a member may incur tax, however employing a ‘re-contribution strategy’ can assist to minimise the impact of this.

Behind every member balance sits a taxable and tax-free component. Where a death benefit is paid to an adult child, the proportion of the benefit that represents a taxable component is taxed at 17% including the Medicare Levy and the tax-free component is just that – tax-free. So, it follows that to minimise tax, one should seek to maximise the tax-free component and minimise the taxable component.

Penny is aged 62 years, a widow and has three adult children. She has superannuation of $1.5 million in an account-based pension and per her member statement, 33% of this sits within the tax-free component and 67% in the taxable component. Penny has in place a binding death benefit nomination in favour of her three children, equally.

On Penny’s passing (assuming no change in her final balance), the total taxable component at the time would amount to $1 million. As Penny’s beneficiaries are not tax dependants, the taxable component will give rise to tax of $170,000 (17%), reducing her death benefit from $1.5 million to $1.33 million.

What can Penny do now to improve the after-tax inheritance left for her children?

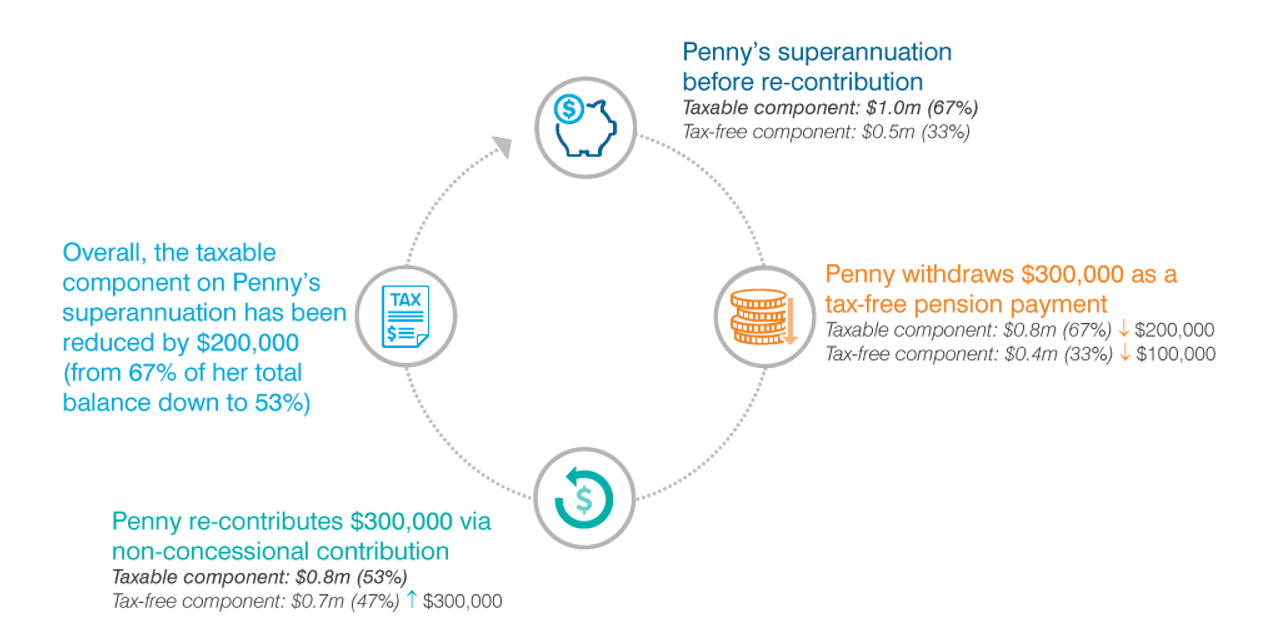

Following a review of her affairs and estate plan, Penny is advised to withdraw $300,000 from her pension and re-contribute the same amount back as a non-concessional contribution. In Penny’s case, this is permissible as she has an unrestricted pension and is under the age of 65 years; her withdrawal is also tax-free as she is above the age of 60 years.

The withdrawal of $300,000 is taken proportionally from both the taxable and tax-free components that is $200,000 from the taxable component and $100,000 from the tax-free component. However, non-concessional contributions are always treated as an increment to the tax-free component, therefore the contribution itself will increase her tax-free component by $300,000.

On a net basis, the re-contribution will have the effect of reducing Penny’s taxable component by $200,000 or 53% of her total balance (down from 67%), as illustrated below:

Then on Penny’s subsequent death, the tax on the taxable component is only $136,000. This means $34,000 more ends up in the hands of her children; a saving not to be sneezed at.

What it means for you: if you are eligible to make non-concessional contributions, have a balance below $1.6 million and have met a condition of release permitting withdrawals, recycling funds through a re-contribution strategy can significantly reduce this implicit ‘death tax’ and increase the amount of wealth transferred to your children. Those aged between 60 and 65 years stand to benefit the most from this strategy.

Hazards to avoid:

Before any re-contribution strategy is implemented, it is important to consider and assess:

Eligibility to withdraw

Taxation consequences of withdrawals

Eligibility to contribute, by reference to age, prior contribution history and current balance

Liquidity of investments backing the member balance (i.e. will a sell-down of assets be required in order to fund a re-contribution strategy and costs thereof)

To recap, members are now limited to a pension balance of $1.6 million, therefore amounts accumulated in superannuation prior to 30 June 2017 in excess of that cap have been commuted back to accumulation mode where earnings are taxed at 15%. To minimise this tax impact, an opportunity may exist for couples to equalise their superannuation balances if:

One member is above the $1.6 million cap; and

The other member is below the $1.6 million cap and still eligible to make non-concessional contributions.

The end goal is to place the maximum amount into members’ pension accounts, with the minimum residual amount being in accumulation mode.

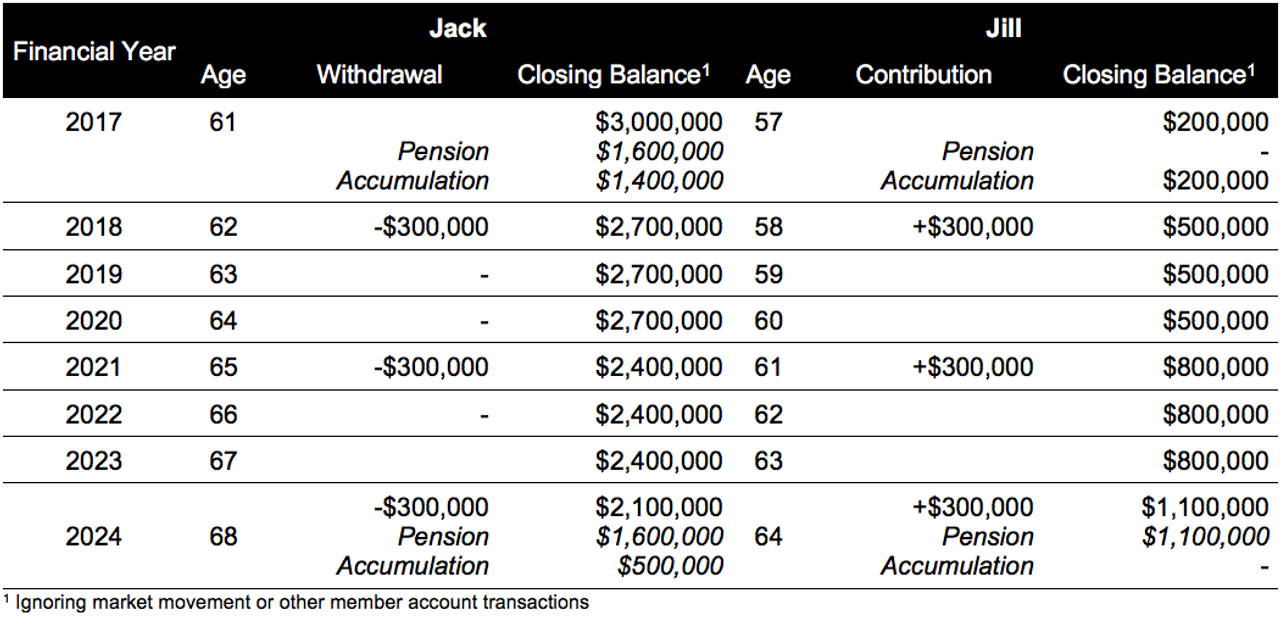

Jack & Jill operate a self-managed super fund which was valued at $3.2 million on 30 June 2017 – $3 million for Jack and $200,000 for Jill. Jill is aged 58 years, has retired, and has not made any non-concessional contributions in the past three years. Jack is 62 years of age and is also retired.

What opportunities do Jack & Jill have to equalise their superannuation balances?

In a perfect world, Jack & Jill would have equal balances of $1.6 million each, both fully in pension mode. However, as it stands the majority of the $3.2 million is in Jack’s account and from 1 July 2017 onwards, $1.4 million of Jack’s balance has been in accumulation mode attracting tax on earnings, probably in excess of $10,000 per year.

So, what can Jack & Jill do?

Jack could withdraw part of his $1.4 million accumulation balance (tax-free as he is above the age of 60 years), gift the funds to Jill who could then contribute the monies to her account through non-concessional contributions.

Due to non-concessional contribution caps, Jill won’t be able to contribute the full $1.4 million to superannuation all at once, but over a period of time, Jack’s pension and Jill’s contributions might look like the following:

It is not possible for Jill to get the full $1.4 million into her own account due to contribution limits, but they can successfully move $1.1 million of Jack’s accumulation balance into a pension for Jill and reduce the effective tax rate on fund earnings. On $3.2 million, Jack & Jill might save $8,000 in tax each year by equalising balances, reducing the effective tax rate of their combined superannuation from 8% down to 2%.

What it means for you: as a couple, you may be able to move funds that would otherwise be taxed at the accumulation rate of 15% to a spouse’s account who has a balance lower than $1.6 million. With a carefully constructed plan over multiple years which is continuously monitored, this can result in a significant increase in your combined after-tax superannuation benefit.

Hazards to avoid:

Before any spouse equalisation strategy is implemented, it is important to consider and assess:

Eligibility to contribute for lower balance spouse

Taxation consequences of withdrawals for higher balance spouse

Asset protection risks that may present themselves by withdrawing from one member and contributing to another member

Estate planning consequences such as reversionary pensions, death benefit nominations and amendments that would need to be made to Wills

It is not possible for Jill to get the full $1.4 million into her own account due to contribution limits, but they can successfully move $1.1 million of Jack’s accumulation balance into a pension for Jill and reduce the effective tax rate on fund earnings. On $3.2 million, Jack & Jill might save $8,000 in tax each year by equalising balances, reducing the effective tax rate of their combined superannuation from 8% down to 2%.

What it means for you: as a couple, you may be able to move funds that would otherwise be taxed at the accumulation rate of 15% to a spouse’s account who has a balance lower than $1.6 million. With a carefully constructed plan over multiple years which is continuously monitored, this can result in a significant increase in your combined after-tax superannuation benefit.

Hazards to avoid:

Before any spouse equalisation strategy is implemented, it is important to consider and assess:

Eligibility to contribute for lower balance spouse

Taxation consequences of withdrawals for higher balance spouse

Asset protection risks that may present themselves by withdrawing from one member and contributing to another member

Estate planning consequences such as reversionary pensions, death benefit nominations and amendments that would need to be made to Wills

Cameron Harrison’s partners have been delivering specialist advice to business owners and families for over 50 years. Through our defined planning methodology, our clients gain access and receive a careful and properly integrated wealth framework.

For further information on how to consider and effectively plan for the end of financial year or any other inquiries, please contact us on +613 9655 5000.