Retail sales for July were unchanged from June, going against hopes for a rise of 0.3%. Whilst only a monthly statistical read, it joins a number of poor monthly reads. This, combined with a fall of 0.6% in the ANZ Job Ads Survey in August, now indicates a headwind to further falls in the employment rate.

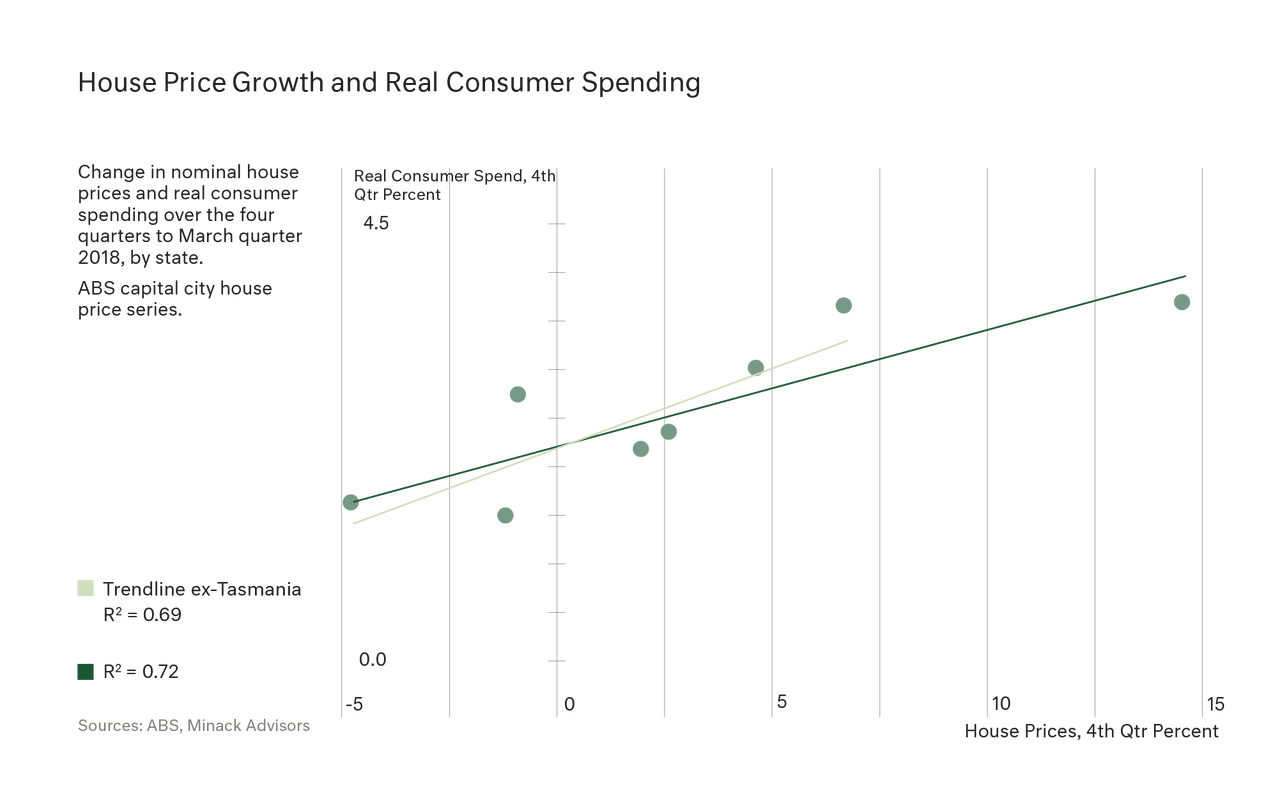

Also released today was CoreLogic’s National Home Value Index which declined 0.3% in August. Most noticeable were the continued declines in Sydney (-0.3%) and Melbourne (-0.6%). Whilst not predicting imminent property collapse, the negative movement in house prices is gathering some momentum and will not be helped by recently depressed clearance rates over the last few weeks. What it does portend is that a ‘reverse’ wealth effect for households may be in progress.

What we mean by ‘reverse’ wealth effect is should house prices – currently at elevated levels of around seven times income – fall by 10%, then real consumer spending would diminish by 1.25%. This would seriously harm domestic demand (refer chart below). The changed structural environment for credit supply combined with the Hayne Commission is a further significant ‘downdraft’ on domestic activity and household credit. Up until recently, Australian domestic demand has been experiencing and benefiting from a positive wealth effect. In this context, households may now need to assume the ‘brace position’.